Poor Q4 16 Vivocom Quarterly Performance

Wonder88

Publish date: Wed, 01 Mar 2017, 10:58 PM

Based on RM2 Billion projects, is it a BIG Surprise for the Q4 16 performance?

Let us go through the Quarterly Performance as below:

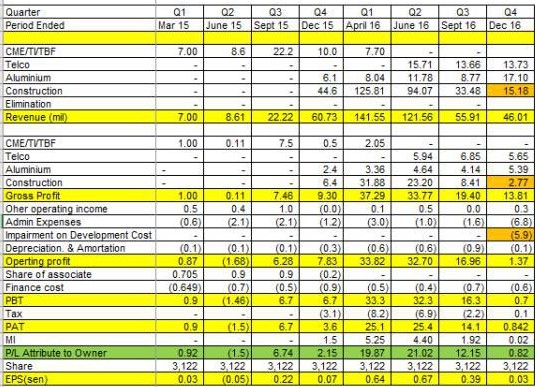

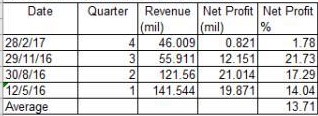

Table 1

From the table 1 ,

1)The Aluminium sector revenue and segment profit is only 17.1 and 5.39 million respectively.

2)The construction sector revenue and segment profit is only 15.18 and 2.77 million respectively

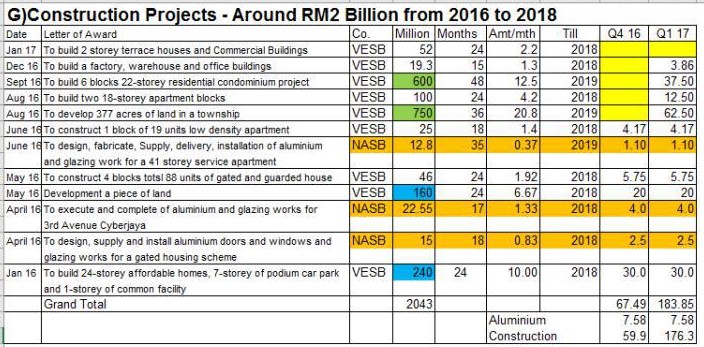

Again, Let us go back to the Project contracts obtained in 2016 as per table below

Table 2

From the table 2,

1)The projects obatained after June 16 (generally Aug 16 and onward) is not considered in Q4 16 revenue,

there is total RM1.5 billion sales, where there are 2 Big projects value at RM600 mil and RM750 mil (highlighted

in Green)

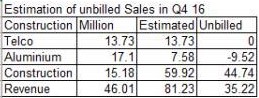

2)Based on above assumption, the estimated Aluminium and Construction revenue vs actual in Q4 16 as below

Table 3

From the above table, there are approximately RM35 million unbilled sales.

Now, let us calculate the average % Net Profit vs Revenue as below

Table 4

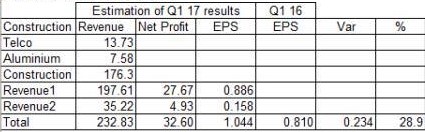

From the Table 2 and Table 4, we estimate the Q1 17 Revenue, Net Profit and EPS as per table below

Table 5

Based on the estimation, the EPS for Q1 17 Vs Q1 16 should around or above 28%.

Wow, although the estimated EPS is not fanstatic, but logically should above Q1 16 value.

Above estimation based on assumption made as below:

1)No Change in Projects Contract Value

2)Projects and billing is execute accordingly as per schedule

3)Any impairment loss is ignored, especially in this analysis.

Remarks

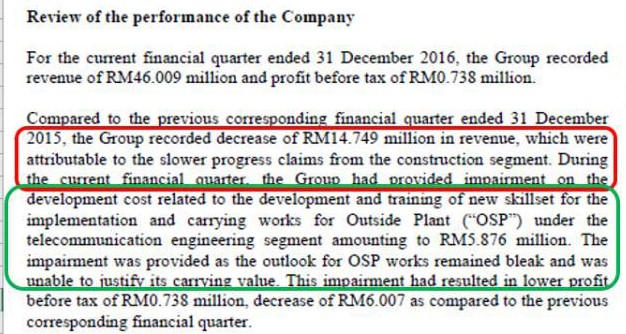

1)Reveiw of the performance of the Company (Q4 16 Vs Q4 15)

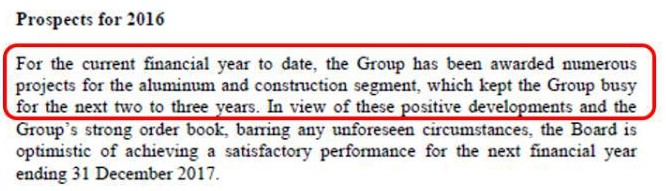

2)Prospect for 2016

3)MIDF Research for Vivocom

4)The author only share the information, it is not a buy or sell call.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Vivocom- The Future Construction Dragon

Created by Wonder88 | Jul 29, 2017

csan

well, good effort.....but those 2 mega contracts highlighted in green are not finalised yet if you read carefully. vivocom is not trusted by the market because it may be the case that their real orderbook(where they can actually start work and recognise earnings) is actually very little.

2017-03-02 21:37