Hibiscus – What Warren Buffet sees in oil

zhangzuode

Publish date: Mon, 19 Sep 2022, 09:40 AM

Every other day, there are talk about the end of oil & gas industry. But Warren Buffet is investing more money into Occidental. WHY?

The main reasons:

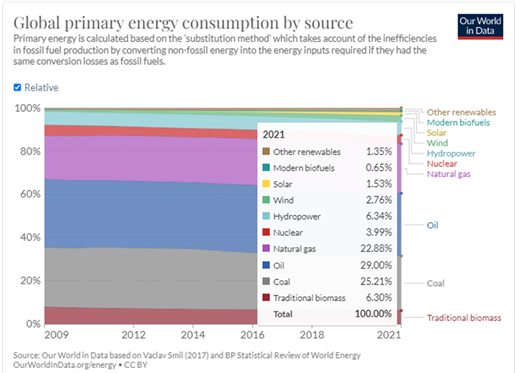

a) Investment required – solar+wind contribution to global energy consumption (figure below) is only 4.3% (2,900 Twh) while O&G is 51.9% (91,500 Twh). It is obvious that renewable / green energy will take decades (beyond 2035 or even 2040) to replace O&G.

Assume O&G current consumption is at a standstill (no increase in years to come), it is estimated that with a rate-of-increase 4 time current solar+wind annual increases (251.5 Twh/yr x 4), it will take 73 years to replace 80% of O&G (remaining 20% for petrochemical & mining).

From 2010 to 2019, 2.4T was spent to bring solar+wind to 4.3%.

Current “natural” experiment in Europe on reducing consumption of O&G by about 15% would be interesting to watch, to see whether the population agree or not.

b) Reduction of finance to fossil fuel projects.

Fossil fuel projects financing reduction

Since May 1992, UN Environment Programme Finance Initiatives (UNEP FI) was established by visionary leaders that finance need to be transformed to achieve sustainable development. The 13 original banks can be found here together with a timeline of the evolution to todays’ almost strangulation of finance to fossil fuel projects.

Over the years, UNEP FI evolved and strengthen its impact on financial institutions all over the world through initiatives, here are some pertinent developments:

· BASEL III & ENVIRONMENTAL RISK (2014) UNEP FI conducted a study (by University of Cambridge) exploring the role that financial – and in particular banking – regulation can play in the transition to a green economy. The result was the release of a report which comprises a series of recommendations on how to optimize the way existing financial policy and regulation is deployed to achieve (financial and environmental) sustainability goals

· 2016 - PRI (Principles for Responsible Investment), and The Generation Foundation, launched the Statement into Investor Obligations and Duties to call on international and national policy makers to introduce a policy instrument that clarifies investor obligations and duties to make explicit reference to the requirement to integrate environmental, social and governance (ESG) issues in investment decision-making.

· Principles for positive impact finance (2017) - a set of high-level guidelines that aim to promote the development of positive impact business and finance and thereby contribute to achieve the Sustainable Development Goals (SDGs)

· The Principles for Responsible Banking (2019) were launched during the annual United Nations General Assembly.

· Net-zero Banking Alliance (2021) – to align lending and investment portfolios with net-zero by 2050 with intermediate targets for 2030 or sooner, actions with accountability. This initiative is accredited by the Race to Zero (2019).

· TEN UNEP FI MEMBERS MADE CLIMATE COMMITMENTS AND CALLED ON GOVERNMENTS TO STEP UP ON ADAPTATION (The statement signatory firms are the European Bank for Reconstruction and Development, Rabobank, Rockefeller Asset Management, Standard Chartered Bank, Yes Bank, ABN Amro, Danske Bank, ING, AXA XL and LinkREIT. They have all committed to publish climate risk disclosures relating to their business within two years.)

