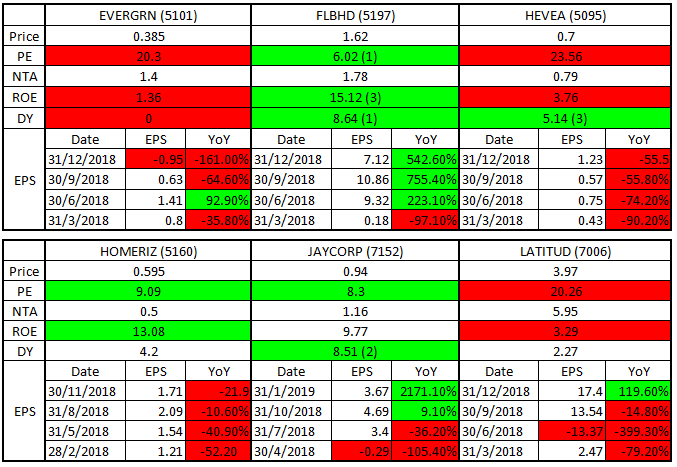

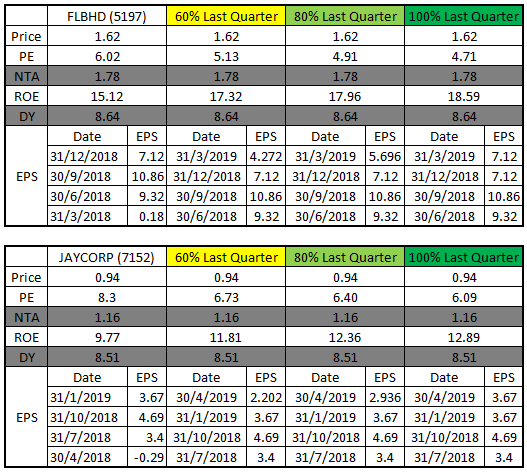

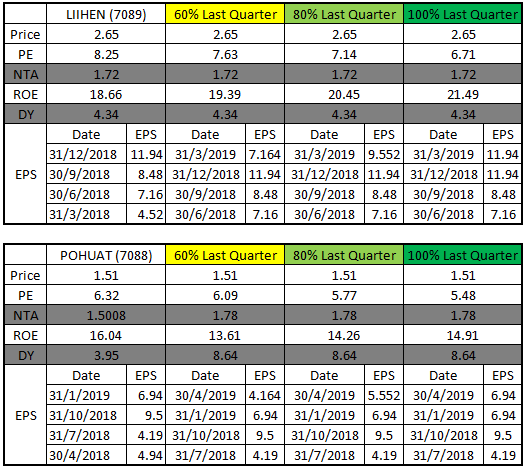

(Forecast) FLBHD (5197), JAYCORP (7152), LIIHEN (7089), POHUAT (7088) Quarter Report PE and ROE

Wah Lau

Publish date: Sun, 21 Apr 2019, 07:34 PM

Last week I check about "plastic product" share.https://klse.i3investor.com/blogs/WahLau/202231.jsp

Just sharing for study propose. No call buy, Take your own risk in investment ><"

This week we check another export share. "Wood" or Kayu share.

Starting of Mar 2019, I study some furniture company before.https://klse.i3investor.com/blogs/WahLau/196080.jsp

This time I add few more wood product company, due to increase of USD to RM (good for export)

*Please let me know the company you want me to add in ^^

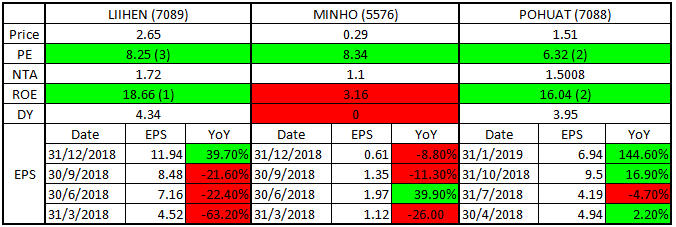

Top 3 list base on they PE, ROE and DY performance.

(I just 100% base on those data, if you have any information for those company, welcome to add in comment)

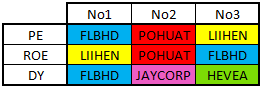

Base on current USD to RM performance and last quarter E{S performance

Let us "forecast" next quarter results (PE and ROE), if we consider next quarter EPS are 60%, 80% to 100% of last quarter EPS.

