AVALAND: Transforming From Strength to Strength - KingKKK (Intrinsic Value 46 sen, 57% upside)

KingKKK

Publish date: Fri, 01 Mar 2024, 03:52 PM

A. How much is AVALAND worth? 46 sen by using average P/E and P/B method (53% upside)

On average, property stocks in Malaysia trade at average Price/Book (PB) of 0.82x or Price/Earnings (PE) of 22.5x. The details is as below. Date of data captured is 29-Feb closing.

| Stock | PB | PE |

| Sunway | 1.32 | 20.3 |

| Mah Sing | 0.64 | 10.5 |

| UEMS | 0.77 | 65.0 |

| IOI Properties | 0.57 | 16.0 |

| Matrix | 1.04 | 9.0 |

| SIME Properties | 0.52 | 14.8 |

| Average | 0.81 | 22.6 |

| Avaland (at 30 sen) | 0.48 | 4.2 |

| PE Method | Value | Note |

| Fair PE | 6x | 75% discount to peers average |

| EPS for 2024 | 7.1 sen | Q42023 already make 2.58 sen |

| Intrinsic Value (sen) | 42.6 | |

| PB Method | Value | Note |

| Fair PB | 0.77x | 10-year average |

| Book Value for 2024 | 65 sen | Latest book value is 64 sen |

| Intrinsic Value (sen) | 50.1 | |

| PE Method | 42.6 |

| PB Method | 50.1 |

| Average | 46.3 |

B. Q4 earnings confirmed the turnaround is working

| | Q4-2023 | Q4-2022 | Change |

| Revenue | 261.65 | 76.55 | 241.8% |

| Gross Profit | 90.57 | 46.43 | 95.1% |

| Profit Before Tax | 46.517 | 11.25 | 313.5% |

| Net Profit | 37.522 | 13.506 | 177.8% |

| EPS | 2.58 | 0.93 | 177.4% |

| | | | |

| | 2023 | 2022 | Change |

| Revenue | 608.25 | 224.92 | 170.4% |

| Gross Profit | 210.17 | 93.08 | 125.8% |

| Profit Before Tax | 92.606 | -4.724 | Turnaround |

| Net Profit | 64.236 | 7.092 | 805.8% |

| EPS | 4.53 | 0.03 | 150 times |

In Q4-2023, AVALAND EPS grew 177% against Q4-2022 to 2.58 sen. 2023 EPS is even more powerful as it surge 150 times to 4.53 sen. The reason behind the strong earnings growth which doubled in 2023 and tripled in Q4-2023. The improvement in revenue was supported by higher sales recognition and advanced construction work progress from ongoing projects in addition to sales of completed units.

