Fresh for IPO Today!! How much is Solar District Cooling Group (SDCG) Worth?

LizzaLE65

Publish date: Thu, 19 Sep 2024, 02:28 AM

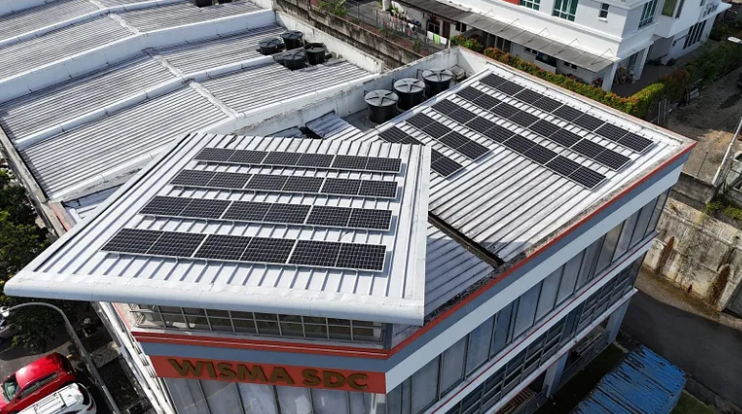

Today marks an exciting day for Solar District Cooling Group (SDCG) as the company officially lists on the ACE Market of Bursa Malaysia. SDCG and its subsidiaries have built a strong reputation for providing energy-efficient solutions in sectors like healthcare, hospitality, and industry.

The group’s services focus on building management systems (BMS), solar thermal systems, and energy-saving solutions, all of which are becoming increasingly vital in today’s world of rising energy costs and sustainability goals.

SDCG’s energy performance services are making a big impact, particularly in Malaysia’s public healthcare sector. The company has in yesterday, just before their listing, been entrusted with significant projects involving hybrid solar thermal hot water systems and LED lighting retrofitting in hospitals, for a contract sum of RM8.1 million.

Their subcontract work involves a wide range of services from installing building automation systems (BAS) to maintaining extra low voltage (ELV) and information communication technology (ICT) services. These projects are expected to be completed by May 2027, further solidifying SDCG's role in the energy efficiency landscape.

SDCG’s IPO has already garnered significant attention, being oversubscribed by 144.08 times. This level of interest reflects strong market confidence in the company’s future potential. With a fair value of RM0.60 per share, as estimated by Eco Asia Capital, investors who buy in at the IPO price of RM0.38 could see a substantial upside of around 58%.

The funds raised will be put to good use, with most allocated for capital expenditure (62.36%) and working capital (28.10%). This will allow SDCG to continue expanding its capabilities and take on more energy-saving projects across Malaysia and beyond.

Looking ahead, SDCG has ambitious plans to expand its headquarters and invest in new tools and IoT software to enhance productivity. The company is also exploring opportunities in the solar photovoltaic (PV) system market, which would further diversify its revenue streams and capitalise on its existing solar expertise.

With a solid financial foundation, strong government support, and a growing demand for its energy-saving solutions, SDCG is poised for long-term growth. For investors looking to capitalise on Malaysia’s push towards energy efficiency and sustainability, SDCG offers a compelling investment opportunity.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-09-26

SDCG2024-09-25

SDCG2024-09-25

SDCG2024-09-24

SDCG2024-09-24

SDCG2024-09-20

SDCG2024-09-20

SDCG2024-09-20

SDCG2024-09-20

SDCG2024-09-19

SDCG2024-09-19

SDCG2024-09-19

SDCG2024-09-19

SDCG2024-09-19

SDCG2024-09-19

SDCG2024-09-19

SDCG2024-09-19

SDCG2024-09-19

SDCG2024-09-19

SDCG2024-09-19

SDCG2024-09-18

SDCG

.png)