Hibiscus - oil price

zhangzuode

Publish date: Mon, 06 Jun 2022, 09:23 PM

Hibiscus’ quarter 3 result came and gone. Now, with management's estimated oil (& gas in boe) to be sold, a robust estimate of the revenue could be made.

Gas prices

Oil price for Hibiscus has been established as that based on Brent and this is well known.

However, gas prices vary widely around the world. Based on Hibiscus, Malaysian gas price is linked to High Sulphur fuel oil (page 13 section 3.3 of the circular 1, 13/12/21). Q3 gave it as US$ 6.98 per Mscf or US$ 41.88 boe, i.e., only 34% of the realized oil price of 123.

Appreciate fellow investors that would point to relevant sources for this grade of high sulphur fuel oil pricing, thank you. Meanwhile, the Henry Hub natural gas price will be used.

Revenue from UK

Production from UK as a percentage of Hibiscus’ total production going forward would be reduced. The windfall tax details is here: https://home.kpmg/uk/en/home/insights/2022/05/tmd-uk-government-announces-windfall-tax-on-extraordinary-oil-and-gas-profits.html. There is deduction for investment allowance to incentivize investment in UK to support energy security. Hibiscus might incurred a reduced windfall tax rate with Marigold development.

The windfall tax should end on 31/12/25.

As revenue from UK fall in percentage to total revenue, the correspondent profit after tax contribution should equally fall and the windfall tax will not have a significant dent in the PAT.

