Riverstone (SGX: AP4)- The forgotten twin brother of Malaysia’s glove king

value_trading

Publish date: Sun, 31 May 2020, 02:20 PM

Riverstone was established in 1991 and listed on the Mainboard of the Singapore Stock Exchange in 2006. The company specialise in the production of Cleanroom and Healthcare Gloves, finger cots, cleanroom packaging bags and face masks. It was the pioneer in nitrile glove production from Malaysia.

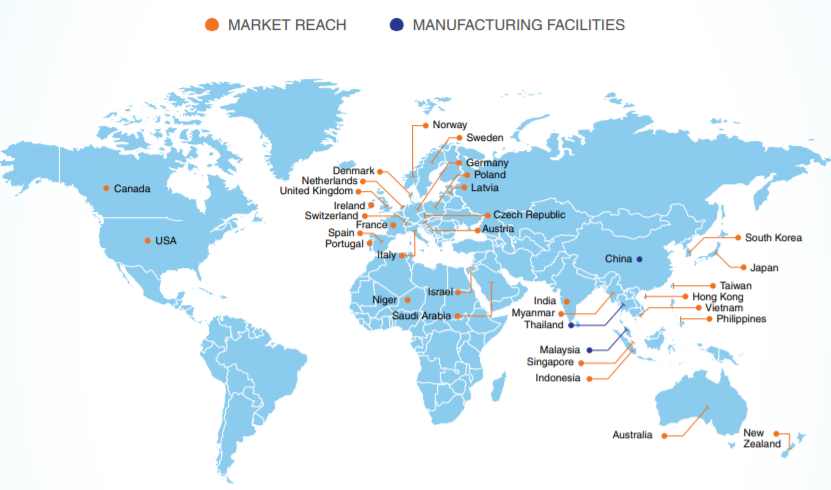

Currently, Riverstone have five manufacturing facilities, located in Malaysia, Thailand, China and established network of sales offices and strategic partners in Asia, the Americas and Europe. They export more than 80% of our products to key high technology customers in Asia, the Americas and Europe and play an important role as global supplier of Cleanroom Consumables and Healthcare Gloves.

Coming into 1Q20, Riverstone saw sales growth of 16% which was generally in-line with its historical volume growth. Net Profit skyrocketed from RM$30.2m in 1Q19 to RM$46.6m in 1Q20 or a 54% improvement, largely a result of Gross Profit Margin (GPM) improvement where its GPM increased by 4.6ppt on a YoY basis to 24%.

GPM improvement was largely the result of 1) Better pricing environment for Riverstone’s products 2) lower raw material prices 3) Wider market reach and reduce distribution cost

Better pricing environment

The average selling price (ASP) increase for the healthcare segment only materializes in May, thus 1Q20 did not benefit from any ASP rise. From May onwards, healthcare glove ASP is set to increase by 10% for existing customers and 20% for new customers.

Based on management’s guidance, the order backlog for healthcare glove has now extended to 6 months vs. prior level of 3 months. This could potentially further extend given number of COVID-19 cases increase exponentially.

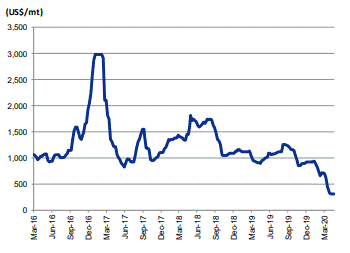

Lower raw material price

Riverstone has benefitted from the down-trending prices of Butadiene, a key raw material used in the production of its nitrile-based gloves. Butadiene price, which tends to move in tandem with oil prices, is down 33% in 1Q20. This has a huge impact on Riverstone’s gross margins since this raw material alone accounts for 50% of Riverstone’s cost of good sold.

Wider market reach and reduce distribution cost

Riverstone have factory and office located in Malaysia, China, Thailand and United States. This can reduce the middleman cost for the glove distribution around the world.

