Hibiscus - is there a future

zhangzuode

Publish date: Sun, 31 Jul 2022, 08:30 PM

Hibiscus – is there a future

Since the release of Q3 FY2022, it appeared that there is no future in oil, by extension, Hibiscus. Hibiscus share price dropped from RM 1.49 to 82 sen. It is like the end of the world if one is to follow comments in investing forums. Mind you, oil prices have REMAINED above US$ 100/barrel.

Rational for the dropped was the impending recession supposed to be caused by the high inflations occurring all over the world. This supposedly recession would cause such devastating demand destruction – mother of all demand destruction. Is this warranted?

Below is OECD Petroleum inventory (https://ycharts.com/indicators/oecd_petroleum_stocks) since 1996. The OECD Petroleum Inventory is considered a proxy for world petroleum (crude oil & products) inventory.

From the graph, there are 2 periods of demand destruction (reflected as inventory increase/build) namely:

1) Asian Financial Crisis – 0.53 mbpd

2) 2008 Financial Crisis – 0.45 mbpd

And 2 periods of uncommon events:

a) Oil over production crisis – due to shale oil (drill at all cost) and OPEC production “war” to maintain market share – 0.59 mbpd (it was a protracted “war” – 912 DAYS)

b) Pandemic – 2.45 mbpd (very high, also very short in duration compared with the others)

Correspondingly, after each recession and events, there is recovery (reduction/draw in inventory):

· AFC – 0.83 mbpd

· 2008 FC – there was protracted recovery – economic structural change & start of shale oil

· Over production crisis – 0.57 mbpd

· Pandemic – 1.31 mbpd (data up to April 2022)

The market appeared to have considered demand destruction similar to that of the pandemic. This of course is mis-placed. A destruction similar to that of AFC or 2008 Financial crisis would be a better approximation.

The recovery /draw after the Pandemic is exceptional (1.31 mbpd). The following explain:

· Chronic underinvestment (since 2015 & hammered further in 2020) in supply

· Thus, supply growth is slower than demand growth

· Demand can only be met from inventory

· Pent-up demand from the lock-down in 2020

And from the graph, the trajectory of this recovery appears to continue in coming months. Mind you, air-travel has not fully recovered yet.

From my previous post:

Oil price should remain above USD 100 per barrel for coming 3 years.

With oil price expected to be above USD 100/barrel, free cash flow will be EXCELLENT. Now, already results announced by oil majors are OUTSTANDING,

and for coming 3 years also.

There are also some other points to consider:

a) The number of free drilling rigs available for hire is now approaching ZERO. Since 2015, compounded with Pandemic, a lot of rigs have been scrapped. Those not scrapped, to return them to service would require substantial amount of cash (refurbishment) due to inflation! New build will cost a bomb.

b) Ditto for vessels (AHT, work boat/barge, etc.) servicing oil & gas industry.

c) And the most interesting of all the points is that financial institutes are still mandated not to lend to oil & gas companies for development.

All the above points, taken together, will prolong supply shortfall.