Oil price

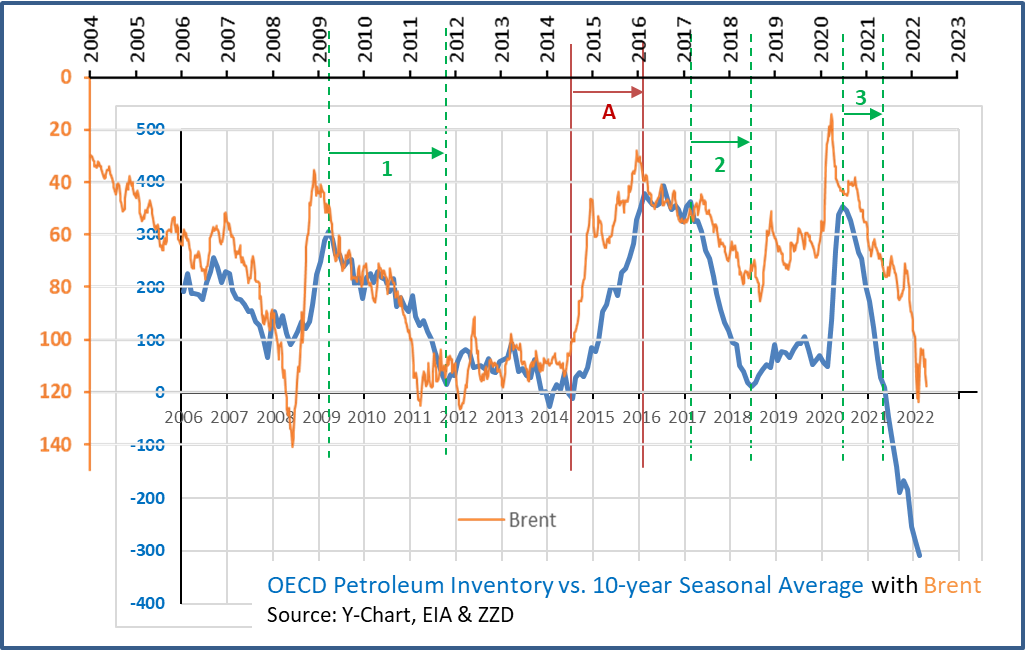

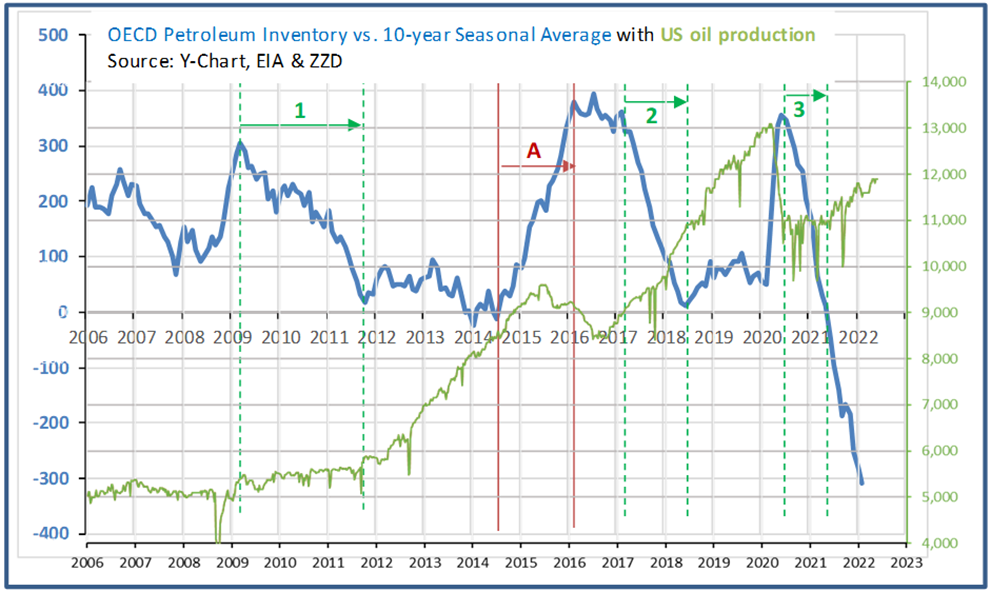

From the figures below, OECD petroleum inventory (up to February 2022) is as shown, one with (spot / dated) Brent oil price included, the other with USA oil production. The 10-year seasonal average is zeroized while any particular month will be either above or below these zero averages. OECD inventory can be considered a proxy for global inventory.

Observations:

- It can be observed that the reduction of inventory – (marked) 1, 2 & 3, the period of the reduction is shorter for each time period. These 3 periods, the reduction in inventory is due to demand exceeding supply and the pace of demand increase has quicken.

- Period A where there was a build in inventory, this is due to the fast growth of USA shale oil production from year 2012 onward with a pause in mid-2015 to 2017

- Inventory increases in 2020 was due to prevention of consumption rather than destruction of demand like those that occur in 2008-2009

- It is clear that when inventory drop, oil price increases, but note that correlection may not be causation, you are warned

- Last time inventory is near the 10-year seasonal average – 2012 to 2014, the price of oil hover around 110

- 2020 peak at July, 4.8 billion barrels and February 2022 is 4.1 b, a plunged of 1.2 mbpd.

USA production remains below 12 mbpd, a 1.1 mbpd less than the peak at beginning of 2020. This is because when wells are shut in (during lock-down), wax / glue / rubbish clogged up the pores of the oil-bearing rock formation. So, there was supply destruction in addition to depletion.

Also, between 2012 to 2014, the increase in supply is just enough to keep pace with demand, all thanks to shale oil. Again in 2018 to 2020, shale oil saved the day for the increase demand. Today, shale oil is so restraint that they won’t come to the rescue this time. The restraint is mainly due to ESG as well as regulations.

Now, after 2020 where the greenies saw what happened during lock-down, it has quickened the pace to ESG and oil (& gas) extraction become pariah. This coupled with already much (chronic) under investment (from 2015), supply of oil will NOT meet current demand in the foreseeable future.

China and now India has both increase their demand for oil, while SE Asia, especially Indonesia are just as hungry. These 3 billion people are not easy to keep down, they want to prosper too.

From the above figure with oil price, it would suggest that oil price could go much higher and last longer, at least minimum 3 years.

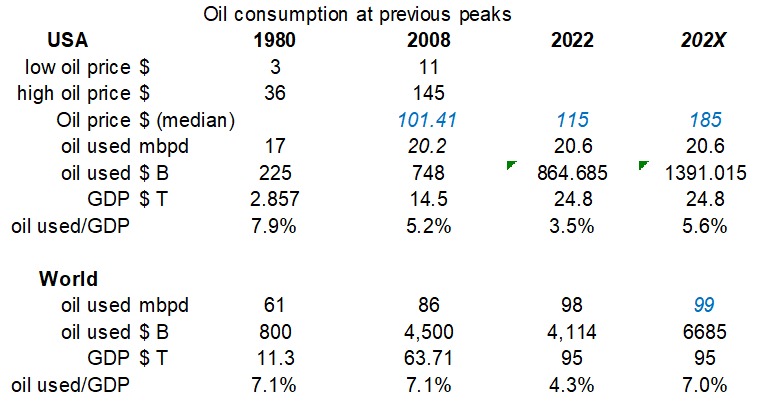

Yes, there will be demand destruction as oil price increases, but at what price. Below are some estimates:

At current price, the amount of oil used/GDP has not reached those of previous year where demand destruction happened. There is still room for oil price increases.

Sure, there are other factors like the average wage over the years, etc., etc., that might cause demand destruction at lower or higher oil price. Choose whatever suit the narrative.

Conclusion

Oil price might increase nearer to 185 USD/b. Nonetheless, oil price would stay elevated at around USD 110/b for at least 3 years going forward due to time required to bringing new supply to the market. Hibiscus will continue to make excellent profit in the coming 3 year or more.

HAPPY INVESTING, PEACE.

Disclaimer:

I wrote this myself without pay. I and my families own Hibiscus shares. This is not an advice to buy / sell Hibiscus or any other equities / securities / assets.

zhangzuode

Goldman thinking is similar : https://www.zerohedge.com/markets/goldman-again-hikes-oil-price-target-now-sees-barrel-hitting-140-125

2022-06-07 14:25