BSTEAD (2771) : Evolving to possibly LIMIT UP

Sipekhuat

Publish date: Tue, 01 Jun 2021, 12:34 AM

BSTEAD : Evolving to possibly LIMIT UP

Dear readers, Welcome back to “The Huat Project”. In this article, we would like to share about BSTEAD (2771): Evolving to possibly Limit Up.

The Term “EVOLVE” means to “develop gradually, from a simple form to a complex form”, and we opine that BSTEAD(2771) is on the path of correct evolution towards greater days and higher share price. Let us analyse Why

Qualitative Fundamental Analysis

On 1 Dec 2020, Dato Sri Mohammed Shazalli Bin Ramly has been appointed as the Group Executive Managing Director for BSTEAD(2771). Dato Sri Mohammed Shazalli has been in various MD/ CEO of many successful public listed companies, such as TM, AXIATA, CELCOM, ASTRO & BAT. (https://www.klsescreener.com/v2/announcements/view/3269361)

We belive that Dato Sri Mohammed Shazalli, with his vast experience and knowledge will be able to “reinvent” BSTEAD (2771), as some of the plans are already set in motion. (https://www.thestar.com.my/business/business-news/2021/04/30/plans-in-place-to-reinvent-boustead)

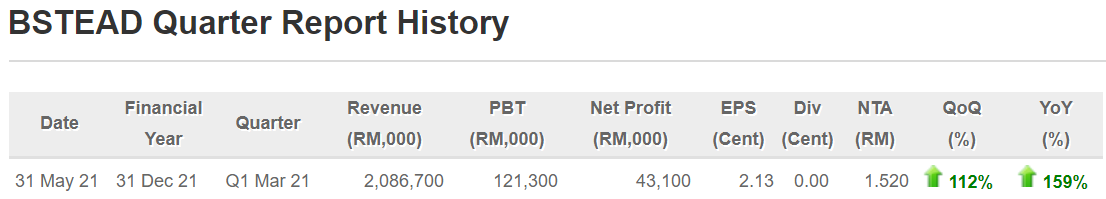

As such, BSTEAD(2771) posted a Positive Quarterly Report on 31/5/2021, and QOQ up 112%, YOY up 159%

RECOVERY of BSTEAD (2771)

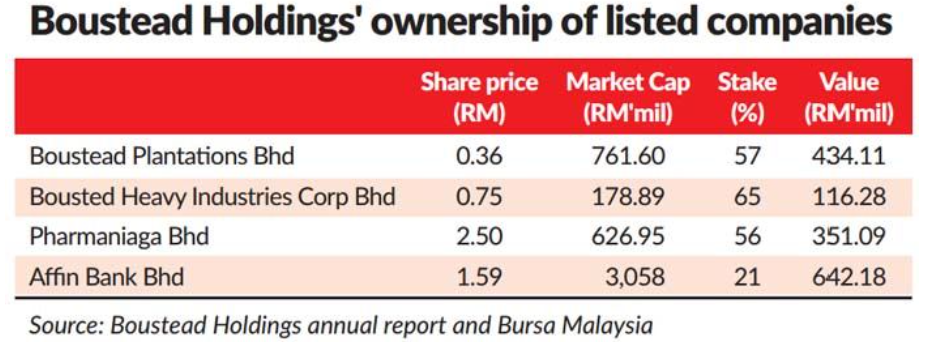

BSTEAD (2771) is in a position to come back stronger as it has investment in Plantation, Bank, Heavy Industries & Pharmacy.

FCPO Prices have been on a uptrend which will be good for BPLANT, and ultimately benefit BSTEAD (2771)

Once our economy recovers, interest rate hike will benefit Affin Bank, which will also Benefit BSTEAD (2771)

BHIC:https://www.theedgemarkets.com/article/government-greenlights-boustead-group-continue-littoral-combat-ship-project

***As for Pharmaniaga, the share price went Limit Up on 31/5/2021. BSTEAD (2771) has a direct interest of 56% in Pharmaniaga. Technically speaking, BSTEAD (2771) should also have a gain of 15%? (56% of 30%) ***

TECHNICAL ANALYSIS

BSTEAD (2771) broke up from its downtrend & resistance of RM0.595 which will now become the resistance. Since Pharmaniaga Limit Up, we opine that technically BSTEAD (2771) should at least have a 15% gain on its share price, in which coincidentally after 15% BSTEAD (2771) should be able to close its gap at Resistance of RM0.705.

With RM0.595 as support, BSTEAD(2771) has a lucrative Reward to Risk Ratio of about 4 Times.

Conclusion

We strongly believe that BSTEAD (2771) would benefit from PHARMANIAGA. Also under the new management, We believe that “A New Bstead” would be reinvented, under that guidance of Dato Sri Mohammed Syazalli. Not withstanding the above, BSTEAD(2771) is also strongly positioned for future growth.

Who knows maybe once BSTEAD(2771) has successfully turned around, LTAT is interested to privatise it for RM0.80 again? ![]()

What will you do?

DISCLAIMER: This post serves as an educational analysis and is never meant to be a buy/sell call or recommendation. Investors must always do their own due diligence before making any investment decisions. The author of this post is not liable in any way for any decisions made by any individual.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|