Will MSM back to the glory in the past under Robert Kuok era

StallionInvestment

Publish date: Mon, 29 Jul 2019, 06:45 AM

29 JULY 2019

MSM 5202

PE : 76.03

Share Issued : 702.98M

Syariah : YES

NTA : 2.89

Diviend Yield : -

RECENT NEWS DEVELOPMENT

26 July 2019

FGV in talks – including with international players in the sugar industry to dispose of part of its 51% strategic stake in refined sugar producer MSM Malaysia Holding.

The Edge Financial Daily was by a source that there are at least 4 companies that are eyeing the block of shares. One of them, the source said, is JAG capital Sdn Bhd, which is an investment holding company liked to the family of former second financial minster Datuk Seri Johari Abdul Ghani. The others are Wilmar International Ltd, the Singapore-based agribusiness firm owned by Kuok Group, an unnamed Indonesian company and another unnamed Chinese outfit.

Source obtain from https://www.theedgemarkets.com/article/fgv-talks-sell-msm-stake

4 July 2019

MSM is on track to introduce healthier sugar-related products to enhance the company’s revenue by year end.

Source obtain from https://www.thestar.com.my/business/business-news/2019/07/04/trading-ideas-msm-mmc-yee-lee-benalec-yong-tai-damansara-realty/

Technical Outlook :

Chart Formation : Long Term Downtrend Reversal

Volume Pattern : Sky volume

SH TREND : BULLISH ( OCCUR ON 26 JULY 2019)

MACD : BULLISH (OCCUR ON 26 JULY 2019)

RSI : 58.58

B-BAND : POSITIVE TERRITORY

CURRENT PRICE : 1.38

SUPPORT : 1.24 ; 1.30

RESISTANCE : 1.56 ; 1.70 ; 2.10 ; 2.48

PERSONAL OPINION :