· PRI, UNEP FI and The Generation Foundation launched our work programme “A Legal Framework for Impact.” The report provides ground-breaking legal analysis on the extent to which legal frameworks enable investors to consider impact in their activities across 11 jurisdictions: EU, Australia, Brazil, Canada, China, France, Japan, South Africa, the Netherlands, UK and US.

Then, at Paris “One Planet Summit” in December 2017, eight central banks and supervisors established the Network of Central Banks and Supervisors for Greening the Financial System (NGFS). Since then, the membership of the Network has grown dramatically, across the five continents. Bank Negara is also a member.

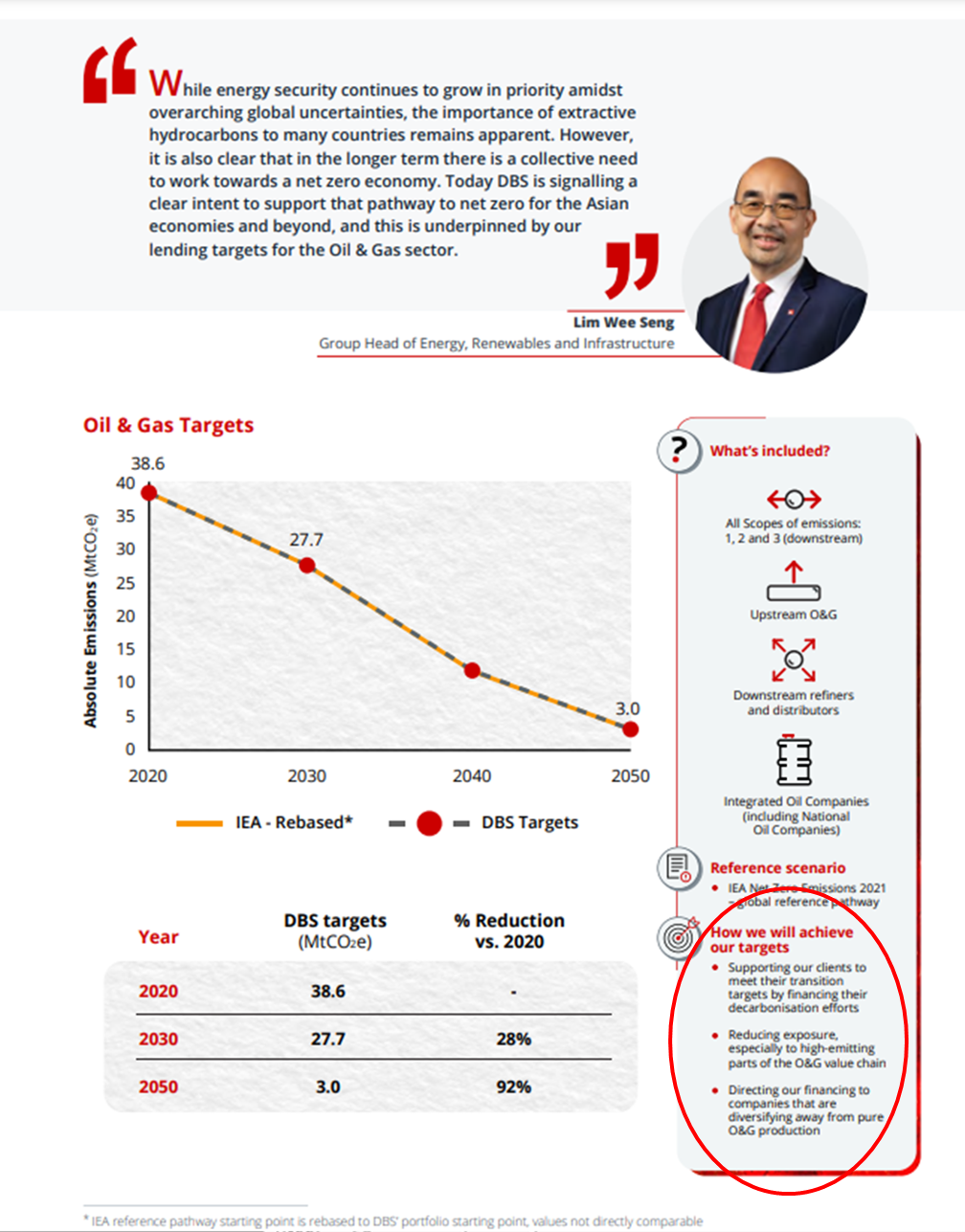

All the above led DBS to recently issue its “Glidepath” to net zero, oil & gas being one of nine sectors targeted. Below is the summary page on O&G.