*We fix NTA and DY

Top 2 PE, ROE or DY to check here:

FLBHD

-Best PE and DY. Good ROE

-Quarter 31/3/2018 bad EPS, this quarter YoY high possible >1000%

JAYCORP

-Good PE, ROE and DY

-Quarter 30/4/2018 bad EPS, this quarter YoY high possible >500%

LIIHEN

-Best ROE and good PE

-The only QoQ improve in last quarter

-Lower DY, maybe they need money to reinvest for better EPS

POHUAT

-Good PE,ROE and DY

-Good quarter result at 30/4/2018. It consistent EPS, but not much spec. for next quarter YoY result

Remarks:

-I have a bit FLBHD and this week fail to buy at 1.50-1.52 =.=...

-Let us wait and see the impact of minimum wage in area

-"Kayu" share always have good PE and DY, maybe they profit no consistent and not "laku".

-All Sensei and friend welcome to leave suggestion and advice in comment and thanks for reading or leave comment.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on WahLau Share Forecast

Created by Wah Lau | Aug 31, 2020

Created by Wah Lau | Jan 19, 2020

Discussions

These are good counters. Not like speculating counters from other uncle. I seldom praise others. Thumbs up.

2019-04-21 20:04

calvintaneng - Ic. Any advice the cash and share ratio we need to keep?

ramada - thanks and I still learning.

2019-04-21 20:08

calvintaneng - thanks for your advice, I try to control myself to buy share =.=...

For those no good results in quarter results, I try sell those. Between I like your Asiapac share with good book value.

2019-04-21 20:30

Posted by Wah Lau > Apr 21, 2019 8:30 PM | Report Abuse

calvintaneng - thanks for your advice, I try to control myself to buy share =.=...

For those no good results in quarter results, I try sell those. Between I like your Asiapac share with good book value.

Asiapac undervalue

Now T3 to T2 is a bane for traders

Powell increased interest rates caused DOW to go down & Trump hopping madhttps://www.businessinsider.sg/trump-fed-interest-rate-hikes-comments-2018-7/?r=US&IR=T

2019-04-21 20:35

calvintaneng - Asiapac undervalue - yes but it up too fast. USD interest rates increase. It is make USD to RM up, money move to US, FKLI down?

2019-04-21 20:50

The main danger is this!

Rm32 Billions being taken out of Malaysia as Foreign Funds flee bailout of FGV (Rm6.2 billions) T Haji & Others

See

https://www.theedgemarkets.com/article/rate-cut-may-not-save-ringgit-bond-rally-index-outflow-looms

2019-04-21 21:11

There might be A Panic into CASH

Banks calling back loans

Those companies with high borrowings or over leveraged or insolvent might be in deep deep trouble

SOME MIGHT EVEN GO LIMIT DOWN

2019-04-21 21:13

calvintaneng - Aiya, I wish it not happen and our new government do something good for FKLI. Else FKLI will have next mega sell...

2019-04-21 21:42

(2.6m shares buyback April ) Philip

Calvin you do know there is a difference between bonds and stocks right? If 32 billion of bonds are taken out of the market, where do you think the companies are going to get their funding? From the stock market. When the bonds go off the market, companies will be more inclined to get more funding by doing more rights issues and preferred shares and warrants sales in the stock market. To increase that interest in buying private placements rtc, more and more companies will have to entice customers and companies by doing share buybacks to increase the price, raise dividends to make it more attractive to hold, do preferred shares (ICULS) to raise money.

The only companies I would be worried about are those penny stocks and dent ridden companies you like do much.

https://www.thebalance.com/how-bonds-affect-the-stock-market-3305603

Good riddance to investors like you, it's better if you just keep 80%of your money in cash and stop harassing good investors.

It's a wonderful time to start investing in Malaysia.

2019-04-21 22:31

Zulfikri

Slowly buy and keep lots of cash since April 29th will wash out day traders and short term punters from bursa

As for Philip with tunnel vision he cannot see that liquidity of rm32 billions withdrawn from Malaysia will cause a panic into cash

As such whether through pp, bonus or whatever means the collective pool of liquidity being diminished will result in lower asset prices as a whole...there is no escape.

If the reservoir is drying up the only way to stay solvent is to have your own source of water

That means look for cash rich companies or companies backed by huge hoard of valuable assets which can be liquidated for cash in emergencies

2019-04-22 01:05

zulfikri- =.= today up 8.33%

calvintaneng- I wish you can write a blog when u start use your 70-80% of many. If you free write about money management too

(2.6m shares buyback April ) Philip - current market still got pro and con view. Our market still balance =.=? (but today our construction overheating)

2019-04-22 20:24

calvintaneng

Ooi!!

Be careful hor

Rm32 BILLIONS FOREIGN BOND SELLING MIGHT CAUSE KLSE

TO SINK! SINK! SINK!

SO DON'T CATCH FALLING KNIVES HOR!!

2019-04-21 19:59