Just like Supermax and Topglove who have factories spread across the world, this helped company to save the middleman cost for distribution of the sales across the world. This explained the higher revenue growth of this company compared to Hartalega and Kossan.

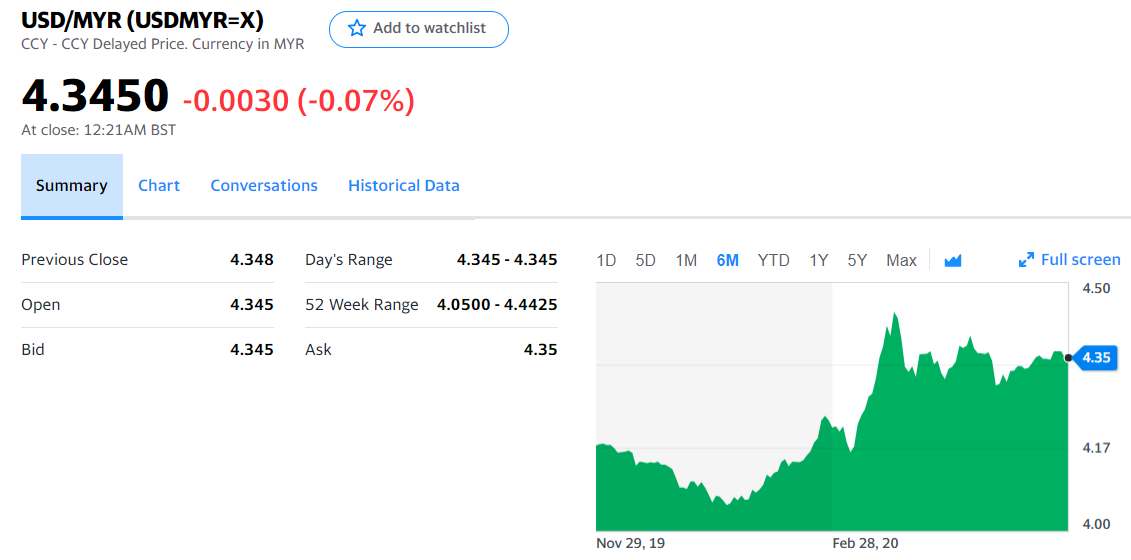

Benefit from strong US currency with falling MYR Currency

Riverstone’s revenue is denominated in USD while costs are mostly in MYR. Hence, the strengthening of the USD against the MYR tends to be beneficial to Riverstone in terms of GPM improvement.

The exchange rate have increase of around 7% from 1 USD to RM 4.05 in Jan 2020 to RM 4.35 (May2020)

Pricing at a discount compare to his Peer

Among all the glove company, only Riverstone and Hartalega with free cash flow. In their latest QR in March 2020, Riverstone is holding RM 170 million is cash.

Among all the glove company, Riverstone is one of the highest profit margin and gross profitability.

If Riverstone PE move closer to his peer. For PE 48 , the reasonable price should be SGD 2.8 (RM 8.59) or if PE move to 60 SGD 3.5 (RM 10.7)