Just look at the red oval and note how DBS will achieve their targets – basically finance transitioning away from oil & gas production only.

All other banks in SE Asia are under pressure to follow suit – peer pressure as well as regulator pressure. Do not forget Bank Negara, MAS are both in NGFS.

To recap, the two main reasons why WB is investing in Occidental are:

1) Investment required – to put in place renewables to replace fossil fuels runs into the tens of trillion and is estimated to take 73 years to replace 80% of O&G current usage.

Investment here is not restricted to finance, but also include land (for solar/wind farms – this is already facing push-back in certain localities due to size required, noise, birds killed, etc.), production facilities and the whole supply chain (mines, storage batteries, etc.).

2) Strangulation of finance to O&G – Since 1992, UNEP FI has evolved to put in place legal as well as peer pressure to banking and financial institutions to stop financing O&G projects that maintain (depletion - don't forget) or increase production. Central banks are also involved since 2017.

Do note that the above two reasons are being carried out by non-public actors. That is, they are not representatives of legislature.

Repercussion

Since 2020, with the lockdown, the green momentum has gathered pace as utopia was experienced (during lockdown).

1) The first reason above, confirmed that oil & gas will still be in demand for decades to come. WB is known to be a long-term investor.

2) There has been chronic underinvestment (in O&G) since 2015

3) Spare capacity is almost zero – OPEC has already sounded the alarm as well as recently shale oil in usa.

4) With the diversion of funding from O&G to renewable or green energy, the spare capacity issue will not be solved any time soon, instead, it is going to get worse.

5) Oil & gas projects will have to meet higher ROI given limited financing leading to fewer projects (few if any oil & gas companies can fully finance new production projects by themselves).

6) New supply to replace depletion and meet higher future demand will not be there / enough.

7) Supply will not meet demand = higher price of oil & gas.

Of course, some will say, the current Ukraine Russia conflict will cause Europe to go into a recession thus reducing oil & gas consumption. Equally, sanctions threaten removal of Russian oil & gas from global market.

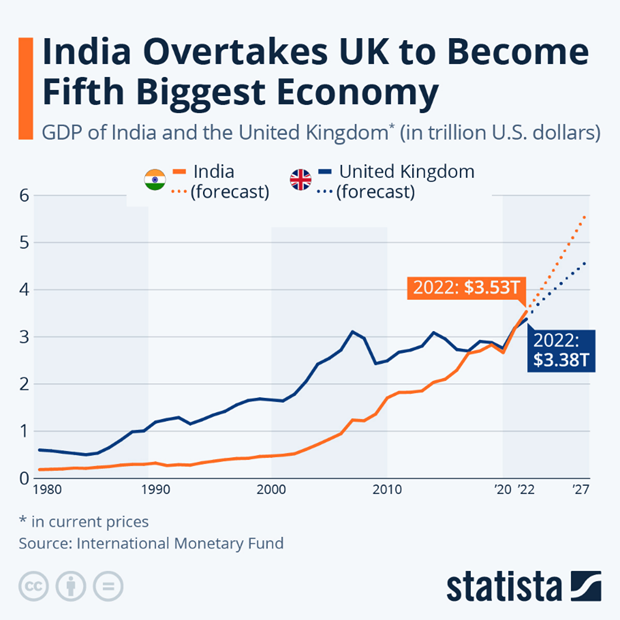

Do note that it is Europe that will go into a recession and NOT the whole world. Yes, some part of the world is also suffering – Sri Lanka comes to mind, but India is sizzling as well as most of SE Asia and other parts of the world. OPEC latest monthly report is upbeat on global growth.