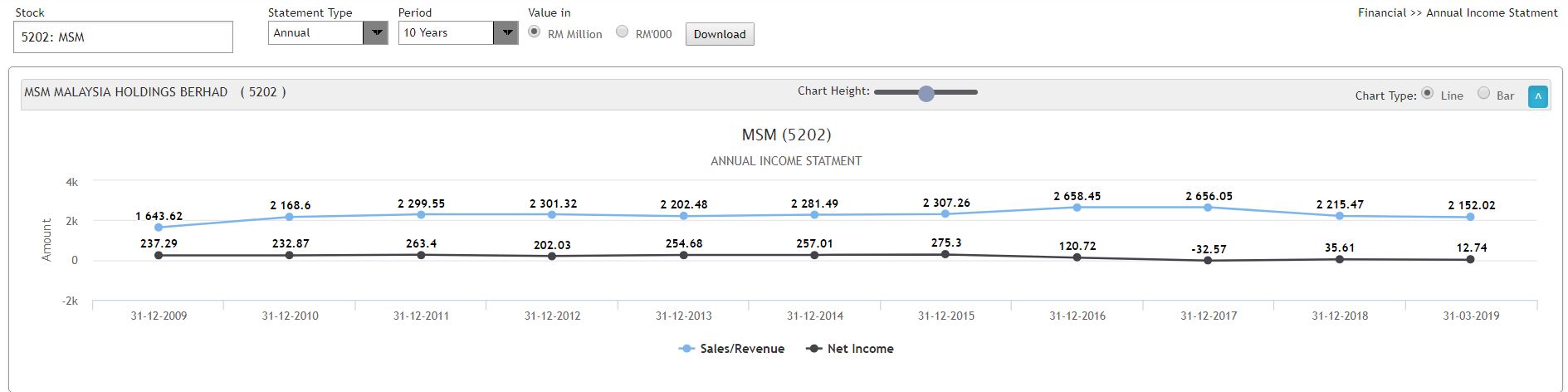

Market do react positively toward the possibility disposal of the stake of MSM to potential buyer. Having said that, market is happy to see new management to take over the major shareholder role of FELDA in the company to revamp the structure as this is monopoly business in Malaysia and it can’t deliver consistent profit compare to Robert Kuok managing the firm. So, monopoly business does not guarantee profit if poorly manage. Worst still , it is making losses from the recent financial quarterly result. That the reason why MSM is trading in high PE. Although there is plenty of potential buyer, but I guess the best bet will be WILMAR as WILMAR is related to Robert Kuok. Why this is the best choice? Simply to say that, he is the best person who know MSM in the past. He exited the sugar business in Malaysia in the year 2009. So, that is 10 years ago story. Compare to 10 years ago profit, it is clearly show it has shrink approximately 80%. That pretty much telling us why MSM is a long term downtrend stock even it is profit making company. On top of that, top 30 shareholder controlling stake at 98.38 base on financial result as at 20/03/2019. Just to name a few top 30 major shareholder such as FGV SUGAR SDN BHD, FGV HOLDINGS BERHAD, KOPERASI PERMODALAN FELDA MALAYSIA BERHAD, VALUECAP SDN BHD, AMANARAYA TRUSTEES BERHAD FOR MANY FUND ( AMANAH SAHAM MALAYSIA 2- WAWASAN, AMANAH SAHAM MALAYSIA 3 , AMANAH SAHAM MALAYSIA, PUBLIC ISLAMIC EQUITY FUND, AMANAH SAHAM BUMIPUTERA 3- DIDIK, PUBLIC ISLAMIC SELECT TREASURES FUND ) , BANK SIMPANAN NASIONAL. Look at those big name carry in the top 30 major shareholder, with the remaining 2% share floating in stock, can those syndicate or operator goreng this stock? They gonna think twice if any of this 30 major shareholder choose to dispose their stake, meaning to say that the fund size gonna to be big to play the game. However, it is illogical to sell at the low price for them. Meanwhile, I believe this stock will remain under the radar of retail trader for the month of Aug 2019. If the financial result improve and back to track, what will be shares price of MSM look like? That I will leave it to research analyst to give their assumption. I only talk about business logic and technical.

Upcoming event

如何快速辨别暴涨股形态讲座会

日期: 8/8/ 2019 (星期四)

时间:2.00pm – 4.00pm

地点:282A, Jln Batu Unjur 7, Taman Bayu Perdana,klang, Selangor 52200

报名链接:https://www.eventbrite.com/e/66676464099

如何快速辨别暴涨股形态

日期: 23/8 /2019 (星期五)

时间:8.00pm – 10.00pm

地点:Nomazon Coworking Space ,Lintang Bayan Lepas 11, Bayan Lepas, Pulau Pinang

报名链接:https://www.eventbrite.com/e/66678167193

如何快速辨别暴涨股形态

日期: 31/8 /2019 (星期六)

时间:2.00pm – 4.00pm

地点:CE CONNECTION, Wisma City Explorer, D13-3, Jalan Persiaran Utama S2-1, Seremban 2, 70300 Seremban, Negeri Sembilan.

报名链接 : https://www.eventbrite.com/e/67134887255

8 月份课堂时间表:

9,10 / 8 /2019 : PJ, SELANGOR ( ENGLISH )

24,25 / 8 / 2019 : BAYAN LEPAS, PENANG ( 中文班 )

如有兴趣,请电联本人: 016-4993828

Trade with Wisdom

Fb Link : https://www.facebook.com/Steventheeinvestment/

Telegram Link : https://t.me/steventhee628

Disclaimer: Trade at your own risk. Above information is for educational sharing purpose. It does not solicit any buy/sell recommendation. Kindly consult your dealer/ remisier before making any investment decision. Author does not hold any legal responsibility for any losses occur from your personal trading/investment activity.

More articles on Stevent Hee

Discussions

shiok sendiri only. Since when Robert Kuok said want to buy back this high debt company???

2019-07-31 01:04

Airline Bobby

Speculation is the game :D

2019-07-29 12:31