|

|

Top Glove |

Hartalega |

Kossan |

Supermax |

Riverstone |

|

Glove production output (Billion pieces/ year) |

73.8 |

34 |

25 |

24 |

10.4 |

|

Revenue (RM) |

4.82B |

2.92B |

2.2B |

1.5B |

1.0 B |

|

Free Cash Flow (RM,mil) |

(110) |

397 |

39 |

33 |

30 |

|

EPS |

0.145 |

0.128 |

0.181 |

0.109 |

0.174 |

|

PE ratio |

92 |

97 |

48 |

70 |

38 |

|

Price/ NTA |

13 |

17 |

7 |

8 |

6 |

|

Revenue growth |

1.6 |

3.4 |

2.3 |

9.4 |

7.2 |

|

Gross profit margin |

18 |

20 |

12 |

12 |

20 |

|

Net profit margin |

7.8 |

14.8 |

10.2 |

8.9 |

13.2 |

|

Return on Equity |

14 |

17 |

15 |

11 |

16 |

|

Gross profitability |

12 |

17 |

11 |

9.5 |

21 |

|

Debt to net profit |

9.7 |

0.6 |

2.8 |

3.3 |

0.1 |

|

Debt to cash flow |

6.1 |

0.43 |

2.85 |

2.03 |

0.07 |

|

Current ratio |

1.6 |

2.7 |

1.5 |

1.1 |

3.1 |

|

Cash ratio |

0.5 |

0.7 |

0.34 |

0.36 |

1.04 |

|

Current price |

RM13.30 |

RM 12.54 |

RM 8.70 |

RM 7.70 |

SGD 2.23 (RM 6.80) |

|

Revenue growth QoQ |

9.3% |

