20Dec - NWP [FIRST-OF-ITS-KIND HYBRID]

Alpha7

Publish date: Sun, 20 Dec 2020, 08:53 PM

Stock code: 5025 NWP

20 December, Sunday

Covid-19 transformed the way we live.

The new way of life = WFH (work from home)

Next?

FOOD DELIVERY.

NWP : FIRST MOVER ADVANTAGE

Since NWP’s Group CEO hinted to the media that they are entering the automotive business targeting the food delivery sector, I have been trying to establish the market size of this particular business. And since the top players like Grab, Foodpanda are not public-listed, information is hard to come by.

Thanks to some friends in VC who partook fund-raising rounds for the top players, we have the following data:

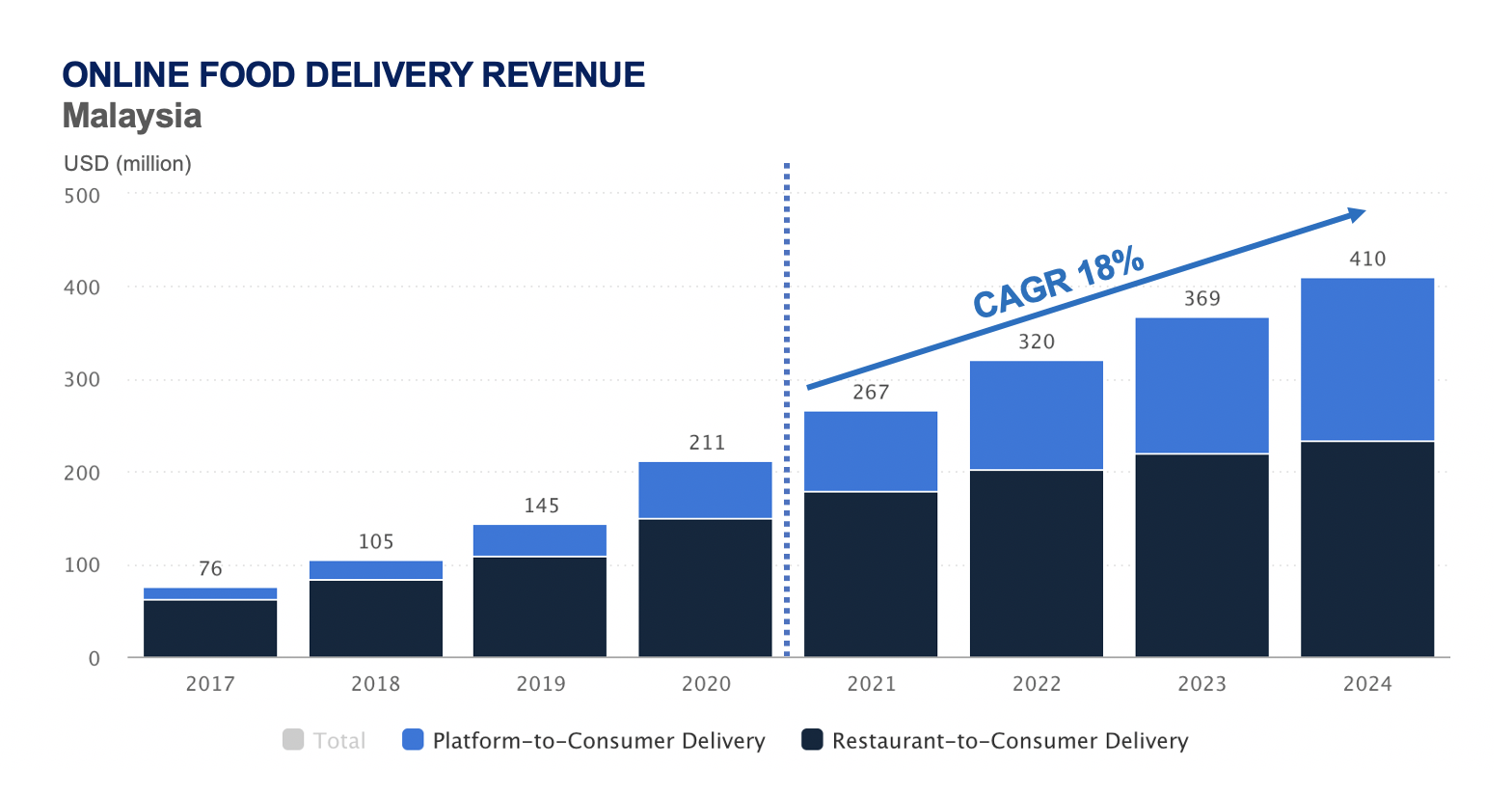

Revenue in the Online Food Delivery segment is projected to reach ~RM900m (USD 211m) in 2020.

Revenue is expected to show an annual growth rate (CAGR 2020-2024) of 18.0%, resulting in a projected market volume of ~RM1.7billion (USD 410m) by 2024.

In an existing billion ringgit market, can someone name an AUTOMOTIVE PARTNER of the TOP 2 delivery platforms in Malaysia? No names?

Well, the FIRST would be made known very soon. (Or do we have enough clues to know already?)

HOW MUCH PROFIT?

