What are the odds of trading against the coming Quarter results?

SimonShuet

Publish date: Mon, 08 Feb 2016, 11:08 PM

I have written in length, in my previous subject on why I believe trading will be prevaient against investment, eps will be prevalent against just quarter results and a bullish move in export stock vs political concern.

Lets face it, the political situation thus far has brought about concern on the future of the country. This has led to many foreign investor pulling out at many point during the turbulent back and forth crisis while the ringgit fluctuate to its worst against the greenback and trying to recover.

Now put yourself as a foreign investor looking in. Situation.....ringgit falling, investors jittery while the direction of the country is uncertain. More to that, with the uncertainty, we are sitting duck to terrorism, while many of our leadership still spewing venom at each other and not putting their finger on the pain point of the country has led to further downward spiral.

At this point, we are all at our wits end asking

1. What will change in Malaysia? The local political concern has been abound for the last 1 year and the end seem very distant every time we thought the ending was near....here your guess is as good as mine.

2. What will change in US? The US market showing signs of revival with improvement in the job market statistic overall during Obama's 2 terms however his business prowness maybe lacking with just TPPA to show and yet to be completed. This really doesn't matter. In fact, his failure in foreign policy and trying to resolve matters through solely diplomacy. His only showing of fighting terrorism was taking out Osama bin Laden which was already an ongoing intelligence since Bush administration and he took credit for it.

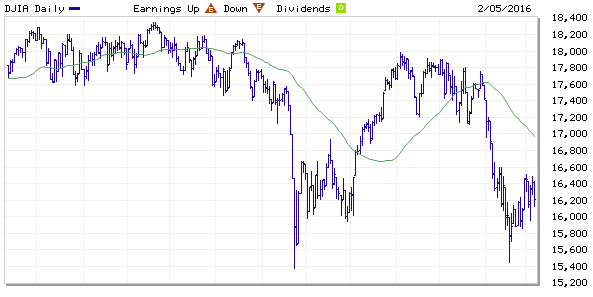

Chart 1

Chart 1

I took a 1 year DJIA chart trend to gauge. On a single year to date the chart does not reflect the growth. In fact it did a double bottom.

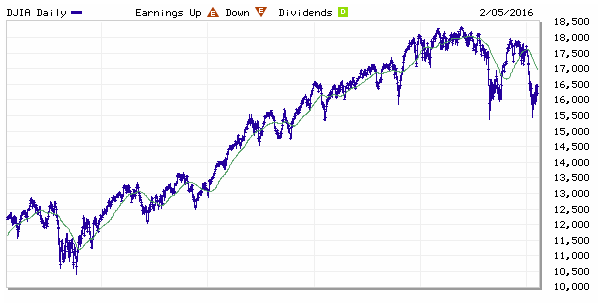

Chart 2

Chart 2

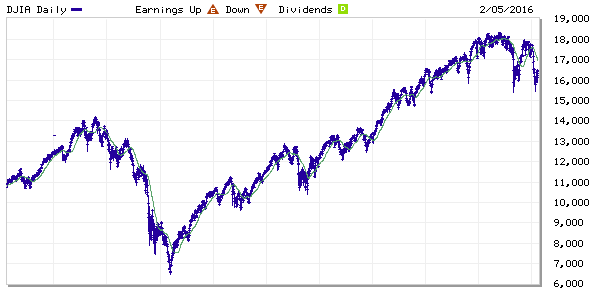

Compare the 1 year to date in Chart 1 vs the 5 years of DJIA trend in Chart 2. See the growth in DJIA? At this point, I would have liked to see a higher support for the second bottom however it really makes no difference though the second support if its higher may mean that the market is ready for the next round of uptrend instead of double bottom. Refer to Chart 3 below where the ridge was deep in one of the years taken over the 10 yrs trend but did not do a double bottom and the recovery was swift.

