Is Vivocom Devil or Gold Fortunes?

Wonder88

Publish date: Sun, 02 Sep 2018, 11:21 PM

Another upset Q2 18 released on 30/8/18, Vivocom investors curse around being cheated by the Management and

MIDF research (initial target around 75 sen and revised to 40 sen in 2018). However the share price drops from

highest around 0.164 (adjusted after OR on 30/7/18) to 0.02, which is 720% drop from high.

(People say "No Eyes to See").

A few questions raised as below:

1)Is the management really BAD?

2)Is the company going to BANKRUPT?

If it is so, why the company not sell to CNQC International Holdings Ltd (If not wrong, the CNQC gave extention of

another 1 month to let the Vivocom management to consider). Anyway, whatever is, already become history.

Let us look at the latest quarterly report.

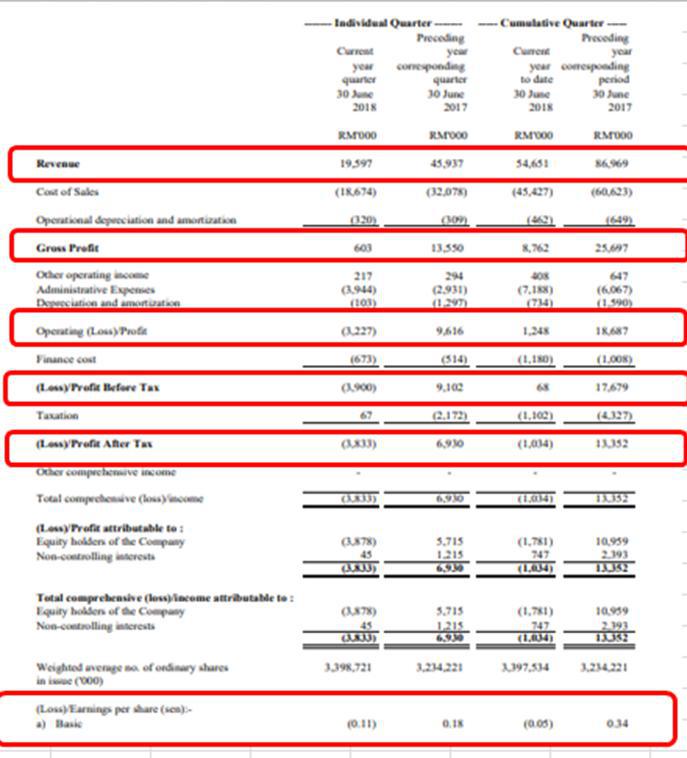

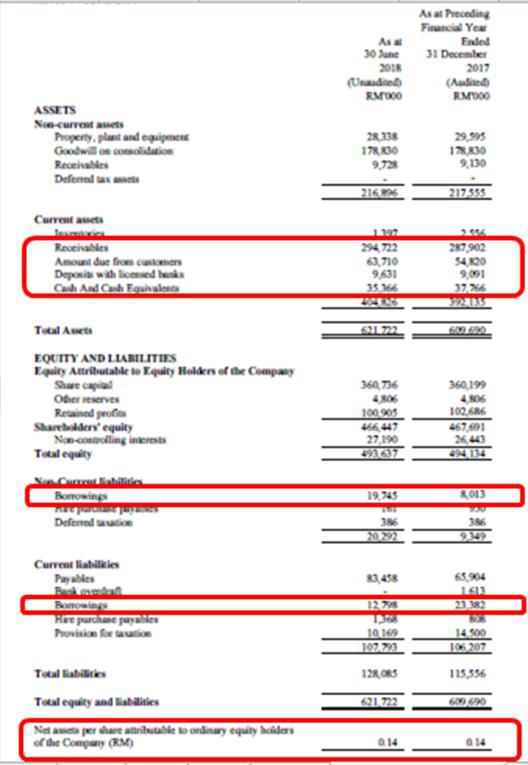

A)Income Statement

The summarization as below:

Really "No Eyes to see"

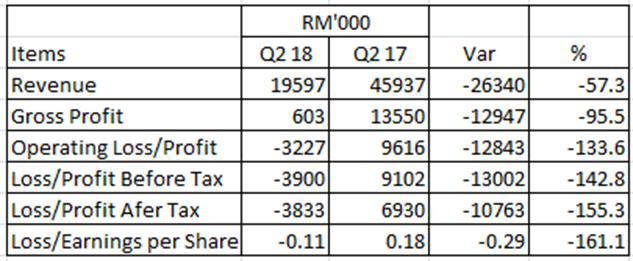

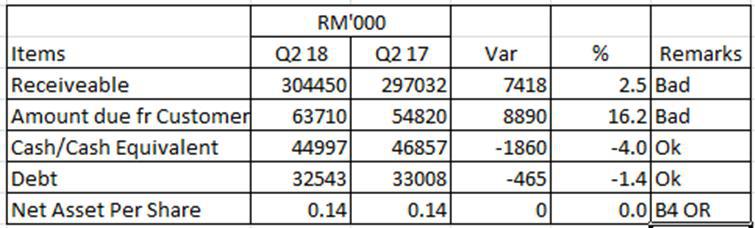

B)Balance Sheet

From the above table, the Finance/Account Department & the Boss is "sleeping", amount due fr customer, increases

to 64mil or 16.5%. Can we say the company is hopeless?Let us look at the past history as below.

