My Thoughts on Cocoaland Berhad

ajim102

Publish date: Sat, 26 Aug 2017, 11:09 AM

Cocoaland Berhad's share price had gone up from RM1.86 to RM2.93 in one year's time (from 23/8/16-23/8/17) a 58% increase.An excellent result for a company in which business is manufacturing and trading of candies, beverages and other related food stuffs. But what drives the rise in share price of Cocoland?does it comes from the business performance or is it just an effect from current bull market?

“Growth is never by mere chance; it is the result of forces working together.”

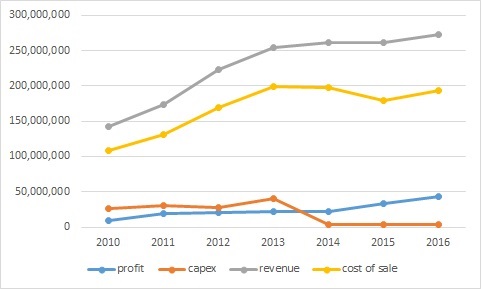

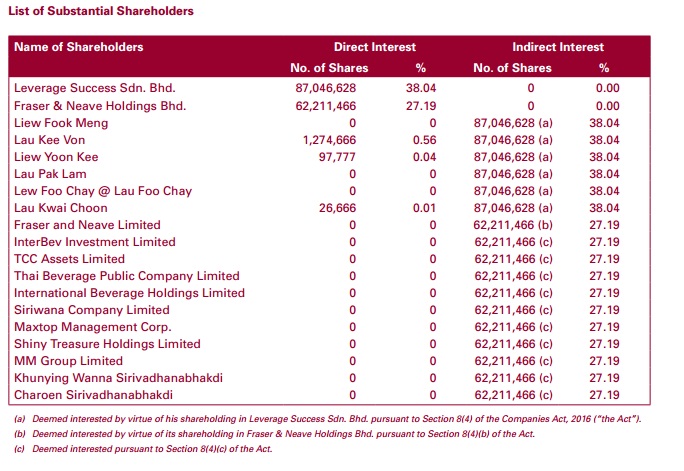

Lets look into the company's performance to see whether the rise in share price is justified by the business performance or not. Figure 1 shows the trend in revenue,cost of sales,profit and capex for Cocoaland Bhd from 2010-2017. I decided to take 2010 as the base year because in 2010, Fraser & Neave Holdings Bhd (F&N) becomes the 2nd largest shareholder in cocoland (and still the 2nd largest shareholder as per latest annual report)

Figure 1

We can clearly see that revenue is on an upward trend rising exponentially from for the first 4 years and stagnate for the next 3 year but increase back in 2016.Cost of sale is rising in tandem with revenue for the first 4 years but starts to fall afterwards. This trend can also be seen in profit and capex, figure 2 shows a clearer picture of the relationship between capex, profit and its free cash flow

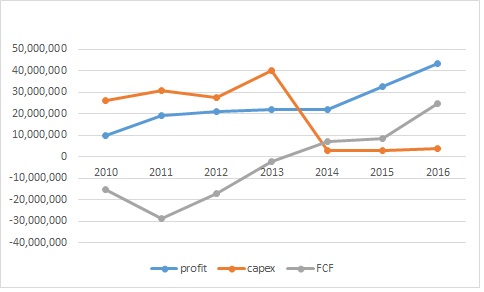

Figure 2

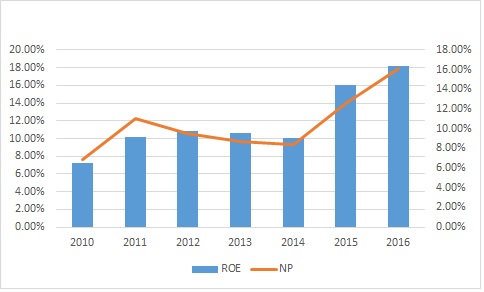

We know that prior to 2013,Cocoaland Bhd had been spending a lot on capex to expand its production line in rawang thus its free cash flow (FCF) is in the negative territory.But since then we can see that capex drops significantly,profit and FCF start to rise as the company's investment starts to bear its fruit. Similar improvement can be observed with Return on Equity (ROE) and net profit margin (NP)

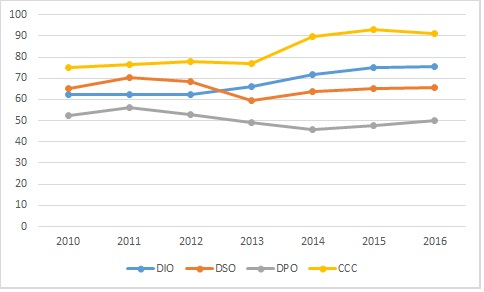

Cash Conversion Cycle (CCC) is a metric used to gauge the effectiveness of a company's management and, consequently, the overall health of that company. The calculation measures how fast a company can convert cash on hand into inventory and accounts payable, through sales and accounts receivable, and then back into cash (Investopedia) , the lower the days the better.

I know we are supposed to look at a company's CCC in comparison with its peer but lets look at the trend over the years as shown below.