Chart 3

Chart 3

As most of us understand the frustration and wanting change in the current Malaysian politics, the US is no different. The exception in US is the max 2 terms for the sitting President and the citizen gets to make their choice. Cutting the chase, the point here being frustration in US will bring about wanting a different President for the occasion. The occasion here being, wanting a President to address terrorism in the most sterned way living up and above the "no negotiation with terrorist" principle. Secondly, the over repeated tagline used in the Presidential race....."Making America great again" would require nothing less than a shrewd leader with personality to match.

while I am not supporting any candidate in US Presidential run up, we MUST be realistic in putting our bets here in Malaysia due to the fact that our ringgit is riding against the USD in performance, terrorism affect business globally and even more so locally if we are attacked and crude oil and alternative energy are mostly spearheaded by US vs OPEC vs Russia

3. What will change in China? This is my last point because I am not touching Europe as of now since they have contributed too much in the last round with Greece, Spain ........ I mentioned in one of my article (something which I feel very very important) i.e. "market always want to recover". This may be in opposition to what many believe that we live in a negative market. By that, what many are saying is that there are more downs than ups in the market hence contributing to the term negative here and bearish.

Here China will represent the Asian market. My personal outlook of China is that they are testing the global market while experimenting on leverage for their own. They own large assets all over the world, their curency reserve in US is in Trillion, while they continue to lead Asia where manufacturing is concern through Asian industrial and raw material usage while their import of finish product is also increasing.

I believe China have not grasp the actual barometer in their tweaking as yet and any changes as they know now, have sizeable impact not only globally but in China itself as seen by the 2 successive market avalanche after devalueing their currency. Since then they have remove the activation of the circuit breaker base on 7% change. This means that the circuit breaker will not kick in and the market in China will not be halted if it plunges 7% or more.

Based on the 3 scenarios above at this point, we can be sure that the US market in order to climb further needs to control the global market better and whilst TPPA may ensure a more predictable playing field, it remain that they need dynamism to control China who is pushing the boundaries at every opportunity. Given that my statement "market wants to recover at every opportunity" we need dynamism that can counter the changing landscape and US knows that it cannot continue to be held at ransom in the oil trade, global market space and to terrorism in order to be great again. The dynamism here equate to the Presidential candidate this time around who will be President because he needs to be a shrewd leader, business minded and able to turn the table against the changes in the market on the go.

The US Presidential Election will be on 8 Nov this year. From now till then, the polling result of the running candidates' standing will change and more terrorism attacks will continue, more market fundamentals will be challenged which will drive the US citizens to want the change in their leadership to someone more extreme and less diplomatic in his handling of situation and addressing their economy.

The harmonics of the changes in US will strengthen their currency towards their Nov 8 date and China's pressure on the global market will act as a pressure valve in dictating the winning candidates with the strongest resolution to the their economy woes. Further to that, rise in terrorism will demand a stronger leader. This winning candidate will bring optimism to the global market and that will include KLSE. The chances of China being managed better will also be higher if dynamism can be brought into the equation by the new President.

All that is left now is Malaysia ourselves and our political woes. As i mentioned, nobody knows when our situation will improve, change or shed some light, but what I am certain with is that IF a change does happen here and perceive as a middle ground or compromise, our market will have the biggest bullrun.

So YES, I still do believe between now till year end the KLSE market will have a good chance of a BULLRUN, and in shorter term till the coming financial results (majority end of this month) will have a uptrend following the prolong and mostly unnecessary correction/consolidation

Pls note: This is purely a logical view with best determination base on my experience and should not be use as buy signal if you are not monitoring proactively

More articles on Rules of Investment

Created by SimonShuet | Jan 27, 2016

Discussions

There was concern in the market today of another sub-prime and banks were concern which led to another downtrend. Whilst we are all concern, however the global market has pickup up since then. We can look forward to a positive closing at best.

Now if we look and focus at our market vs the rest of other market which went down earlier today, I can say again "we want to recover, or we are trying to recover or someone or something wants us to recover" why?

Gainers vs losers - approx 50/50%

Traded vs Untraded - Approx 54/46%

Under traded category - Unchanged vs Change (Gainers+Losers) -approx 42/58%

The above tells me we are trying to recover, although in adverse global market or we are bottoming or have bottomed ready for rebound

Either way whether rebound or plateau, maybe a better sign compared to a diving KLCI with a majority loser with unchanged combo.

In my opinion, klse market is trying to recover even in adversity today. We will see rebound this few days as long as no new adversity news adding pressure to the local market.

2016-02-10 23:28

For those wondering what the future holds for USD and crude oil. It is easier to predict USD as a currency and I will explain why. Firstly US does not hv much control over the current drop in oil prices directly. I did a check on US as a consumer and exporter and overall they are nett importer of oil with up to 5MMbpd nett base on 2014 stats.

http://www.eia.gov/tools/faqs/faq.cfm?id=727&t=6

This means that if USD weakens as oil price continue to drop , United States as a nett importer of crude oil will NOT benefit much.

