EATECH - 17/2/2020

StallionInvestment

Publish date: Mon, 17 Feb 2020, 08:43 AM

EATECH 5259

E.A Tech currently involved in 3 business segments

1. Marine Transportation and offshore oil and gas storage

2. The Provision of part marine services (towing, diverting and docking of vessels and ferry service)

3. Marine engineering (ship repair and repair) services.

News Flow:

14/2/2020

Sources at Shandong ports said while storage levels are high, they are working with refineries to move oil out and make way for more cargoes that are expected to arrive in the coming weeks.

"The pace of moving crude out from tanks is slow. So if vessels are arriving at the same time, some of them might need to wait for 2-3 days," said a source at Rizhao port in Shandong.

"We still have around 30% of space at our oil storage at this moment, which is already a lot better than the previous weeks, as truck drivers are gradually returning to work."

Manufacturing activity was paused for the Lunar New Year last month when the virus struck, preventing workers from returning to their jobs.

State-run ChemChina has diverted some crude oil cargoes which were supposed to arrive in China to floating storage near Malaysia, a source with direct knowledge of the matter told Reuters. ChemChina did not respond to an email seeking comment.

Source obtain from : https://www.thestar.com.my/business/business-news/2020/02/14/some-oil-cargoes-for-china-being-diverted-to-malaysia-s-korea

3 Feb 2020

On behalf of the board, RHB Investment Bank wishes to announce that the company had on 3 Feb 2020 submitted an application for an extension of time to complete the implementation of the proposal

Source obtain from https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3020535

Personal Opinion : Base on my interpretation, corporation action if going to be benefit the company if the shares price rise up as they can raise more fund to reduce their existing debt level.

3 Sept 2019

EA Technique (M) Bhd, a subsidiary of Johor Corp Bhd (JCorp), is looking to expand its presence in Indonesia in the downstream oil and gas segment.

Managing director Datuk Ir Abdul Hak Md Amin said the company had penetrated the market by offering services to PT Pertamina International Shipping.

He said demand for shipping was high as Indonesia is a net importer of crude oil.

“We see Indonesia as a growth market especially in the downstream segment. We hope the Indonesian government will buy more refined products from Malaysia," he said in an interview here recently.

Source obtain from https://www.nst.com.my/business/2019/09/518199/ea-technique-expand-further-indonesias-oil-and-gas-market

3 July 2019

E.A. TECHNIQUE (M) BHD has proposed to undertake a debt settlement exercise owed to its major shareholder, Sindora Bhd, totalling RM57.16mil via the issuance of 121.62 million new shares at 47 sen a piece in the company .

The share issuance might result in the company’s public shareholding spread decreasing below 25%, the marine transportation provider said in a filing with Bursa Malaysia yesterday.

E.A. Technique has also proposed a private placement of up to 106.36 million new shares, representing approximately 17% of its enlarged total number of issued shares.

Source obtain from https://www.thestar.com.my/business/business-news/2019/07/03/ea-technique-to-issue-new-shares-to-settle-debt

Personal Interpretation : Major Shareholder would not happy to see if the shares price keep on fall below the propose debt settlement exercise at 47 sen.

FINANCIAL RESULT

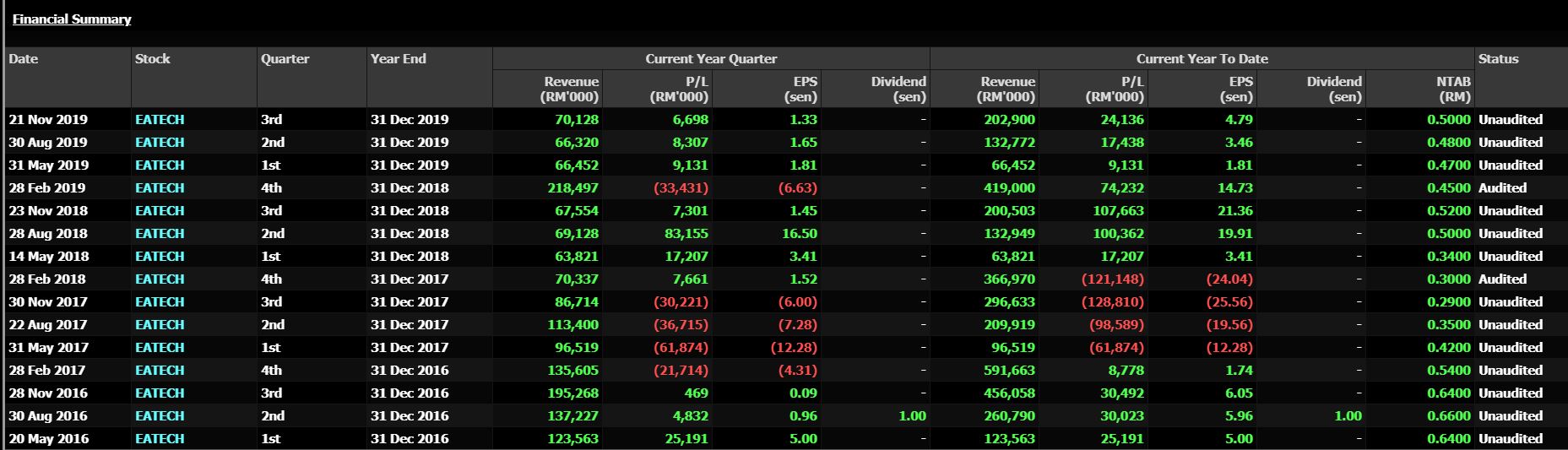

Financial earning for Eatech might be release 28 Feb 2020 base on historical result release date. Consecutive 3 quarter mark positive earning but on declining growth which telling investor that company facing profit margin squeeze.

RISK TO TAKE NOTE

Generally, there were mix news from EATech meaning business seem to be on the recovery path but at the same time there is court case which approximately 21 million USD which equivalent to about RM 82 million ringgit. So, till then we would not know what is the outcome yet. Beside that, company debt level remains high and this is not a good sign. Therefore, I would classify this as trading grade stock instead of investment grade stock. I will explain further from technical perspective.

Weekly Chart

DAILY CHART

TRADE WITH WISDOM

FB LINK : https://www.facebook.com/Steventheeinvestment/

TELEGRAM LINK : https://t.me/steventhee628

Subcribe Stevent Hee Youtube Channel :

https://www.youtube.com/channel/UCYm446mSdNPaxlSVDCVj7bA

DISCLAIMER : Trade at your own risk. Above article is merely for educational sharing purpose, it does not solicit any buy/sell recommendation. Kindly consult your dealer/remisier for any investment decision. Writer does not hold any liabilities if any financial losses occur due to your investment you have make.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|