Cocoaland Bhd's CCC has been increasing from 80 days prior 2013 to 90 days. Is it a bad omen for Cocoaland Bhd? A sign of dark days ahead? Not so fast folks, it is normal for a company to extend credit to their customer especially during its expansion/growth phase, the percentage of impairment of account receivable is very low with an average of 6% for the past 7 years.It shows that the management is very cautious in extending credit term to its customer. The increase in ROE, Net profit and FCF further justify the increase of Cash Conversion Cycle.

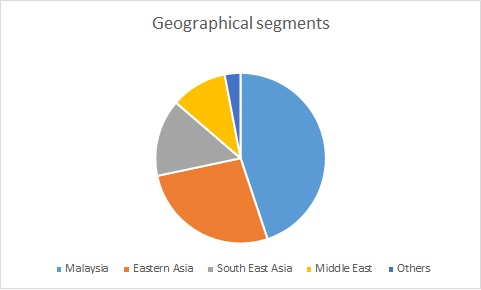

| Geographical segments | |

| Malaysia | 44% |

| Eastern Asia | 27% |

| South East Asia | 15% |

| Middle East | 11% |

| Others | 3% |

| 100% |

Back in 2010, Cocoaland's revenue comes only from Malaysia and China but had since then diversify its revenue steam from various region and is planning to penetrate more market in coming years. This shows that the management is hard at work in expanding the business to capture more market overseas,this shows tht cocoaland is a good consumer stock with worldwide presence

Leverage Success Sdn Bhd a company controlled by the company's director which in turns control 38.04% of Cocoaland Berhad and Frazer & Neave Holding Bhd. controls 27.19, this shows that the management holds substantial interest in the company and with F&N as second largest shareholder it will definitely brings strategic synergy to Cocoaland because F&N being in the consumer industry itself will not simply invest its money for the sake of capital appreciation or dividend income.The effect of this synergy can been seen in the development and improvement of Cocoaland's business over the years

From my opinion the appreciation in Cocoaland Bhd's share price is justified by the business performance and furthermore current utilization rate is only at 55% and the company is planning to boost it to 80% in the next 3 years,there is a lot of room for growth which is what we want to see in a growth stock, the ability to generate more revenue.

Beside growth,the company had been paying dividen constantly with an average of 50% payout ratio and average dividend yield of 4% while maintaining clean balance sheet (net cash) and healthy cash flows. This is a hallmark of a good management team.

Action speaks louder than word.Refer back to figure 2 (Profit vs Capex vs FCF) and you will understand the quality of the company. Revenue, profit and FCF is picking up, cost of sales is going down despite high volatility in its raw material price,high CAPEX spending is over and now its time to focus on growing the company forward.

ROE is at 19%,ROIC at 20%,Net profit margin 16%, FCF yield 5%, 30sen cash per share (net cash position) Cocoaland Bhd is on its way toward a steady and consistent growth. Cocoland is suitable for investor with a long term horizon (more than 1 year) not for those who seek instant gratification on their stock picks.

Disclaimer : This article is only for sharing purpose but any feedback is most welcome

For further reading i strongly suggest looking at Donkey Stock earlier post

https://klse.i3investor.com/blogs/donkeystocks/113053.jsp

And recent news for Cocoaland Berhad:

http://www.theedgemarkets.com/article/cocoaland-focus-more-overseas-markets

http://www.theedgemarkets.com/article/cocoaland-focus-more-overseas-markets

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Thoughts on Investing and Trading

Created by ajim102 | Oct 01, 2017

Discussions

We still think Cocoaland still has great potential as Indonesia is really a big market for Cocoaland to stretch her arms

2017-08-27 00:58

DonkeyStock, better stick to your academic teaching slides. We dont need a undergrad guy with zero investing track record to teach us about investing

2017-08-27 08:14

Learn to be humble. "We still think Cocoaland still has great potential as Indonesia is really a big market for Cocoaland to stretch her arms". <---- LMAO

who do you think you are? do you think your idea is somewhat a big deal??

2017-08-27 08:15

thank you donkey stock for your excellent work.i was inspired by your infographics to write this article.

2017-08-27 13:57

Flintstones Learn to be humble. "We still think Cocoaland still has great potential as Indonesia is really a big market for Cocoaland to stretch her arms". <---- LMAO

who do you think you are? do you think your idea is somewhat a big deal??

27/08/2017 08:15

i think DonkeyStock must have a valid reason for the statement.do you mind sharing with us here DonkeyStock?

2017-08-27 15:12

my logic very simple.

i remember chief joker icap's ttb promoted the stock when it was ard 40c and went quiet shortly afterwards.

since then, i figured out either i buy the counters that he get out early or counters that he promoted but didnt touch such as cocoaland.

best examples of selling out too early r hai-o, petdag, uplant and umw

he only got 2 golden hits of padini and pie in his icap's 11 yrs life.

his misses r mieco, tong herr, poh kong and of cos parkson.

2017-08-27 20:13

Flintstones

It is up because grandpine gang promoted it gao gao la

2017-08-26 11:24