This is one of the aspect of US not making it right in the global market which is highlighted time and time again. Though the oil market has been dropping USD currency have not capitalise enough. If what I hv mentioned does not make as much sense, I will give you an example of Malaysia in the same situation as we too are nett importer of crude oil and our currency against USD peaked at 4.4 on 18/1 even though the crude oil price was hovering in the 30s, the price at the pump could not really drop as much. Now the Govt sensing (last month) that the possibility of the crude oil dropping below USD25/barrel while the ringgit continue to weaken is real, they hv decided to put a floor price to the pump. That's why the calculation of the petrol price at the pump is still a secret.

So the only reason that the price of the petrol at the pump is still high even at RM1.75 (ron97) is because of weak ringgit then. If this month MYR continue to strenthen against the USD while the crude oil price slide or maintain at usd27 /barrel, technically the pump price for ron97 should be at near RM1.25. (I suspect they will come up with floor price higher than RM1.25/liter)

The question now is the ringgit strengthen against the greenback....longer term or just a fluctuation? Does it sound coincidental that the govt wanted a floor price for the petrol announced on 20Jan last month while Bank Negara also announce reducing the SRR to create liquidity and same time the govt investment arms hv sold their property in London to bring back the funds to Malaysia and then suddenly the ringgit strengthens. Coincident?? I don't think so.

It will be short term unless the money can continue to flow in.

Otherwise, expect ringgit to weaken. Again this is a game of desirability. The currency is desirable only if it can be transacted and the more flow of it (transaction) will ensure it does not lose ground. In my opinion, unless there are new announcement of more liquidity pumped in, I do not think the ringgit can sustain its position. We are still early in the game since the money pump in SRR is effective 1st Feb this month.

2016-02-13 22:47

Fantastic rebound esp last line. Didn't know can see the market like that. Thanks I almost sold at lost

Blog: What are the odds of trading against the coming Quarter results?

Feb 10, 2016 11:28 PM | Report Abuse

There was concern in the market today of another sub-prime and banks were concern which led to another downtrend. Whilst we are all concern, however the global market has pickup up since then. We can look forward to a positive closing at best.

Now if we look and focus at our market vs the rest of other market which went down earlier today, I can say again "we want to recover, or we are trying to recover or someone or something wants us to recover" why?

Gainers vs losers - approx 50/50%

Traded vs Untraded - Approx 54/46%

Under traded category - Unchanged vs Change (Gainers+Losers) -approx 42/58%

The above tells me we are trying to recover, although in adverse global market or we are bottoming or have bottomed ready for rebound

Either way whether rebound or plateau, maybe a better sign compared to a diving KLCI with a majority loser with unchanged combo.

In my opinion, klse market is trying to recover even in adversity today. We will see rebound this few days as long as no new adversity news adding pressure to the local market.

2016-02-16 15:46

So far most results at least 40% on net profit due to forex and the latest IOI surges at 37 times of net profit with EPS from 0.31 to 11.51

2016-02-19 21:20

Market excitement currently is not abt just financial results but how much better due to forex. As I hv posted IOI surges 37times and everyone is waiting to see their export stock results and EPS.

2016-02-23 09:56

1692 or straight pass 1700. The former better for sustainence. Achieving this in first half of trading today will be encouraging

2016-02-23 10:51

Simon thanks for the article. Enjoyed it. I am feeling same way about Donald Trump and he is ahead in Nevada too on west coast side where I use to live. The frustration some of my buddies tell me is the same as what we feel in Malaysia currently. I too believe Donald will win and change making US more effective and the world a better place

2016-02-23 14:15

The results of most export and furniture as expected....Now what? Most ppl are sharing with me that their stock is yielding high. Great to hear that! As I hv mentioned, EPS will be prevalent, hence my answer will be along that . It will restart the PE again since EPS will bring down the PE value. With at least one quarter looking at financial and the second quarter on EPS, the 3rd quarter should focus on expansion rightfully. In an ideal situation the increase FCF for a maintain budget would be best option. For those dependent on oil for operation this will be ideal

2016-02-24 21:37

SimonShuet

"Market always want to recover"! Give it a reason, it will move north, give it a catalyst it will be bullish. There will be at least one instant this year the stars will align and the reason being US Presidential election run up will coincide with our change in the country.

2016-02-09 12:42