PolicyStreet's Pivot From Marketplace to Co-Underwriting Customised Products; Now Waiting On DITO

Tan KW

Publish date: Thu, 29 Feb 2024, 01:04 PM

29-Feb-24 10:00

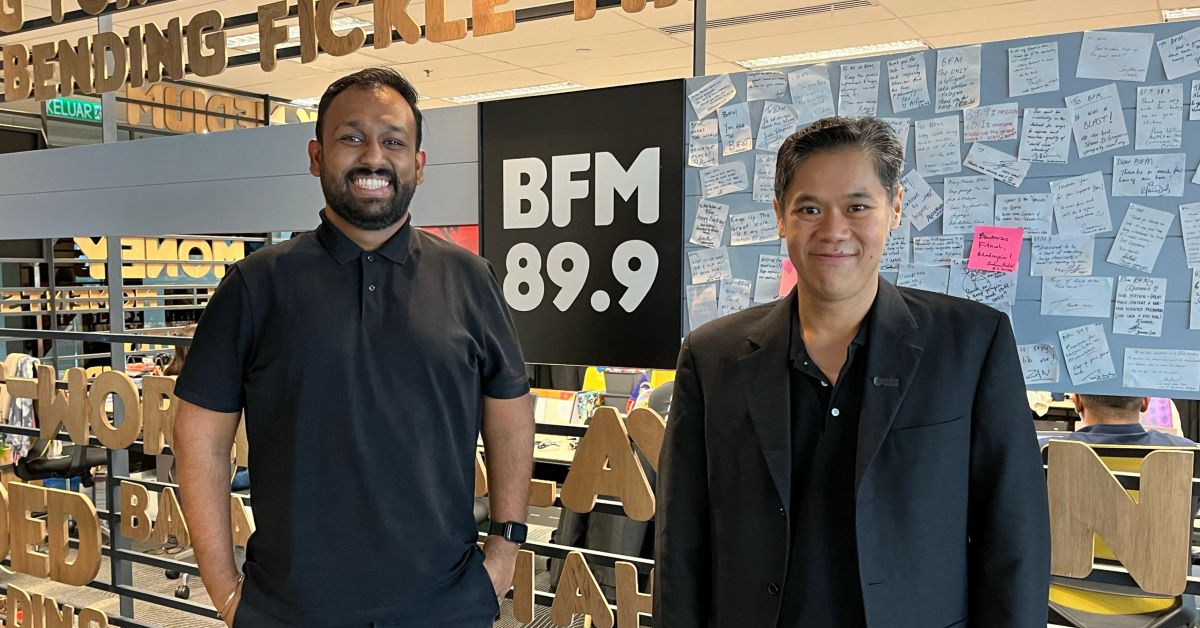

Lee Yen Ming, Co-Founder & Group CEO, PolicyStreet

Founded in January 2017 by Yen Ming, Wilson Beh and Winnie Chua, PolicyStreet began helping consumers and businesses choose and purchase insurance policies based on their needs and requirements, with the underlying aim of making insurance more affordable, simpler, and transparent.

Fast forward to today, they're a regional player in the Insurtech space and work with over 40 life, general, and takaful providers globally to offer a comprehensive range of products and services. As in June 2023, PolicyStreet have served over 5 million customers and achieved a sum insured of over US$6 billion (RM27.7 billion) in Malaysia.

The company also managed to close a US$15.3 million (RM67 million) Series B funding round with Khazanah Nasional Bhd as lead investor in last June, meanwhile earlier this year, the company received the regulatory approval from the Labuan Financial Services Authority (LFSA) to begin its Takaful and Retakaful operations. PolicyStreet is now equipped to reinsure and underwrite Takaful products, providing Syariah-compliant insurance solutions.

Venturing from insurance marketplace platform to financial advisory business, now co-creating and underwriting insurance products, on this episode of Open For Business, we learn about PolicyStreet's journey as a Malaysian Insurtech company over the last 7 years. Diving deeper into how they're tackling the insurance industry while working with agents and incumbents, exploring what they're looking for in potential strategic partnerships including Khazanah's non-monetary value, and much more.

More articles on BFM Podcast

Created by Tan KW | Jul 26, 2024