Vitrox - 过高估值的隐忧 - bluefun

bluefun

Publish date: Sun, 23 Feb 2020, 12:10 AM

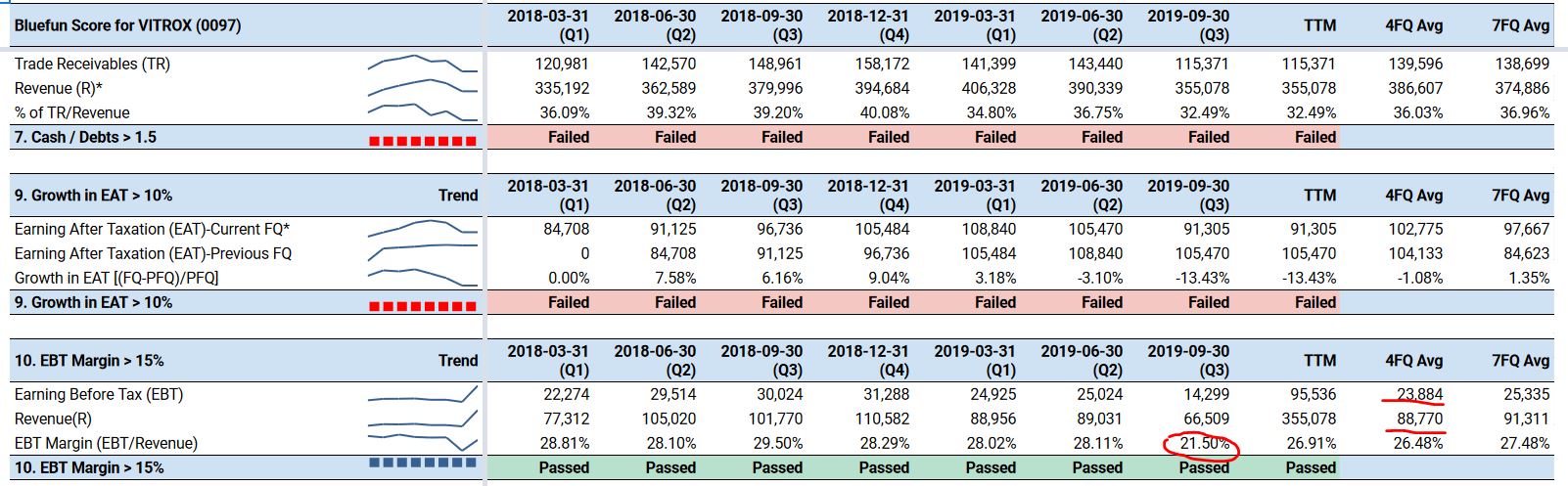

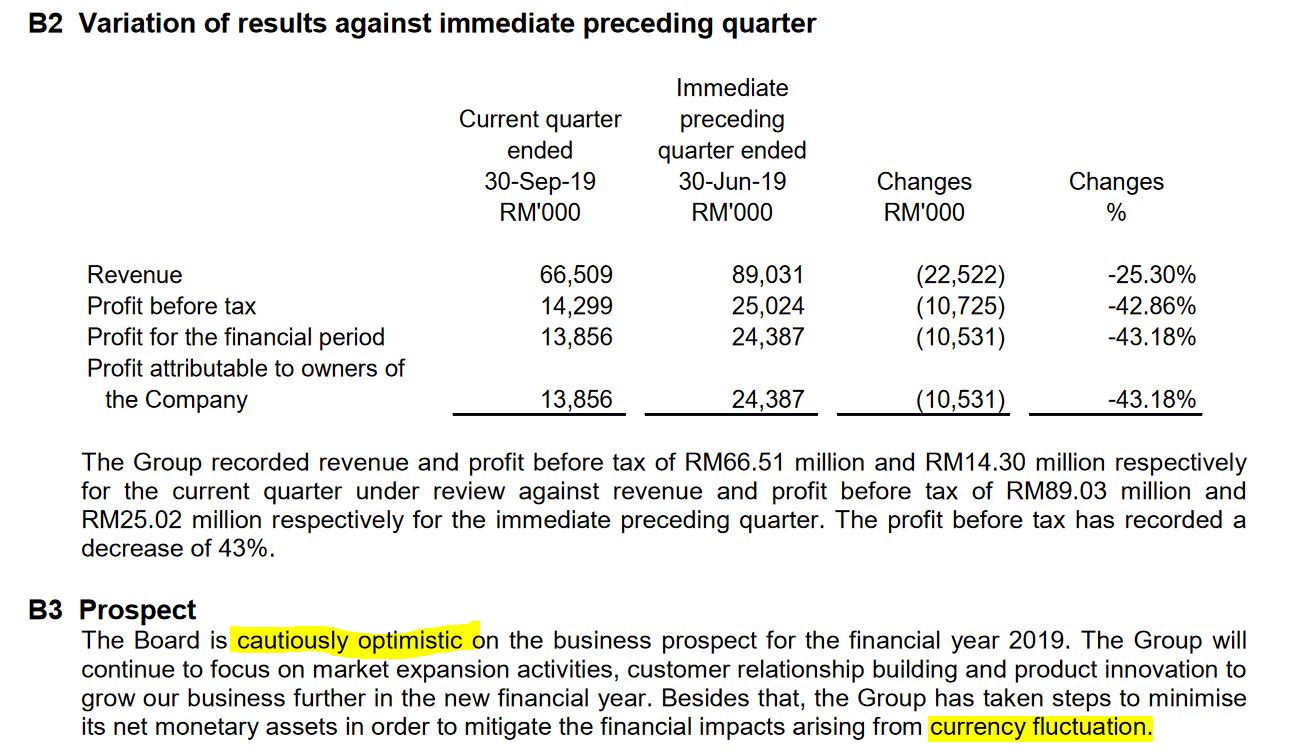

根据投资导航器 VIP by bluefun 的趋势推测法,Vitrox 在即将公布的季度业绩面临重大挑战,因为营收与税前盈利下滑趋势中

Average 4 Quarter:

Revenue:88.77m

PBT:23.88m

PBT margin:26.48%

Revenue营收:

Q418: 110.58m

