The New Data Centre Player in Town!! Still Deeply Undervalued???

raymondsim87

Publish date: Tue, 14 May 2024, 01:56 AM

Investors have been closely watching Southern Score Builders Berhad (KLSE: SSB8) as its share price has shown a noticeable uptick since late March. This upward trend is underscored by the recent strategic acquisition that has piqued market interest even further.

SSB8’s price and volume movement.

What is going on?

SSB8 recently announced its acquisition of a 51% equity stake in SJEE Engineering Sdn. Bhd. (SJEE) for RM22.95 million. SJEE, established in 1992, has carved a niche in the electrical engineering sector, specialising in turnkey projects for complex installations in high-tech industries, such as data centres.

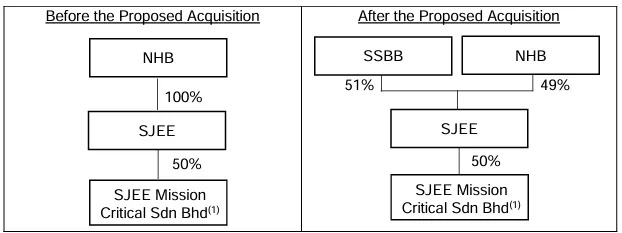

New shareholding structure of SJEE after the acquisition.

Who is SJEE?

As a Class A electrical contractor certified by the Energy Commission since 2013 and a Grade 7 (G7) Mechanical and Electrical Contractor with the Construction Industry Development Board since 2017, SJEE’s credentials are solid.

Their portfolio spans data centres, high-rise buildings, commercial and industrial facilities, and healthcare institutions across Malaysia.

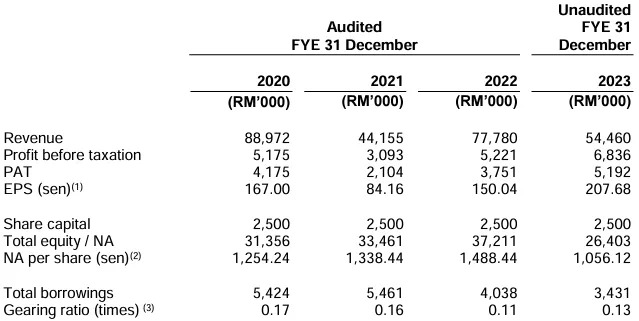

The financial health of SJEE has been robust over the past three years, with the company maintaining a significant order book valued at RM38.31 million. There are also rumours of SJEE nearing a substantial contract win for data centre related projects, which could further bolster its market position.

Financial information of SJEE.

The acquisition deal includes a profit guarantee from SJEE of not less than RM15.0 million over the next three financial years, translating to an approximate addition of RM2.5 million to SSB8’s net profit based on their 51% stake.

This is in addition to SSB8’s existing profit guarantee of RM80.0 million spanning 2022 to 2024, promising significant earnings enhancement, especially with new data centre-related projects.

How about valuation?

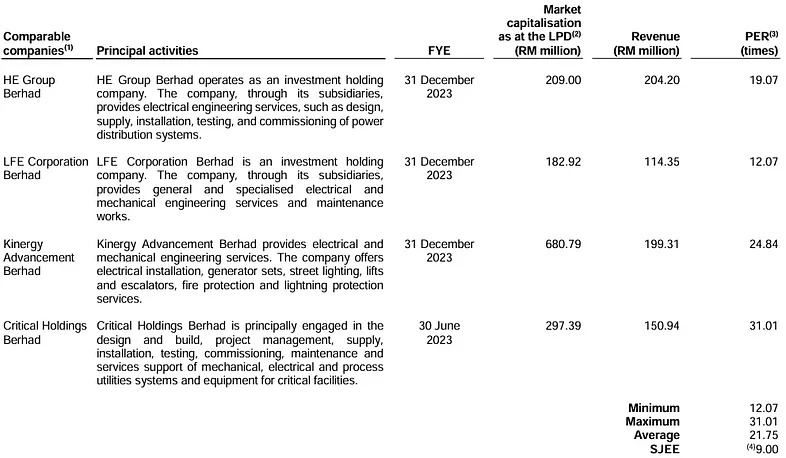

Peer comparison with SJEE in terms of PE valuation.

This acquisition positions SSB8 uniquely in the market, especially when compared to peers like HE Group and Critical Holdings, which also operate in the data centre space. Acquiring SJEE at a 9 times PE ratio represents a value-driven move, potentially boosting SSB8’s earnings per share significantly.

Investors are now posed with the question: How impactful will this acquisition be for SSB8’s growth trajectory?

As the company integrates SJEE’s operations and leverages its expertise, the potential for substantial market expansion appears promising.

Discussions

if you want to sell nasi lemak

You must have rice

So Data Centers must have HDD (hard disk drives )

2 months ago

Xiaoeh

printed circuit board mostly apply to electronics and also in computers

but the very heart of a data center consist mostly of storage devise like HDD(hard disk drive ) and Sdd

2 months ago

speakup

Omg!

Tomorrow I will sell house, sell car, sell jewelry, sell underwear and sailang ssbb

2 months ago