Hibiscus 3Q22 Review

zhangzuode

Publish date: Thu, 26 May 2022, 09:01 PM

Quarter 3 results – good or bad

Expectation was very high, and EPS was 15.28 (diluted), very good compared to 1.59 y-o-y, no?

But Market thought and still thinking otherwise.

Is it that bad? The shock is probably due to this:

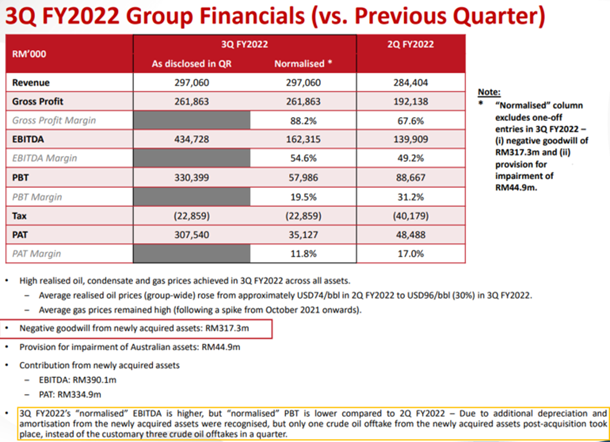

PAT is only 35,127 (normalized) compared with Q2 of 48,488. How can that be lower?

Hibiscus is supposed to triple production, revenue is 297,060 compared with 284,404, an increase of 4.4% ONLY?

There were production issues, impairment, but there are two other items that was not normalized:

1) Depreciation & amortisation, yes it was mentioned as per boxed in orange above but no figures given to set off.

2) Administrative expenses. Yes, the impairment was backed off, but there still remain a rather large amount of 147,574 - 44,906 = 102,668

Will now attempt to shed some possible quantum / value to these two items.

A) Depreciation & amortisation (D&A)

- First, there was no barrels sold for the Kinabalu asset. A cargo was sold just before completion of the deal on 24 Jan 2022 with no quantum given. As per Figure 2 of Corporate and Business Update – 25 May 2022, the estimated quantum to be sold in Q4 amount to about 14,279 boe/d while in Q3, the quantum sold is only 8,863 boe/d.

- The much lower production of Q3 and D&A of RM 88,556 gives RM 96 per boe.

- Taking an average of past quarters, the D&A is RM 50.70 per boe. Thus, an equivalent D&A would be RM 46,800 giving a saving of 41,800.

- Yes, this is very crude but more reflective given the timing issue.

B) Administrative expenses (AE)

- The adjusted expenses of RM 102,668 is still high.

- As this is the first quarter after taking over Repsol assets, there might be many one-off expenses. These maybe hand-over cost, lawyer fees, etc. or timing issue.

- Again, studying past quarters, the AE approximate RM 39 per boe. So, Q3, AE could be RM 36,000K only, giving a saving of RM 66,000.

In total, there is saving of 41,800 + 66,000 = 107,800. Taking a discount of 30%, gives 75,000.

The profit after tax would be 35,000 + 75,000 = 110,000.

Production

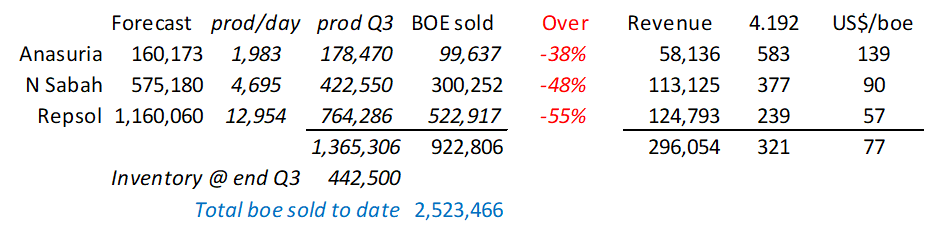

From data provided by Hibiscus, production for the quarter is about 1,365,306 boe. Barrels sold is only 922,806 leaving 442,500 (less gas volume) in tanks or there about.

Two points to note:

a) Earlier forecast was too ambitious from 38% to 55% over actual (sold)

b) Repsol revenue is low because gas was sold at only USD 6.98 per thousand scf (equivalent to USD 41.88 per boe) compared with USD 30.26 (North Sea) = USD 181.56/boe. This resulted in a composite rate of only USD 57/boe despite oil being sold at USD 123/b.

Q4 2022

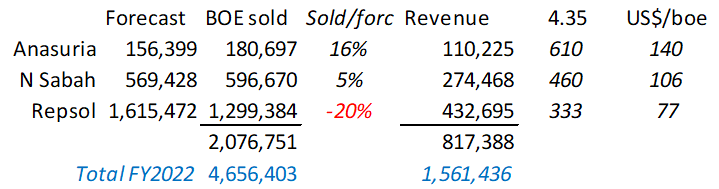

This is a first time that Hibiscus has provided forward production earmarked for sale, Figure 2 of the Corporate and Business Update – 25 May 2022.

The price for gas sold in Malaysia is iffy, so error would be large for revenue from Repsol assets.