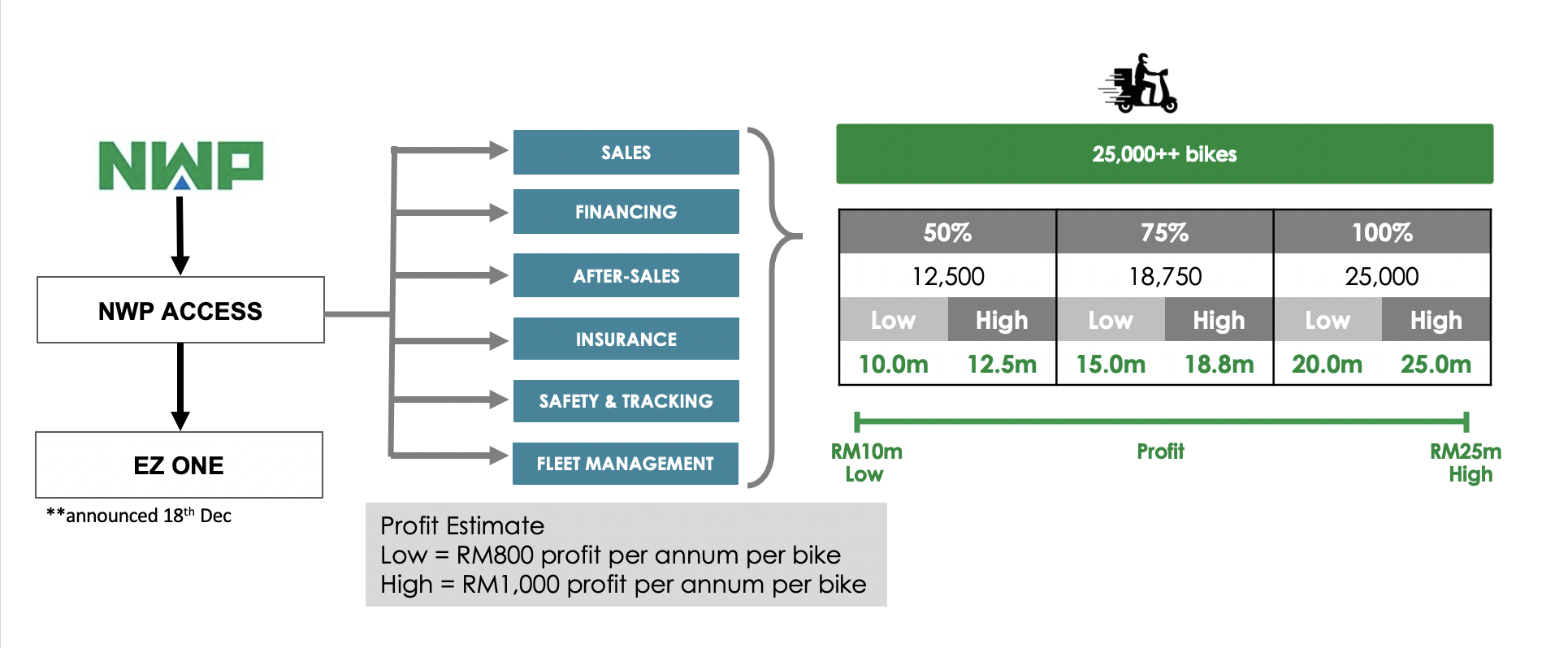

As the project details are still confidential, we would attempt a logical projection.

NEW BIZ 1 - AUTOMOTIVE

Scenario: Partner is the largest delivery service provider with 25k++ riders and growing 15-18% per year.

For providing the list of services mentioned, assuming RM800 profit per annum per bike for the 'low estimate' and RM1,000 for 'high estimate', we have a profit range from RM10m – 25m.

NEW BIZ 2 - PROPERTY

Scenario: NWP appointed as project manager of 500m GDV project

Depending on the final scope of service, whether it is pure project management or with additional engineering consultancy/submission/marketing, the fees can range from 2.5% - 5% of total project value = revenue of 12.5m – 25m.

Profit assumption of 40% would give a profit range from RM5m – 10m.

NEW BIZ 1 & 2

Combining the 2 new biz = PROFIT RANGE RM15m – 35m

Taking a lower-end estimate of RM20m profit, a simple calculation at P/E ratio of 15 would give a valuation of approx. RM300m. This is almost TRIPLE the current market cap of NWP (RM119m as of 18Dec at 25sen) meaning a potential 250%+ upside.

Yes, the share base may get larger once new shares are placed. But if the company manages to have all new shares subscribed by strategic investors, it is a further confirmation of the new biz proceeding. By then, investors would not value the company purely based on simple P/E ratio alone.

- Partnering the fastest-growing delivery provider

- Growing ridership with expanding market size

- Sole automotive partner with full scope of services (!!)

- First-of-its-kind biz model in the region (!!)

- Ripe for multiple fund-raising rounds to expand regionally

FIRST-OF-ITS-KIND HYBRID

We are about to witness the transformation of NWP:

A new HYBRID of Automotive + Finance + IT/Tech + Property.

Considering this and the above factors, how much would NWP be worth?

Have you got your tickets to the year-end countdown fireworks celebration show?

Have a great week ahead.

Best regards,

Alpha7 Research

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

greedy44444

Too good to be true story ? Why don't Alpha sailang all NWP share now ? Surely Alpha will become one of the richest man in Malaysia.

2020-12-20 22:11