Amazing results but lack of recognition – FAST ENERGY HOLDINGS BHD

dessmond1

Publish date: Thu, 01 Sep 2022, 11:16 PM

Amazing results but lack of recognition – FAST ENERGY HOLDINGS BHD

For the longest time, FAST ENERGY HOLDINGS BHD (FAST) had been neglected due to its business being dragged by its non-profitable mould cleaning rubber sheets and LED epoxy encapsulant business, which had resulted in a loss.

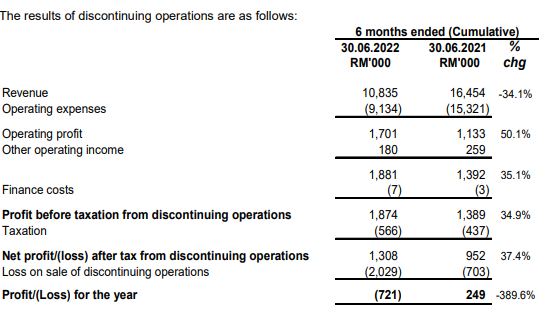

In May 12 however, things had started to take a turn. The company had disposed 100% equity interest in Cape Technology Sdn Bhd, which is good for the shareholders in value creation.

Plus, in tandem with other non-profitable companies which include Oriem Technology Sdn Bhd and Techfast Precision Sdn Bhd, the 3 now-disposed or ceased subsidiaries had resulted in RM0.72 million in net losses. Investors must take note that this will no longer impact FAST going forward.

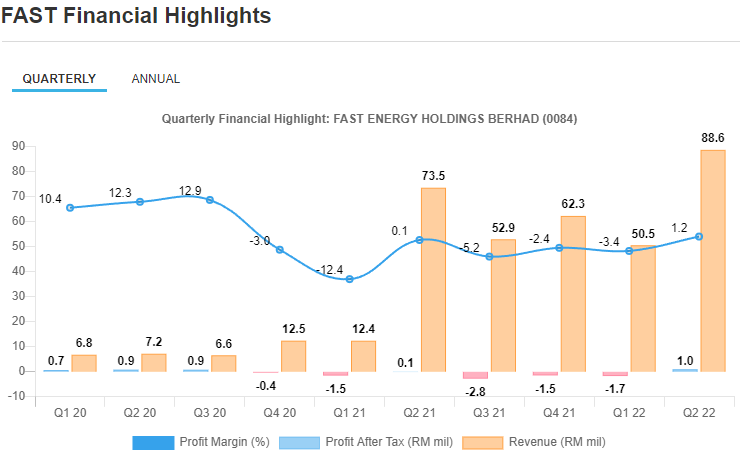

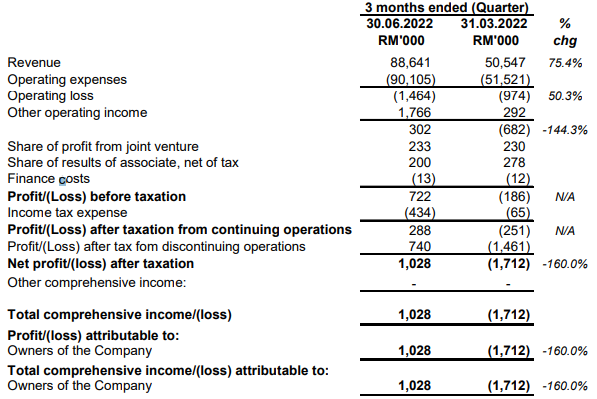

For the quarter under review, the company had generated RM88.64 million in revenue, a stunning 36.2% increment from the year before. The growth was mainly contributed to their new and profitable venture – the bunkering, vessel chartering and petroleum trading business.

The business had also proven to be profitable in the quarter, and the business quickly overtakes the previous year loss-making performance by delivering a RM1.02 million maiden profit after several quarters.

Hence, it is very likely that FAST will remain profitable for the quarters to come.

The comparison between quarters were also commendable for FAST. Aside from a 75.4% jump from the revenue, the company had also turned the loss of RM1.71 million in Q1 to a profitable quarter.

To be fair to the company, the company had a positive EBITDA in Q1 but was badly impaired by the one-off impairment loss from its discontinuing operations. Hence, things are started to be bright for FAST going forward.

As part of the company’s profit enhancement plan, FAST had proposed to acquire another 35% equity interest of CCK Petroleum Sdn Bhd, which is the critical for the profit generative ability for the group as of now. It is also understandable people might misunderstood oil bunkering as non-environmentally friendly business, but we must emphasis that FAST had set their goal on providing low sulphur content fuel, which is now a hard requirement by MGO.

This could enhance the ESG aspects of the company on top of their renewable energy segment focusing on synergizing EPCC service providers as well as people in need of the service and funding, especially in the B2B sub-sector.

It is also important to note that once the company had a stable profit, they will restart their dividend policy of 40% since the commencement on 31st December 2017.

Truth to be told, I think it is unfair for a profitable and growing company to trade a mere RM22.1 million in market capitalization. Recognition is needed in the market to this company to better value the company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|