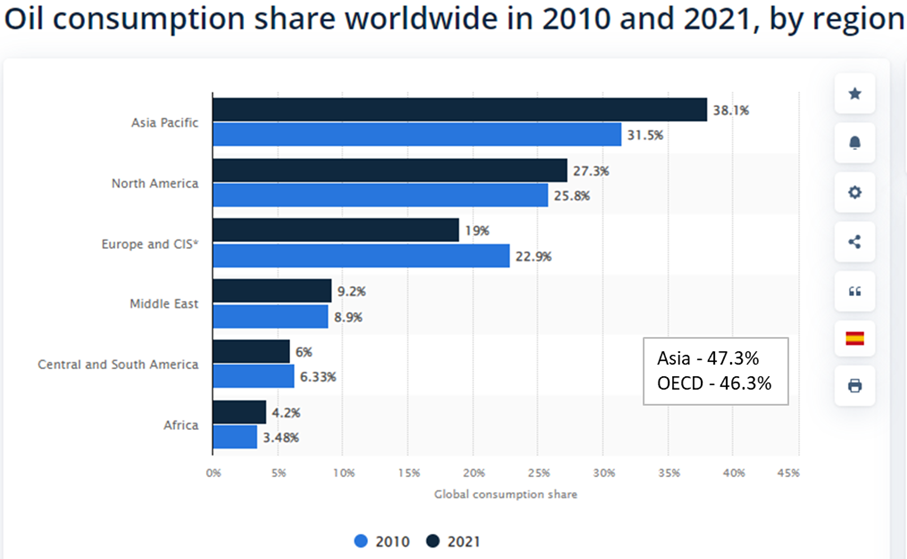

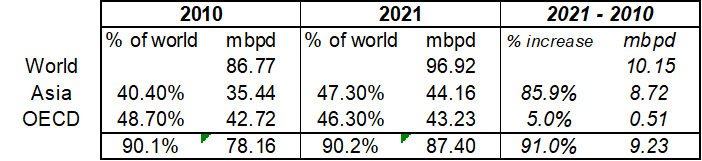

Demand meantime will grow!!! Please do not wrap your mind around the impending recession. This will happen, probably already in recession for the OECD countries. BUT, in Asia, China, India plus ASEAN still want to grow, develop and better ourselves. So, for whatever demand destruction in OECD countries, there will be demand growth in ASIA!

Asia included Middle East. World consumptions are from OPEC Monthly Oil Market Reports.

Note that most of the growth (85.9%) in demand over the last 11 years was in Asia.

Unfortunately, Asia is not a unified market like US that still “make” the oil price. Nonetheless, the premium Brent has over WTI is now at 5.38 which at one time was almost on par. This showed that, Brent, being international (outside US), there is supply tightness.

Conclusion:

· Fear of demand destruction in coming recession equal that of pandemic is over played.

· Recession demand destruction in OECD countries is neutralized by demand growth in Asia

· Aviation demand has still to recover to pre-pandemic level

· Supply growth is hampered by lack of rigs, vessels and still by ESG financing constraint – chronic underinvestment

· Oil price should remain elevated above USD 100/barrel for next 3 years, at least, until new supply come onstream (to replace depleted stocks, production depletion & rising demand).

Hibiscus, is there still a future?

The drop in share price was drastic, other oil majors shared similar predicament.

Recently, oil majors have been releasing their latest quarterly results, and, it is EXCELLENT.

Here is Hibiscus estimated Q4, FY 2022 and preliminary FY 2023 results:

The total EPS for the FY 2022 is RM 0.179 – adjusted to exclude one-off expenses (negative goodwill & impairment).

In estimating Q4 revenue, monthly average oil prices less half standard deviation for the month was used to be conservative as there is no way to know when exactly sale occurs for the month.

For gas, Anasuria gas price is higher than Malaysian. As this is new, estimate is at best, guesstimate.

Among the expenses, General & Admin continue to include the Technical Services charge by Repsol. This might be the last quarter for the technical services.

Free Cash Flow

In 3Q FY2022, the FCF (9 months) is estimated to be:

Net cash from operation RM 615M

PPE RM 79M

intangible asset RM 21M

FCF RM 515M

It is estimated that FCF for 4Q is about RM 280M.

FY 2023

The number of barrels sold is Q4 x 4. Any production increase in Anasuria due to repair of sub-sea valve is negated by depletion. Similarly, depletion in Repsol asset and North Sabah is considered to be overcome by wells maintenance, infill wells or side-track wells.

Preliminary FCF for FY 2023 is RM 960M. This will be revised as more data become available.

HIBISCUS DEFINITELY HAS A FUTURE, A BRIGHT FUTURE WITH HIGH FCF

What to do with the excellent cash generated?

1) Pay down all loans

2) Pay higher dividend

3) Buy back shares

SUGGESTION

I repeat here again, sell Australian asset – this will release manpower to improve productive assets further, better focus.

HAPPY INVESTING.

Disclaimer:

I wrote this myself without pay. I and my families own Hibiscus shares. This is not an advice to buy / sell Hibiscus or any other equities / securities / assets.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Zhang Zuode

Discussions

As posted before, shale oil is currently facing equipment constraint:

https://www.zerohedge.com/commodities/us-shale-defy-calls-boost-output-they-funnel-profits-shareholders

2022-08-09 08:41

The only reason I can think of why Hib sudden drop is Ting Hai effect brought by MoneyMakers and KYY.

2022-08-09 08:52

I have basically given up on rationalizing the drops.

Nonetheless, unless one is a "day" trader, fundamentally, the oil sector, much like the metal sectors as well, are facing supply constraint. And this will eventually lead to higher prices for the commodities.

2022-08-10 10:37

Why Saudi / Venezuela / Shale oil not investing in new oil production capacities

https://www.zerohedge.com/energy/tverberg-why-no-politician-willing-tell-us-real-energy-story

2022-08-25 15:23

zhangzuode

The estimates provided do not include any one-off items like impairment, negative or positive goodwill or such income / expenses.

2022-08-04 10:23