Ace of Bursa

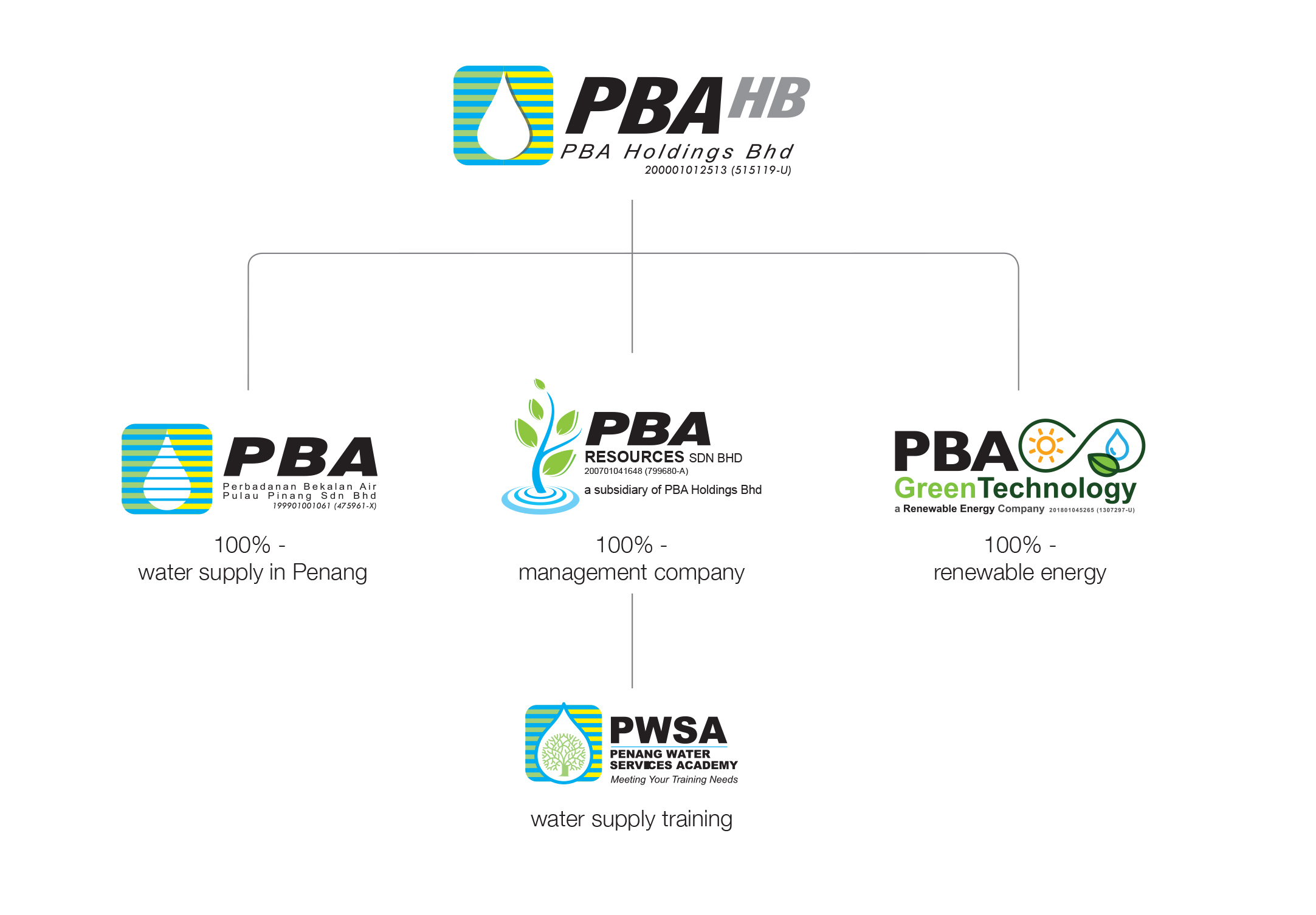

PBA Holdings Bhd (5041) - A Beneficiary of Water Tariffs Hike

aceofbursa

Publish date: Thu, 18 Jan 2024, 02:41 PM

PBA is a very well-run company and as the licensed water-supply operator that serves Penang, it manages the water resources very well.