Q119: 88.96m

Q219: 89.03m

Q319: 66.51m

Average 4 Quarter:88.77m

PBT税前盈利:

Q418: 31.29m

Q119: 24.93m

Q219: 25.02m

Q319: 14.30m

Average 4 Quarter:23.88m

PBT margin 税前盈利率:

Q418: 28.29%

Q119: 28.02%

Q219: 28.11%

Q319: 21.50%

Average 4 Quarter:26.48%

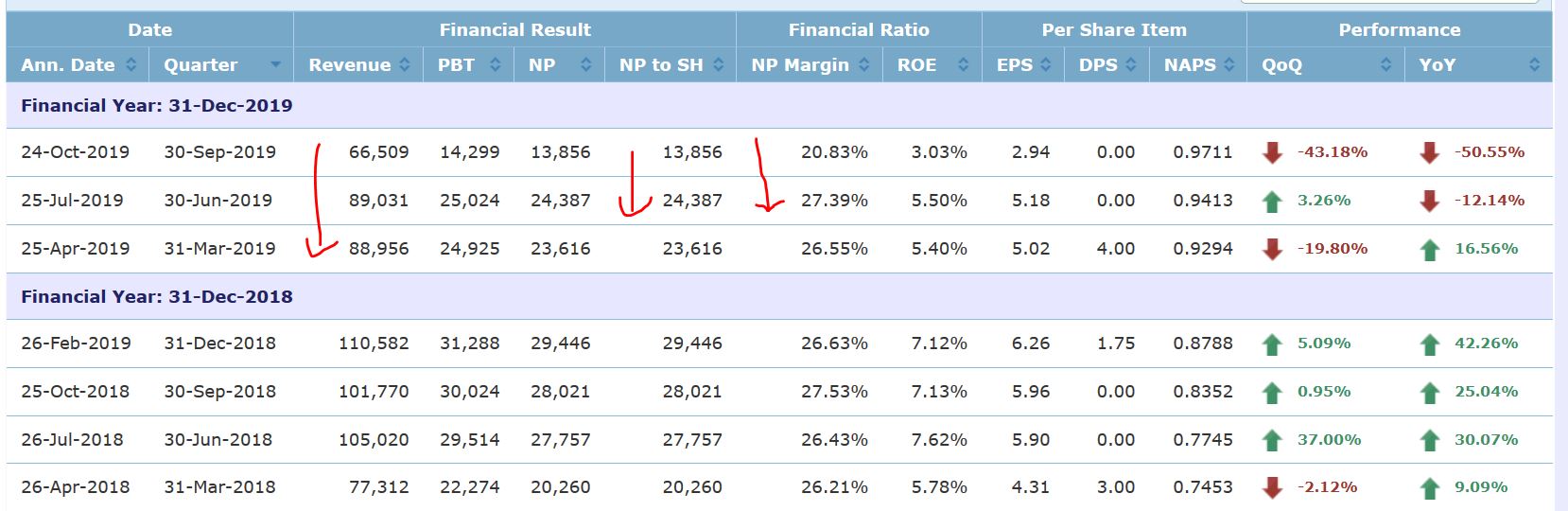

Q419 Dec19 业绩预测:

Q319 Revenue:66.51m

Q319 PBT:14.30m

Q319 PBT margin: 21.50%

QoQ :无论是 QoQ revenue & PBT ,改善都有机会

Q418 Revenue:110.58m

Q418 PBT:31.29m

Q418 PBT margin: 28.29%

YoY :无论是 YoY revenue & PBT,似乎突破的机率很渺茫

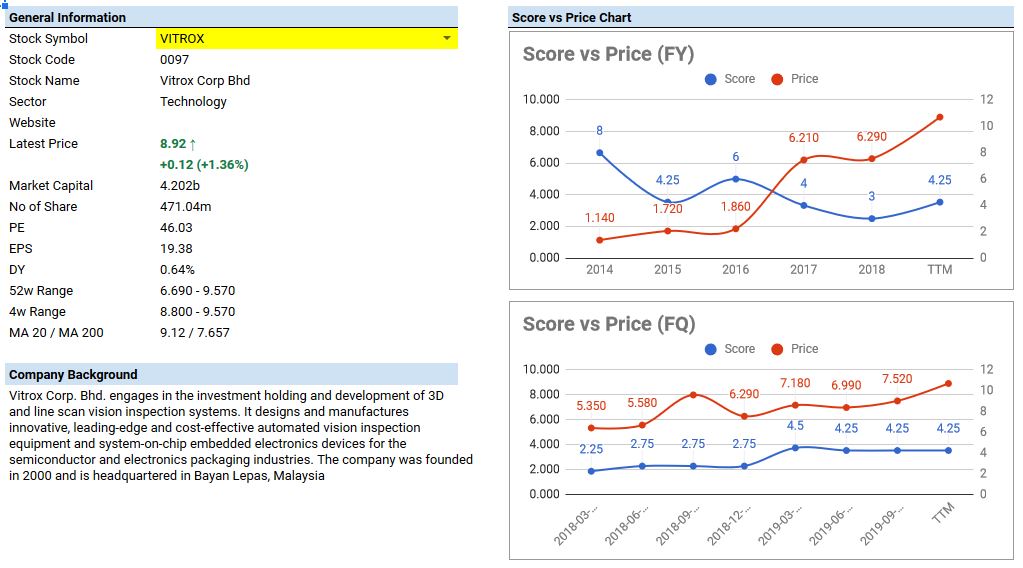

Stock name: Vitrox

Share price: RM8.92

EPS: RM0.1938

PE: 46.03

估值 PE 46.03,太太太太太高,Q419 又面对 YoY 无法超越的困境( lower EPS than Q418),现在进场就等于把辛苦赚来的血汗钱拿去打水漂

看看就好,若有雷同,绝对不会是巧合,那是抄袭 XD

Original article link: https://www.facebook.com/bluefun696/posts/1050956808630732

说故事的人

22.02.2020

不煩幫幫忙系列故事延伸:

《如何開始投資股票?》

@ https://www.facebook.com/197828520610236/posts/850296215363460?s=1424783954&sfns=mo

《開始交易前,需要注意什麼?》

@ https://www.facebook.com/197828520610236/posts/863110724082009?s=1424783954&sfns=mo

《在有限的薪資裡,該如何開始儲蓄? 》

@ https://www.facebook.com/197828520610236/posts/872197393173342?s=1424783954&sfns=mo

《什麼是股息?? 》

@ https://www.facebook.com/197828520610236/posts/874229179636830?s=1424783954&sfns=mo

《如何閱讀財務報表??》

@ https://www.facebook.com/197828520610236/posts/895100177549730?sfns=mo

《投資這件事 Inilah investing》

@ https://www.facebook.com/197828520610236/posts/908590592867355?sfns=mo

《股息率 > 4% 就可以投資的迷思》

@https://www.facebook.com/bluefun696/posts/914067025653045

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|