(Forecast) JAYCORP (7152) & POHUAT (7088) Quarter Report EPS and PE

Wah Lau

Publish date: Sat, 02 Mar 2019, 08:05 PM

Just sharing for study propose no call buy, Take your own risk in investment ><"

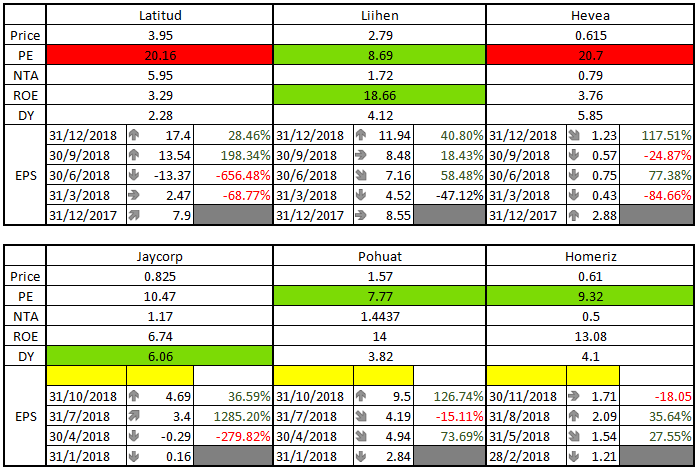

Below is some furniture company in Bursa

Last Month Good Results For Furniture Company

LATITUD LIIHEN and HEVEA all 3 furniture company EPS compare last quarter increase 28.46% to 117.51%.

But share price so so only ><"

Forecast JAYCORP and POHUAT EPS increase 28.46%.

I select lower increase for LATITUD LIIHEN and HEVEA. 28.46%, and consider JAYCORP and POHUAT EPS increase 28.46%.

POHUAT QoQ EPS increase from 9.5 to 12.20

T4Q EPS=30.83 and PE=5.09 (consider share price RM1.57)

*=.= just base on calculation, any mistake please advice

JAYCORP QoQ EPS increase from 4.69 to 5.138

T4Q EPS=12.94 and PE=6.38 (consider share price RM0.825)

JAYCORP EPS no increase 4.69 to 6.02

Due to Fire incident JAYCORP loss about 0.9mil, we consider 1.2mil.

=JAYCORP next quarter EPS

=Next quarter net profit ratio X previous EPS

=[(previous next profit increase 28.46% and reduce fire loss)/previous next profit]X previous EPS

=[(6.346mil*1.2846) - 1.2mil)/6.346mil]X4.69

=1.096X4.69

=5.138

But JAYCORP some production delays after fire. Losses below RM1mil

USD VS RM

For LATITUD LIIHEN and HEVEA

|

Date |

Average |

|

1/7/2018 to 30/9/2018 |

4.0927 |

|

1/10/2018 to 31/12/2018 |

4.1716 |

|

1/1/2019 to 28/2/2019 |

4.0992 |

For JAYCORP and POHUAT

|

Date |

Average |

|

1/8/2018 to 31/10/2018 |

4.1299 |

|

1/11/2018 to 31/1/2019 |

4.1580 |

|

1/2/2019 to 28/2/2019 |

4.0787 |

Trend

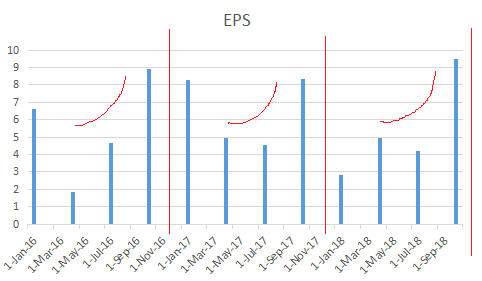

POHUAT have yearly trand compare JAYCORP.

POHUAT

POHUAT

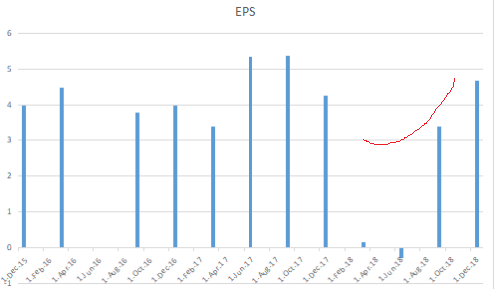

If JAYCORP EPS > previous quorter it will meet KYY Golden Rule

KYY Golden rule for share selection:

The company must report profit growth for 2 consecutive quarters before I decide to buy it. Moreover, it must be selling below PE 10.

JAYCORP

JAYCORP

Pro And Con

Pro

This forecast take lower increasement 28.46%

Con

1.)average USD VS RM for 1/10/2018 to 31/12/2018 is 4.1716 higher than 1/11/2018 to 31/1/2019 with 4.1580, please refer USD VS RM

2.)Different between 1/10/2018 to 31/12/2018 (4,1716) and 1/7/2018 to 30/9/2018 (4.0927)=0.0789,

but different between 1/11/2018 to 31/1/2019 (4.1580) and 1/8/2018 to 31/10/2018 (4.1299)=0.0281.

3.) POHUAT have yearly trend.

Suggestions

Any suggestions, please advice and we learn together and thanks.

Just sharing for study propose no call buy, Take your own risk in investment ><"

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on WahLau Share Forecast

Created by Wah Lau | Aug 31, 2020

Created by Wah Lau | Jan 19, 2020

Discussions

Suggestion : Furniture counters .... strongest buy now bcos of excellent fundamentals.

2019-03-02 21:56

FLBhd, Jaycorp n Pohuat ... potential furniture counters for us to make easy money. Just look out for them. Thanks.

2019-03-06 12:39

USD/MYR direct impact mostly furniture company profit. Set cut loss point in mind as contingency plan and wish u huat ar.

2019-03-06 18:49

Icon8888

A lot of new bloggers recently

2019-03-02 20:37