[转贴]阿笔讨论冷眼心水股(2)-MBSB&RCECAP

ahbi

Publish date: Tue, 22 Nov 2016, 10:38 AM

你想成为合法大耳隆吗?

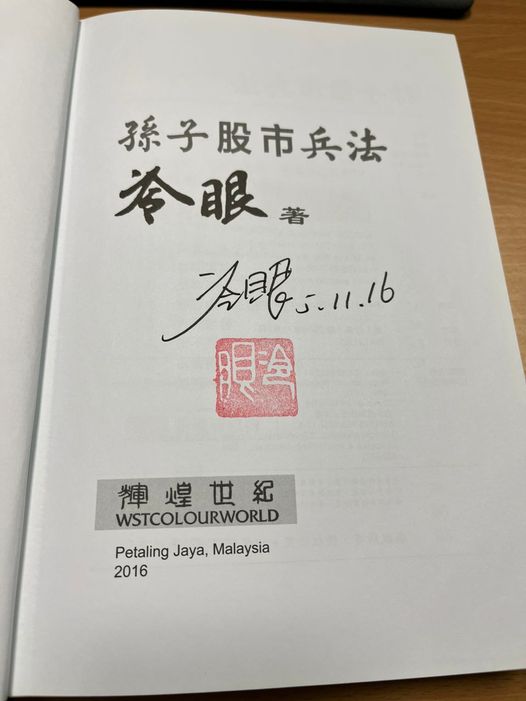

感谢冷眼前辈在新书《孙子股市兵法》推介给予的演讲,让阿笔受益良多。祝冷眼前辈身体健康,生活充实,继续为大家写好文章。

MBSB & RCECAP 主要业务就是借钱给公务员赚取利息.

冷眼前辈在新书推介礼告诉大家, 他如何计算MBSB 的盈利.阿笔深感冷眼前辈的方法非常高明。使用Bank Rakyat 年报来推算MBSB 合理的盈利。

Bank Rakyat, MBSB 和 RCECAP都一样,借钱给公务员。

MBSB总共借出去的钱为RM31,800M (MBSB 2015年报30页), 几乎是半个Bank Rakyat(RM 64,463M)所借出去的钱(Bank Rakyat 2015 年报, 60页https://s3-ap-southeast-1.amazonaws.com/bankrakyat/annual-reports/AR2015%2BLATEST%2BFINAL%2BVERSION.pdf)

BankRakyat分别在2014和2015年,净盈利为RM1,950M和RM1,780M。所以,预计MBSB应该可以赚取和Bank rakyat一半的净盈利,分别为RM975M 和RM890M.

MBSB在2014 年净盈利表现与以上数据几乎稳合(RM1,015M)。但,2015年净盈利才RM2,58M 而已!这是因为从2014年底开始,MBSB 开始impairment programme。这为了提升公司资产素质,以便合符Bank Negara的标准,提升为一间银行。

预计impairment programme 将于2016 年底结束。所以当RM890净盈利浮现在财报时, 给予P/E10, 那MBSB 将价值RM8,900m。现在股价RM0.925,市值RM5,364M,还有很大的空间!

除此之外,当MBSB符合标准, 升格为银行时,又有扩充业务成长的空间。

RCECAP RM1.40 市值RM487M, P/E 8.7,大约借出去的钱为RM1.364M (RCE2016年报90页),用Bank Rakyat 以上的数据,估计RCECAP净盈利为RM37.6M 和财报公布的RM39.5M 非常接近。

有些人会用 AEONCR来和MBSB, RCECAP做比较。AEONCR RM13.96, 市值RM2,010M, P/E 8.4, P/B 2.35

AEONCR 借出去的钱为RM6.020m, 2016 年净盈利RM228M。用Bank Rakyat 以上的数据, 它应该只赚RM166M.

AEONCR 赚比较多, 是因为它的借贷风险比较高

做借钱的生意(大耳窿)最怕就是借钱不还。

就算前几年赚的一点点利息也不够回本。所以,MBSB &RCECAP 借钱给公务员相比之下,比较有保障。

这不是因为公务员很有钱还债,而是因为怕他不还债, 所以薪水通过Angkasa, 还没到公务员手里就已经被扣除去还钱了。(http://www.angkasa.coop/)

Angkasa 据说有很多好处, 例如部门主管可以通过Angkasa 来监控该部门下属是否借贷过多。如果一半以上的薪水都被Angkasa 扣除还债, 该名公务员将被安排见辅导员寻求辅导服务。所以,MBSB & RCECAP 的风险就是借给有可能被解雇的公务员.

|

年份

|

公务员纪律处分(人数)

|

被解雇公务员(人数)

|

链接

|

|

2009-2013 |

20,434 |

4,743 |

http://www.sinarharian.com.my/semasa/audit-20-434-penjawat-awam-kena-tindakan-1.289131 |

|

1月2010-7月 2016 |

31,230 |

5,778 |

总公务员人数: 1.6M (http://www.theborneopost.com/2016/10/28/jumlah-1-6-juta-penjawat-awam-masih-relevan/)

催化剂: 六个月之内, impairment programme 结束, 盈利浮现, 升格银行成功。

启事: 冷眼前辈希望因他的心水股赚钱的朋友, 可以拿一点钱出来做善事。感恩! 感恩!

For more article please visit facebook Investips.my

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Good To Know

Discussions

impairment is just a convenient excuse. look at the profit excluding impairment, it has been on a declining trend for the past 2 years.

MBSB is reducing exposure to government servant now as they screwed up in that segment previously, somehow getting a lot of bad loans from government servant. Aeoncredit and RCE management is much more competent in the moneylending biz

MBSB is one of the few stocks that I cannot agree with coldeye. it's a speculative stock disguised as fundamental

2016-11-23 08:57

Refer to annual report 2015-2011.

Income derived from investment of general investment deposits and Islamic capital fund( FINANCING): FY2015, RM 2,021M (AR 2015, pg 202); FY 2014, 1836M(AR 2015, pg 202); FY2013, 1931M (AR2014, pg 227); FY2012, 1372 (AR 2013, pg 228); FY 2011, 749M (AR 2011, 185 pg); FY 2010, 374M (AR 2010, 185pg)

2016-11-23 12:16

Hello Ah Bi, absolutely a great sharing. Many thanks .. I am new on this stock but I am still wondering why it needs to obtain the Islamic banking license since mbsb can do almost or equal like bank i.e. Received deposit, loan to corporate, mortgage, car etc.. In short, what is the advantage since with this it is required to comply MFRS 9.. more capital less profit ..

2016-11-29 15:23

更正:MBSB impairment programme 将于2017年12月完成,如第3季Qtr 2016分析师简报会上所述。

http://mbsb.listedcompany.com/misc/slide24112016.pdf

2016-12-06 14:20

fattycat

thanks for sharing

2016-11-22 10:43