BOE sold for April and May 2022 would be accurate as April is "gone" and May is at the last week. Figures for June might change due to unplanned shutdown. Thus, the 2.08 m boe sold would be decent (robust).

SUMMARY

In Q3 21 boe sold was 874,944 barrels while Q3 22 only managed 922,806, a gain of only 5.5%. Reasons for the low gain is well covered in the quarterly report and summarized as:

- Lower uptime in both North Sabah and Anasuria

- Key equipment shut in Anasuria and will only be repaired in Q3 CY22

- Kinabalu cargo sold before completion of the Repsol deal

The Q3 22 result, when normalized, resulted in PAT of 35m, a 28% reduction from last year Q3.

As for lower Q3 22 PAT, the normalization ignored: -

1) depreciation and amortisation – while D&A are of course higher, due to timing, production of Repsol is not for the full (3 months) quarter while one cargo was sold before completion

2) higher administrative expenses – there might be many one-off expenses for taking over Repsol assets that should be back-off so that comparison would be like for like. Or, again there are timing issue that cause expanses to be incurred despite the curtailed productions or barrels sold.

Rough adjustment based on past quarterly reports could save 107.8m. Taking a discount of 30%, the saving is reduced to 75m. This would result in a PAT of 110m instead of just 35m.

Hibiscus, for the first time, provided forward guidance to barrels that would be sold in the following quarter. This removes much uncertainty in forecasting production. The remaining uncertainty would be the price of oil and gas. While oil price is relatively stable, there is a big difference in gas price that depended on the location of the gas production (UK is USD 30 vs Malaysia USD 7)

Q4 22 forecasted boe to be sold is 2,076,751 compared with Q4 21 of 862,951 (no gas), a 140% increase.

Estimated revenue for Q4 22 is RM 817m compared with 249m, a 228% increase.

Happy investing, PEACE.

Disclaimer:

I wrote this myself without pay. I and my families own Hibiscus shares. This is not an advice to buy / sell Hibiscus or any other equities / securities / assets.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Zhang Zuode

Discussions

Thank you for reading Raymond.

In arriving at AE, there are many items e.g., engineering studies, reserve assessments (to determine the negative goodwill), admin salaries (directors), and so on that cannot be attributed to operation of particular fields. In this particular quarter, there were many expenses that is related to the takeover of the Repsol assets and is one-off. That is next quarter, these expenses would not be incurred (not recurring). The reserve study (which is expensive) is such one-off. There could be more in the coming quarters as Hibiscus would want to extend the (Repsol) PSC as well as determine what are the projects to be carried out to either maintain current production or further increase production. Again, these studies are not cheap - can run into 10s of millions.

Expenses incurred for these studies and others related to Repsol assets was taken up this quarter while production sold was only for 2 months and none from Kinabalu – timing issue as accountant say.

The “bumper” profits for Q4 was not done as I was pushed for time. Will try to make an estimate when time permit.

Hope the above help and Happy investing, peace.

2022-05-28 10:58

Raymond, my apology on the earlier reply on AE. The studies on possible PSC extension and projects to be executed as well as reserve assessment should all be capitalized.

The expenses (in AE) that will be incurred for the Repsol assets would be the transition cost incurred. This is the Transition Service Agreement (TSA) entered into between Hibiscus and Repsol back in 12 Nov 2021. This TSA will last 9 months from completion of the deal date (25/1/22) and include IT services as well as certain management level manpower. This I believe is calculated based on production and not barrels sold - timing issue.

2022-05-28 17:43

@zhangzuode.... yes IFRS says if the studies are pertaining to future income generation that can be proved to some extent, then can be capitalised and amortised there on. Same with the negative goodwill which is a good thing actually - meaning they paid less than the NTA means they can capitalise the sum, as non distributable reserves, all sounds good, furthermore repsol returns were from an associate and therefore did not show in the revenue, but was present in the PBT, all good... nevertheless the market did not think so.

2022-05-30 04:50

Raymond – “furthermore repsol returns were from an associate and therefore did not show in the revenue”; this is confusing. Care to elaborate, thanks.

The above conflict with page 17 of the Q3 report that clearly state that revenue from repsol assets is accounted under “sale of crude oil and gas”. The total figure (under Group) is cumulative, i.e. 824,196 – 528,142 = 296,054 (exclude project management & interest income).

Yes, I agree that the market looked at the normalized PAT RM 35m and decided it is rubbish. I remember when N Sabah was combined, again with negative goodwill, Hibiscus suffered similar destruction in value.

As negative goodwill is a non-cash item, it does not really bring in any cash. But strictly, it should be viewed as “cash have not gone out”, an equally important if not more important aspect – cash not leaving the company and assets coming in that will bring mountain of cash.

Also, there are big time players that pried on unsuspecting “investors” (day to short term players).

2022-05-30 08:45

Raymond Tiruchelvam

nice analysis, although i found it a little confusing on the AE part, but in summary BOE sales in Q4 alone (2.076m) will be 45% of the whole FY2022 boe sales (4.656m), and looing at the high price of brent today (may25) at 114, and with expectation that it will remain above 100 till 31 june 2022, hibiscus is expected to make bumper profits?

2022-05-27 23:04