C)Past History

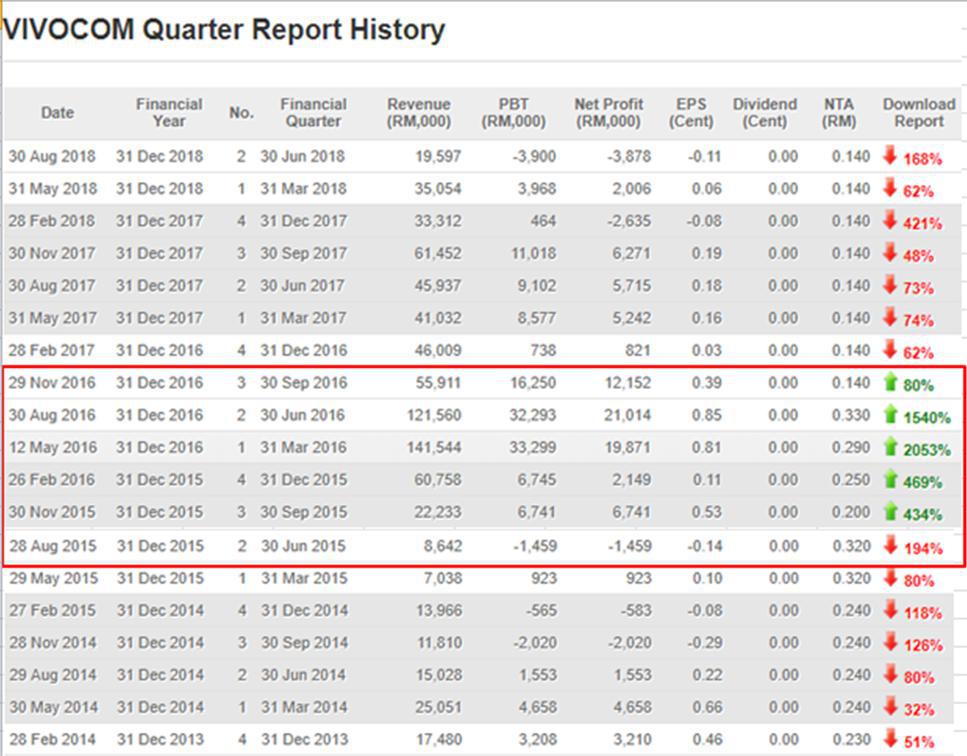

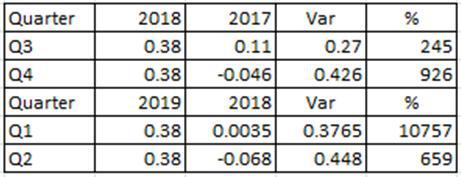

i)Quarterly Performance

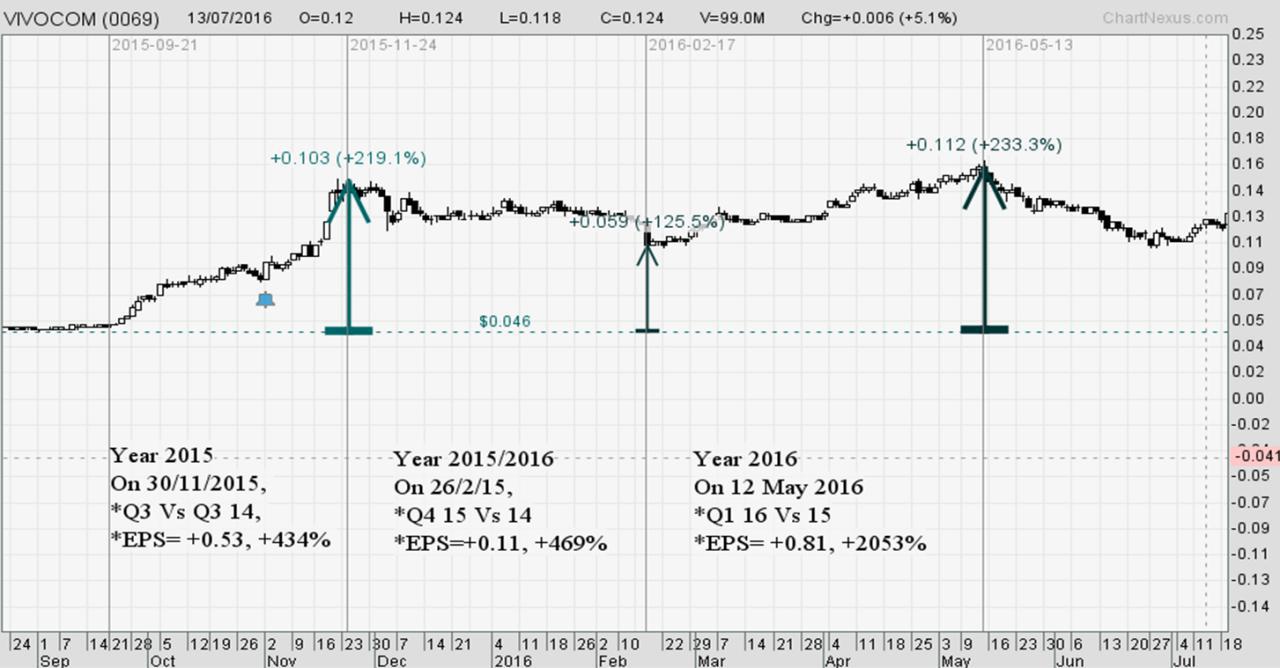

ii)Technical Chart

Technical Chart 1

Technical Chart 2

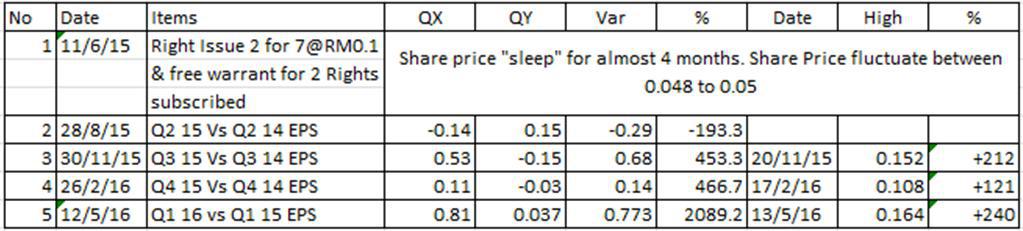

Don't misunderstanding that I want to show you the trend, just want to show the past history with Offer Right Issue.