27% |

10.4% |

105.3% |

16% |

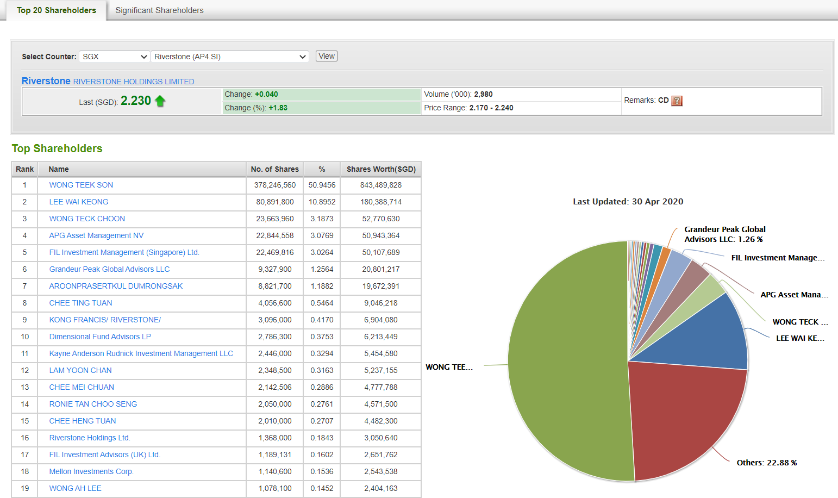

Reliable management team

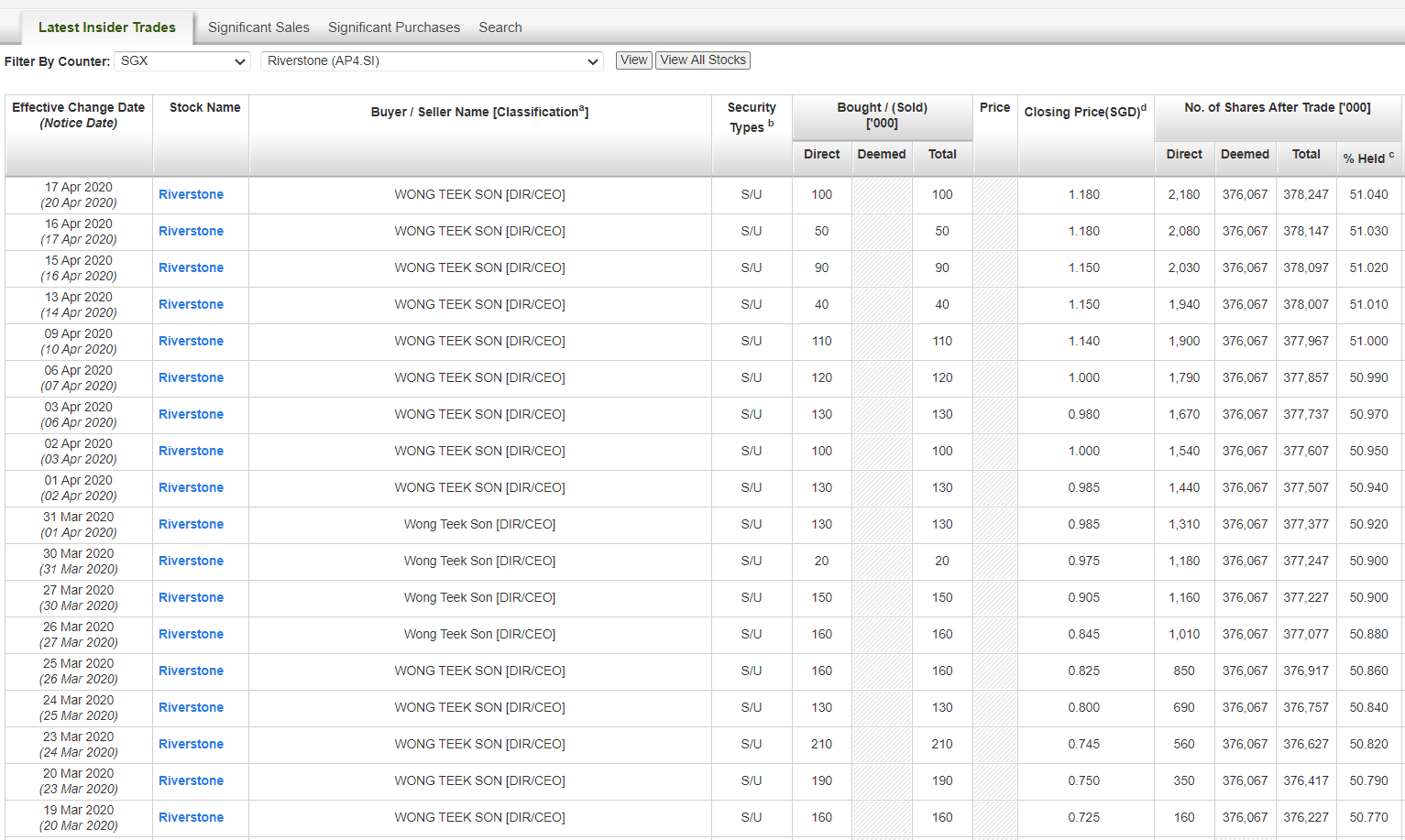

Mr. Wong Teek Son who is the CEO of the company has owned around 50% of the company stock. From 19th March 2020 onwards, he bought back 2,180,000 of Riverstone stock. His holding in his company has increased from 50.77% to 51.04%. Even now with the stock price rising so much, none of the major shareholder sell their stock. This has directly informed us about the management team confidence of their coming business prospect.

Another excellent thing about Riverstone, the company has not issued any additional share listing so far, hence investor does not need to worry about dilution of their company earning. Their number of ordinary shares issued still at 741,084,000 share for the past 5 years.

![]()

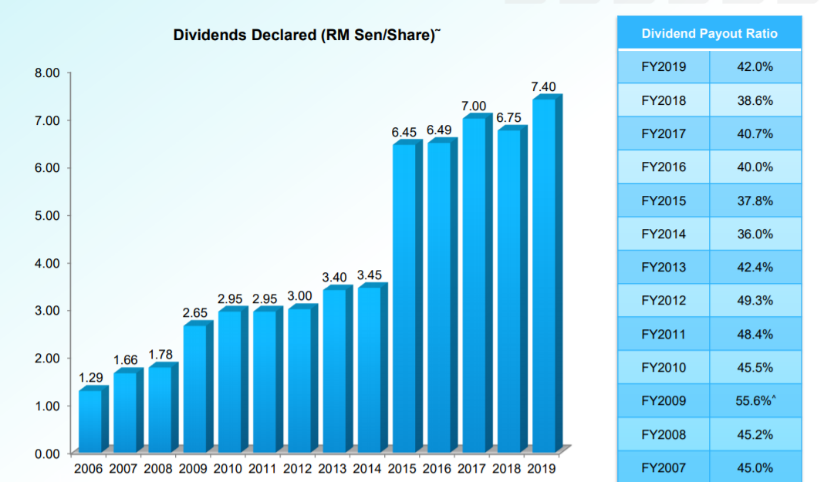

Excellent dividend pay-out ratio

Due to strong free cash flow, the company has been very generous for dividend pay-out. The ratio has been around 40% for the past 13 years.

