Scomi Energy Services Bhd (KLSE: 7045) Given Another Chance to Regularize its Condition in PN17 Process

Robert Waters

Publish date: Fri, 29 Sep 2023, 05:44 PM

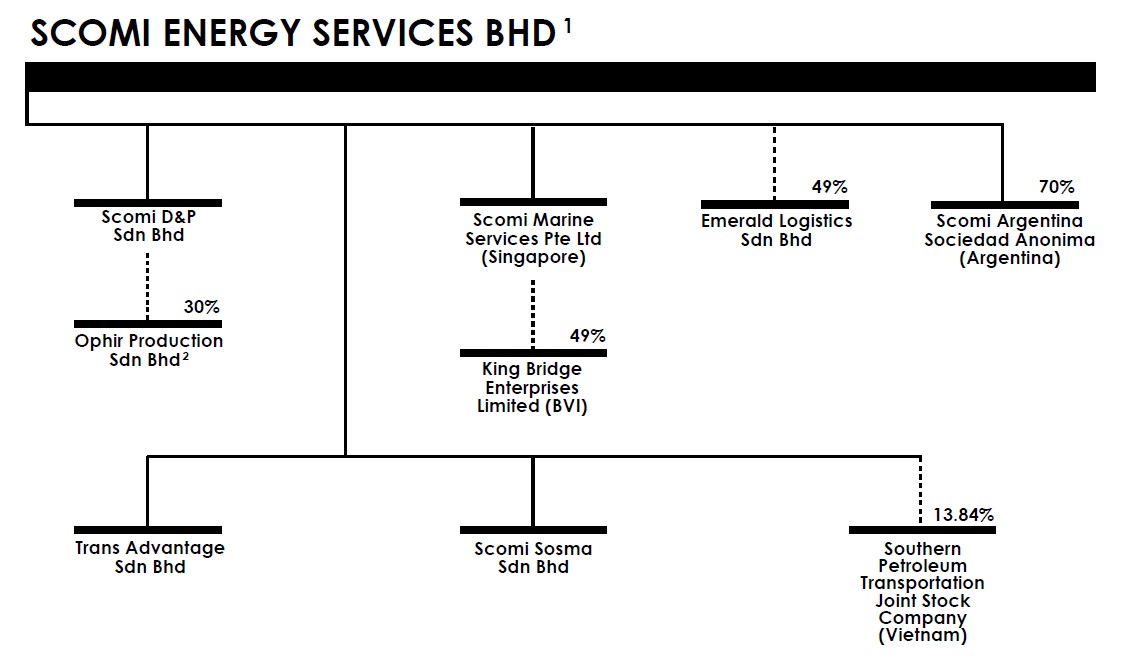

Scomi Energy Services Bhd (Scomies or SESB) at one time was a global technology company in the energy and logistics industries. The Company's segments were Drilling Services, Marine Services, and Development and Production Asset and Services. Unfortunately, the Company fell into PN17 status in January 2020, when its shareholders’ equity on a consolidated basis fell below 50% of its issued share capital. Previous distress signal showed already in December 2019 when its unit KCOB Capital Bhd defaulted on E bonds amounting to RM55 million, which subsequently triggered a cross-default in the company, raising the total to RM147.8 million.

Bursa Malaysia has a special process for companies in distress: PN17, which stands for Practice Note 17/2005. As a PN17 company Scomies will have to:

1. Regularize its condition within 12 months.

2. Submit a regularization plan.

3. Implement the plan.

The contents of the regularisation plan need to address the triggering conditions. Typical exercises performed to regularize the conditions are:

1. Settlement of debts with creditors

2. Reduction of capital to cancel accumulated losses

3. Onboarding of new investors (white knights) via issuance of new shares

4. Sale of assets

5. Issuance of free warrants and right shares to retain old investors

6. Establishing an Employees Share Scheme (ESS)

Scomies undertook such steps. The Company disposed of its core business in offshore drilling services, which provided 75% of its revenue to Cahya Mata Sarawak Bhd for a sum of RM21 million. It also received approval of its secured lenders of a scheme of arrangement received a one-time debt waiver of about RM122.1 million to fully resolve its indebtedness. Also, two white knights related to a highway project (PJD link) have entered into a framework agreement with Scomi Energy for the acquisition of PJD Link for an indicative price of about RM922 million. This agreement was unfortunately terminated.

Following the collapse of the deal Bursa suspended share trading of Scomies on July 24, 2923 with a possible delisting on July 26 after rejecting its application for a further extension of time to submit its Practice Note 17 (PN17) regularisation plan. Scomi Energy’s application was rejected as the company had not demonstrated to its satisfaction any material development towards the finalisation and submission of the regularisation plan to the regulatory authorities. However, Bursa on September 11, 2023 allowed the Appeal and granted SESB a further extension of time until 31 January 2024 to submit its regularisation plan to the relevant authorities for approval.

In a new development, Scomi Energy Services (SESB) announced plans to acquire a company engaged in ship owning, operating, and chartering of marine vessels for transportation through a cash or shares deal the target company, Duta Pacific Offshore Sdn Bhd (DPO) owned by Duta Marine Sdn Bhd (DMSB), which has 51%. The agreement is outlined in a “heads of agreement (HOA)” signed between the two parties, setting the broad framework for further discussions leading to a definitive and binding agreement. The HOA provides for an exclusivity period of 21 days during which both parties will exclusively negotiate the deal. SESB believes that the acquisition will positively impact the company’s earnings per share. It appears that Scomi is returning to its roots.

It appears that there is a way out of the predicament for the shareholders. Largest shareholders included Nik Awang with an 18.11% stake, and former Renong Bhd managing director Mohd Zakhir Siddiqy Sidek’s 12.77%, under Gelombang Global Sdn Bhd. And thousands of minority holders are also affected (5362 per Annual Report). The outcome is unknown. It could be delisting and bankruptcy. Or it could be financial recovery.

KLSE (MYR): SCOMIES (7045)