The summarization as below:

From the above table, the immediate quarter after OR issue on 11/6/15 stil loss, however the share price rocket up

after next few Quarters report. Based on reports, the increases revenue was derived from the progress billings of

several on-going construction projects.

Will the history repeated, I'm not GOD and can't answer you, only the Vivocom Boss know well.

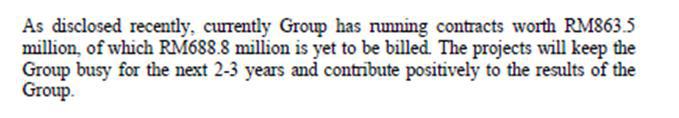

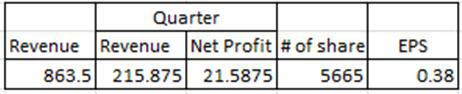

Anyway, based on the latest Quarterly report, the group is running contract worth RM863.5mil of which RM688.8 mil

is yet to be billed.

Let us calculate based on RM863.5mil and the summarization as below:

Assume the company to bill RM863.5mil within next few quarters

1)Assume 10% net profit (Based on average, is around 15%)

2)Assume the revenue is evenly distributed to 4 quarters

the possibility of the quarterly performance as below

Based on the above table, the "predicted" perfromance to be so called fanstatic again. The trailing 12 months

Earning per share is 1.52 sen or with PE=10x, the share price to be worth RM0.15, which is 650% increases

from RM0.02. Wow, somebody is really know how to play the price up and down with the Earning.

Remarks

The above ONLY for knowledge sharing.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Vivocom- The Future Construction Dragon

Created by Wonder88 | Jul 29, 2017

Discussions

How much is latest QR provision for doubtful debts?

https://klse.i3investor.com/servlets/cube/post/jackyong138.jsp

2018-09-02 23:39

I heard Vivo directors oversubscribed RI. If devil not they throw money into dustbin?

2018-09-02 23:45

It want to complain abt devils should be the bankers advising buy eg CIMB and MIDF.

2018-09-03 05:55

wonder88, only 688 million yet to bill, not 863.5million. and also there are many projects will be completed two to three years. If you would like to predict the earning. Maybe 688 million divide by 8 or more quarters, if PE 10, the share price will only worth 0.06. It will be excluded any impairment or bad debts and also other new projects awards.

2018-09-03 10:51

Jeff Ain,

Agreed is RM688mil yet to be bill, but that amount is updated till 30/6/18 (Q2 18 report) only. U mean the bal RM175.5 mil project not going to complete in 1 or more quarter down the road!!

Why shoud it be divide into 8 quarters, If you are the Boss, are u going to bill the clients once project complete and show good performance for the next few quarters. That is what happened in the past history, we, retailers kena "cheat" by the their past results in quarterly report.

The RM688mil or total RM863.5mil is excluded from the Trade receivable amount (RM295mil) and due from customers (RM63.7mil), means they still have RM358mil to collect. May be you can help them to collect, then the next few Quarters will have BIGGER profit, all the Vivocom kaki will happy to belanja you.

2018-09-03 13:18

the RM175.5mil of projects are part of the projects that has been completed and billed to vivocom previous quarters. Now left 688mil which is yet to bill. Boss can bill it once the project complete, but the some completion time for those projects are 2020 and 2021. So it is impossible to bill it in the coming 4 quarters. Maybe part of the 688mil (like 288mil) will be billed in coming 4 quarters . remaining 400mil will be bill in the another 4 to 6 quarters.

2018-09-03 18:01

Vivonewbie

Thanks for the blog.

2018-09-02 23:35