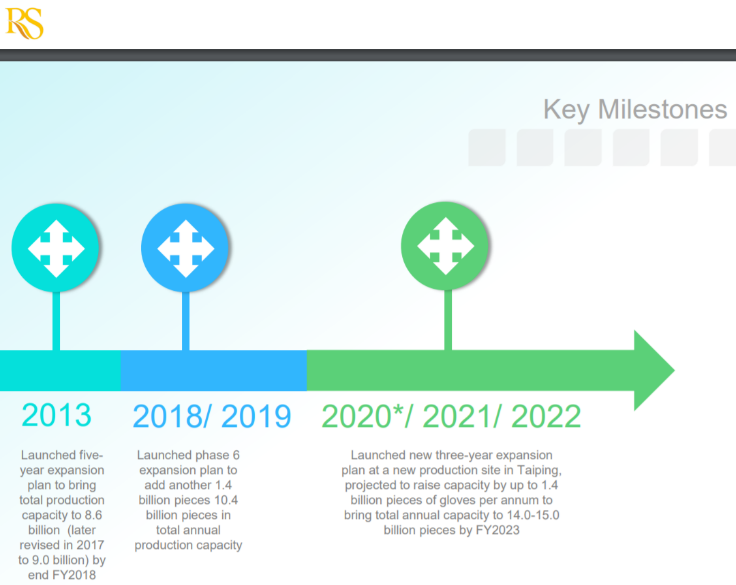

In Riverstone corporate presentation 2020 published on 13th May 2020, the key milestone highlighted the further expansion of their factory with the aim of rising their capacity of glove production up to 14-15 billion by FY 2023, which is another 34-44% increase production from the current capacity of 10.4 billion pieces of glove per year.

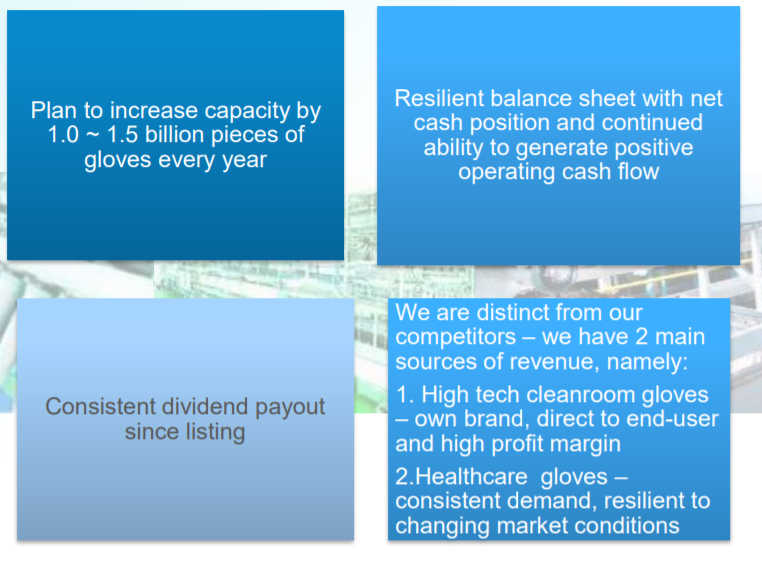

Below is the investment merits for Riverstone presented in their business highlight.

In Summary, Riverstone with a lowest PE among glove stock, higher profit margin, higher cash flow/ cash ratio, higher dividend pay-out ratio and good business prospect is definitely a good choice for value investor. Short term, I am looking at the next target price at SGD 2.8 then SGD 3.5 if the PE marching up to match his peers. Based on the last Friday closing price of SGD 2.23, there is 26 to 57% discount!