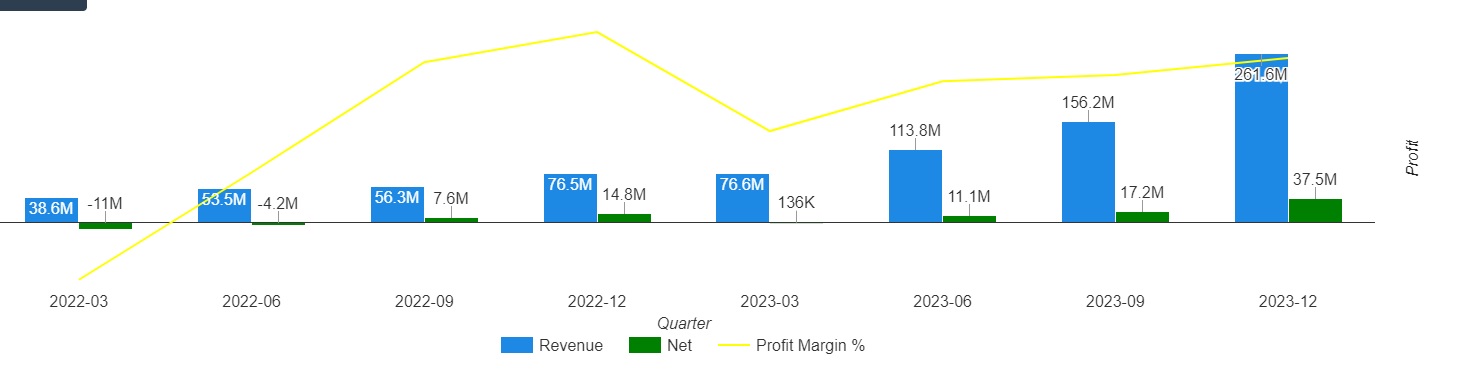

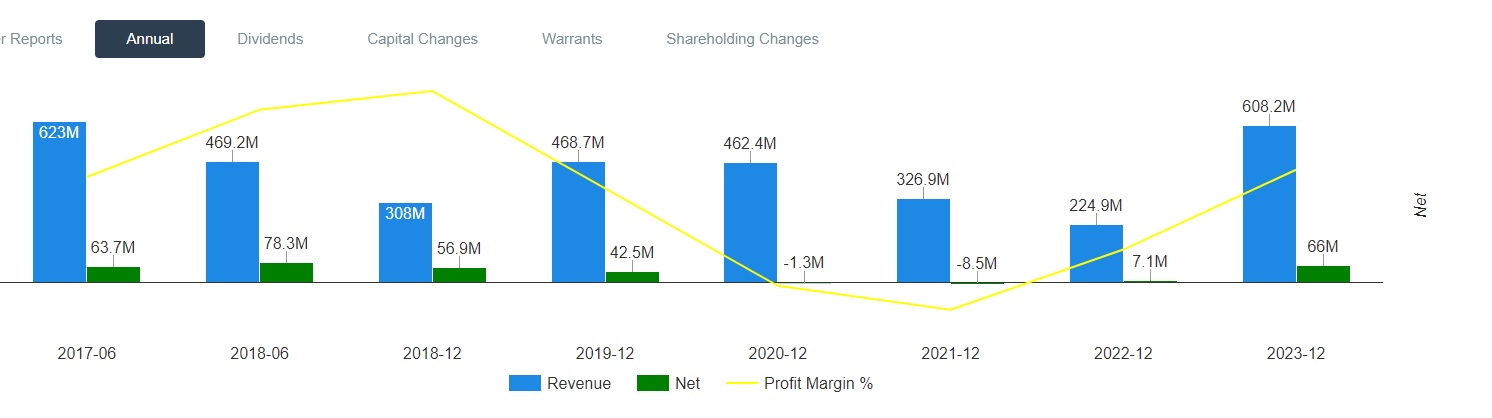

We can see from the Quarterly trend and Annual trend below that the turnaround strategy has worked well and is still progressing with more to come. These are from KLSE screener.

Quarterly revenue and net profit trend

C. Other notable achievement in Q4 2023

1. Sales increased 7.6% to RM586m in 2023.

2. Unbilled sales jumped 20% to RM863m.

D. Future growth plan

1. Plans to launch three new projects namely Amika Residences, Aetas Seputeh and Anja Bangi with a total GDV of RM1.4 billion.

Anja Bangi - Residential project at Bangi, price below RM600,000

Amika Residences - middle price range RM600,000 - RM800,000 per unit

Picture of Amika from Avaland website as below.

Aetas Seputeh - Luxury segment

Picture of Aetas Seputeh from Avaland website as below.

E. Property sector outlook is positive in Malaysia

Strong Demand for Affordable Housing: Government initiatives like the full stamp duty exemption and increased allocation for the Housing Credit Guarantee Scheme are expected to bolster demand for affordable housing, benefiting developers who focus on this segment.

Resilient Industrial Segment: Malaysia's position as a manufacturing hub and the growing e-commerce sector are driving demand for industrial properties, offering opportunities for investors in industrial REITs or developers with strong industrial portfolios.

Potential Uptick in Foreign Investment: The revised MM2H program could attract foreign investors, creating potential demand for specific property segments, particularly in prime locations.

F. Background

Avaland Berhad, formerly known as MCT Berhad, is a property development company listed on the Main Market of Bursa Malaysia Securities Berhad since 2015. The company's vision is to be an Innovative & Timeless Value Creator. They aim to create communities and enhance lives for generations by providing a complete lifestyle experience. Avaland Berhad has won numerous awards including The BrandLaureate Property Brand of The Year Awards 2022 and The Edge Malaysia's Best Managed and Sustainable Property Awards (BMSPA) 2023.

Landbanking:In addition to securing a 4.02-acre site in Bangi in 2022, Avaland made its debut in Kuala Lumpur in 2023 through the acquisitions of 1.57 acres and 3.9 acres of land in Seputeh and Taman Desa, respectively.

In addition to securing a 4.02-acre site in Bangi in 2022, Avaland made its debut in Kuala Lumpur in 2023 through the acquisitions of 1.57 acres and 3.9 acres of land in Seputeh and Taman Desa, respectively.

Some of the videos related to Avaland are as below:

ALORA RESIDENCES, SUBANG JAYA: INSPIRED LIVING WITHIN GREENERY (youtube.com)

Aetas Damansara l Luxury Home in Persiaran Tropicana (youtube.com)

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Stock Market Enthusiast

Created by KingKKK | May 13, 2024

Created by KingKKK | May 08, 2024

Created by KingKKK | May 05, 2024