So how does this affect Hibiscus?

a) Oil (& gas) prices are going to remain elevated, and highly likely to increase over time as supply will not be able to meet demand in coming years.

b) Hibiscus has a long runway (Sunflower/Marigold, infill wells, water-flooding, extension of PSCs, etc.) and its future is secured as oil & gas will remain relevant to the economy of Malaysia and the world in the decades to come.

c) Hibiscus, a supplier of Oil & gas that remains in demand in foreseeable future will continue to make money, lots of it.

Warren Buffet investment in Occidental is a confirmation and vote of confident in the “sunset” oil & gas industry.

Thank you for reading, happy investing.

PEACE

Disclaimer:

I wrote this myself without pay. I and my families own Hibiscus shares. This is not an advice to buy / sell Hibiscus or any other equities / securities / assets.

More articles on Zhang Zuode

Discussions

Where is "SmartMoney" investing:

https://oilprice.com/Energy/Energy-General/Private-Equity-Scoops-Up-Oil-And-Gas-Assets.html

2022-09-21 08:45

This is Bank Negara - again a non-elected person

https://www.theedgemarkets.com/article/bnm-financial-sector-vital-manage-climaterelated-risks-support-transition

2022-09-22 10:40

Spare oil capacity at less than 2% of global consumption

https://www.hellenicshippingnews.com/head-of-uaes-adnoc-says-little-room-for-manoeuvre-in-oil-markets/

2022-09-25 08:13

AET or EAT, what are these in the world of oil:

https://www.hellenicshippingnews.com/oil-in-a-decarbonising-world/

2022-09-26 09:20

us congressperson telling banks to stop financing fossil fuel

https://twitter.com/UncommonYield/status/1572743593508638722?s=20&t=EPls7-q0rbA8Uz4VxUolGw

2022-10-01 14:42

UN control what ones should think:

https://www.zerohedge.com/technology/we-own-science-un-official-admits-they-partner-google-control-search-results

2022-10-04 15:39

An alternative view about climate change (famine) timeline 39:13

https://www.youtube.com/watch?v=sY8aFSY2zv4

2022-10-04 15:42

Occidental on oil supply tightness:

https://www.zerohedge.com/markets/world-risks-living-oil-shortage-while-warns-occidental-ceo

2022-10-06 12:45

Investment of 270 trillion required to meet net-zero:

https://www.hellenicshippingnews.com/investments-of-270-trillion-needed-to-meet-net-zero-targets-by-2050-study-shows/

2022-10-08 08:40

Another bank going to cut finance to oil and gas projects:

https://www.scmp.com/business/banking-finance/article/3203340/hsbc-under-pressure-climate-policies-stop-funding-new-oil-and-gas-projects

2022-12-15 08:17

Do u know....if bank cut finance on o&g.....that means need o&g project need to be more profitable & higher return...b4 it is viable mah!

That means.....good for cash rich oil & gas co loh!

Lu tau boh ?

2022-12-15 08:46

Further evidence that climate change / warming is a hoax : http://www.williamengdahl.com/gr22October2022.php

2023-01-31 09:02

Geological Survey of Finland, GTK, wrote a paper on bottlenecks in Raw Materials Supply Chain for the new renewable economy: https://www.gtk.fi/en/research/time-to-wake-up/

2023-02-04 10:38

https://www.youtube.com/watch?v=sgOEGKDVvsg&t=142s

Minerals required for transition ...

2023-02-13 12:45

zhangzuode

UN repeats the "threats" to de-fund oil & gas

https://oilprice.com/Latest-Energy-News/World-News/UN-Secretary-General-Fossil-Industry-Is-Feasting-On-Windfall-Profits-As-Plane.html

2022-09-21 08:36