My Thoughts on Superlon Holdings Berhad

ajim102

Publish date: Sun, 24 Sep 2017, 06:39 AM

| 2,013 | 2,014 | 2,015 | 2,016 | 2,017 | Average | |

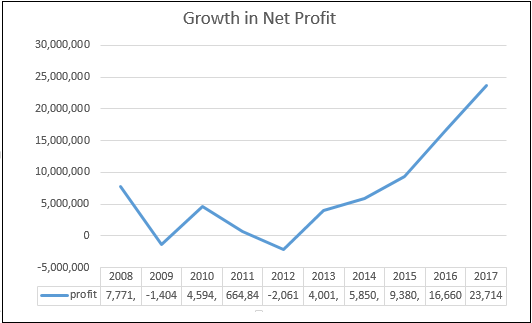

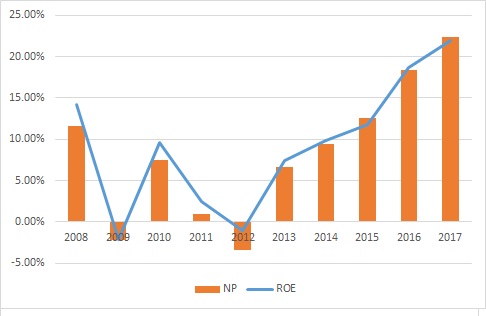

| Net Profit | 4,001,613 | 5,850,480 | 9,380,590 | 16,660,089 | 23,714,774 | 11,921,509 |

| CFFO | 9,393,602 | 10,516,133 | 11,525,241 | 25,131,142 | 16,224,959 | 14,558,215 |

| Capex | 494,714 | 3,140,327 | 2,932,470 | 5,382,982 | 12,346,997 | 4,859,498 |

| FCF | 8,898,888 | 7,375,806 | 8,592,771 | 19,748,160 | 3,877,962 | 9,698,717 |

| FCF/Profit | 222% | 126% | 92% | 119% | 16% | 115% |

Table 1 above shows that Superlon Holdings Berhad is a cash generating company with an impressive 5-year FCF/Profit averaging to 115%,more than its net profit. FY 2017 FCF/Profit is the lowest among the 5-year (16%) due to high Capex spending for the new warehouse and its coming factory in Vietnam. It confirms the quality of the spectacular growth shown in Figure 1-3 above.

Valuation of Superlon Holdings Berhad using Free Cash Flow

At current price of 2.83 as at 21th September 2017,is Superlon still cheap and worth to invest in?

"Price is what yo pay value is what you get"

Warren Buffet

"The value of a stock is worth all of the future cash flows expected to be generated by the firm, discounted by an appropriate risk-adjusted rate"

John Burr Williams

Using the average FCF from 2012 to 2017 of 9.6m, assuming growth rate of 20% for the first 5 years, 15% the next 5 years and a 5% untill forever(terminal value).Discount rate of 10% as it has a reasonable healthy balance sheet, the FCF attributed to common shareholders is RM3.39 per share. This represents margin of safety of 17% investing in Superlon Holdings Berhad at RM2.83 at the close on 21th September 2017. Notice that i make a pretty consevative assumptions on the growth rate of 20% compared to the company's recorded net profit CAGR of 42.74% to minimise the impact if my assumptions turn out to be wrong “Heads, I win; tails, I don’t lose much.”

With an excellent management team that has a proven track record over the years where they was able to turn around a loss making company to an excellent company in 5 years , Superlon Holding Berhad is in my opinion an investment that can give its investor a good night sleep.

Disclaimer : This article is only for sharing purpose . It is not a buy or a sell call. Please do your own analysis before buying or selling

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Thoughts on Investing and Trading

Created by ajim102 | Oct 01, 2017

Discussions

ongkkh, i am one of KCChong sifu's online course student thus im very much influenced by him plus i find that his writing style is very organize and neat.

2017-09-24 16:46

RainT Already up so much

Now only come out hoo ha hoo ha

Last i check there are no rules saying that we cannot do a write up for a company thats already up so much.

And how much up is so much?100% increase?200%?500%? The most important thing is to know the value of a company and pay a lot less. The DCF valuation shows that a current price of 2.83 there is still a margin of safety in Superlon's valuation. But in the end,every analysis or valuation is just an opinion and assumptions based on the writer's point of view. Its not meant to fit with everyone's view.

The stock market is ultimately a game of probability. Whether one speculate,trade or invest and in this game of probability one must always keep risk under control. As far return is concern,u can get 100%,200% or any other percentage that you can imagine.But if one ignores risk (intrinsic value,margin of safety,business quality etc) he will surely lose in the long run

2017-09-24 21:42

Thank you ongkkh.i wanted to edit the comment but end up deleting it.i posted it back with the current price edited.cheers

2017-09-24 21:44

is easy to use excel to extrapolate future income n earning to justify the high prices u pay now.

2017-09-27 07:55

lkoky is easy to use excel to extrapolate future income n earning to justify the high prices u pay now.

27/09/2017 07:55

I agree with your statement. In the end assumptions is still assumptions no matter what number we put in. But we must based our assumption on a good reason. and in the case of Superlon is its record to produce healthy cash flows

2017-09-27 16:19

Ricky Yeo FYI. 20% growth rate is not pretty conservative. It is ultra aggressive.

27/09/2017 14:28

Thank you for your feedback.First of all i would like to say that im a fan of your work Ricky Yoe. I find all of your posts informative and full of value.

I admit that 20% growth rate is on the high side of the assumption. I should have have made a range of valuation with different growth rates.so here goes:

First 5-years Next 5-years Terminal years IV

20% 15% 5% 3.39

15% 10% 5% 2.32

10% 8% 5% 1.75

"Its better to be roughly right than precisely wrong"

John Maynard Keynes

Looking at today's closing price of RM2.32 i would say that it is fully valued now and further drop in price is an opportunity to get the stock at a wider Margin of Safety. The profit drop in its recent quarter report doesnt really change my views of superlon due to

1.My analysis is based year-on-year basis not on quarterly or daily basis

2.The company's fundamental is still intact(clean balance sheet,strong brand recognition,good management team)

3.The construction of new plant in Ho Chi Minh City to expand its manufacturing capacity which in my opinion is an excellent business decision as Vietnam is the largest contributer of export revenue for Superlon.

I like to think Superlon as an Antifragile company.Nassim Nicholas Taleb describe Antifragile as Things that gain from disorder. An antifragile entity will becomes stronger,better,improved when it is faced with difficulty. Superlon had already proven its antifragilitiness when it manage to comeback from a loss making company in 2012 to what it is right now and i dont think that the company had lost its antifragility just by looking at the latest quarter result.

2017-09-27 18:41

ongkkh

Your writting style similar to KCChong sifu....

2017-09-24 10:42