It is a dividend yielding stock with a consistent dividend yield of 3% to 4% per year.

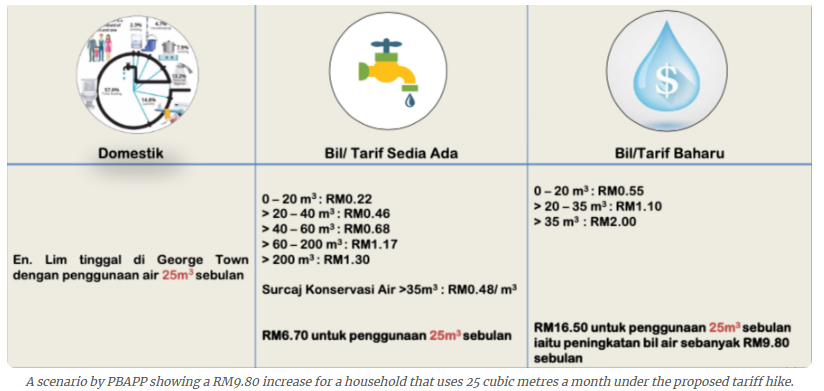

PBA's earnings are expected to come in strong once the water tariffs are revised. When the company's earnings are strong, it will have the ability to pay out higher dividends.

Additionally, PBA is an ESG stock. As such, PBA will likely attract a lot more fund flows from investors who are interested in putting their money into ESG stocks.

With regard to target price, while it is hard to say at this juncture, we believe it should be worth at least double its current share price.

To recap, higher tariff rates for non-domestic users in Penang were implemented on 1 Jan 2023. This along with lower energy costs contributed to PBA achieving its best-ever quarterly pre-tax profit of RM29.1m in 3Q23. Due to the recognition of deferred tax assets on unutilized reinvestment allowances (RA), 3Q23 PAT was higher at RM36.8m.

In PBA’s 3Q notes, it stated that as of 30 Sep 2023, it is anticipated that RM275m out of the RM698m of unutilized reinvestment allowances available will be utilized to set off against future taxable profits. The unutilized RA arising during the special RA period is allowed to be carried forward for 7 consecutive YAs from YA 2025 until YA 2031.

Based on 3Q23 results, an average PAT of RM25m a quarter or RM100m a year seems quite achievable.

As discussed earlier, achieving annual earnings of RM100m seem feasible based on its 3Q23 performance. The revised domestic water tariffs might contribute an additional RM80m-RM100m. To err on the side of caution and provide a buffer, let’s just say an additional RM50m. So, the new earnings base for PBA could be RM150m. Applying a conservative P/E ratio of 6x, PBA could be valued at RM900m or RM2.72 per share.

However, given its monopoly status and its position in a non-cyclical sector with inelastic demand, a higher P/E ratio of 7-8x seems fair. If PBA is valued at 7-8x P/E, its potential worth could range from RM1.05bn to RM1.2bn, translating to a per-share value of RM3.17 to RM3.63.

With higher earnings, a subsequent increase in dividends is likely, providing support to the stock.

It's worth noting that PBA boasts a robust net cash position of RM193m as of 30 Sep 2023, with cash reserves of RM213m against total borrowings of RM20m. PBA's book value stands at RM953.6m or RM2.88 per share.

If PBA could achieve RM150m earnings, what is the fair target PE multiple for a well-run company with high ESG score, net cash balance sheet, solid cashflow and potentially higher ROE from stronger earnings? Does it deserve a higher PE multiple?

Source:

PBA Holdings Bhd: (P)rofits to (B)ecome (A)bundant? | I3investor

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Ace of Bursa

Water related stocks (Ranhill and PBA) set to gain from improved ROI and sector re-rating

Created by aceofbursa | Jan 22, 2024

Penang water tariffs to double from Feb 1, but still among the lowest

Created by aceofbursa | Jan 18, 2024

Proposed Water Tariff Increase In Malaysia Awaits Cabinet Approval For 2024 Implementation

Created by aceofbursa | Jan 15, 2024

RHB raises Ranhill target price to RM1.09 on undemanding valuation

Created by aceofbursa | Jan 14, 2024