Business-sense Strategy in Share Investment – Buddyinvest

buddyinvest

Publish date: Thu, 01 Dec 2016, 02:00 PM

Disclaimer: This blog is to share the interesting observations I made in i3investor. Nothing in this article should be considered as investment advice nor is intended to be investment advice.

Organisational Behaviour was one of seven core courses on the MBA I completed 10 years ago. I guess that may be the reasons why I like to observe what others are doing as I always can learn something from them.

As per my observations, the distribution of readers in the i3investor resembles the body of a bell curve. An extreme few are critical of whatever the writers post. Majority takes their writings as reading pleasure and only an extreme few understand the messages the writers have tried to deliver to them. This can be illustrated as follows:

Are the Business Sense Strategy in Share Investment really difficult to comprehend? I have thought about it and I would like to put up an analogy.

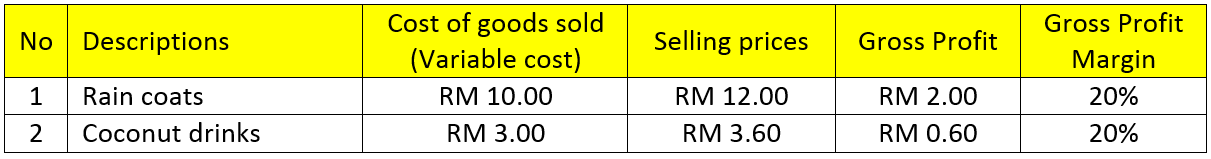

Let’s assume we are operating a retail shop selling all kind of stuffs that include rain coats and coconut drinks. Generally, the selling of rain coats does well during rainy season. Conversely, the coconuts are highly demanded during hot weather.

The cost of goods sold (variable cost), selling prices & profits for both items are tabulated as follows:

For some reasons, the vendors that supply the above items offer us the retailer further discounts, i.e. rain coat & coconut drinks are supplied at RM8.00 & RM2.50 per unit respectively. Lower input cost means we the retail shops can make more profits in the coming months.

As usual, vendors will persuade retailers to stock up both items. A smart retailer is well aware that he has got limited resources and he needs to examine the prospect for both items before he makes a decision.

Let say we are now experiencing hot weather and this is expected to continue to be so for the next few months (this provides hints for its prospect, i.e. it tells us what the market wants). The smart retailer will take advantage of this situation by only stocking up coconuts. He won’t stock up rain coats although he is given good discount by vendors.

The retailers who stock up rain coats would have to wait a longer period of time to realise the profits. These group of retailers have normally forgotten the cheap sales for the rain coats can continue for a prolonged period of time, thus dearly costing them opportunity cost.

As far as present share investment is concerned, the above presents a simple and easy-to-understand analogy for CSCSTEL (coconuts) vs MKH/CHOOBEE (rain coats).

Retail investors typically have small capitals and can’t afford to own so many stocks at a given time. They must choose the correct path to invest.

More articles on Share Investment

Discussions

Thanks buddyinvest for the article. It is simple yet educative, brilliant!

Stocking goods with higher demand is certainly a wiser choice. Increase in inventory turnover doesn’t only drive revenue and profits higher; share price, which moves in tandem with profit growth, will also be catapulted upward.

2016-12-01 22:54

Just imagine every retailers will be stocking raincoats during the rainy seasons, and hence they need to dispose it cheap when the rainy season is over loh...!!

Thus during rainy season bcos of huge stocking and competition...u cannot sell expensive even demand are high mah !!

Thus chasing....popular or season...can only be...hit and run play loh..!!

when rainy seasons....over KYY....sell cheap cheap and share price crash mah....!!

This what happen to KYY... VS, Liihen, Flb, Latitude, all crashed drastically when season over loh....!!

Don invest short term....go for longer term...margin of safety play...a better preposition loh...!!

2016-12-01 23:45

Professionals take action

Amateurs become frozen soldiers and call it long term ......

2016-12-01 23:49

Remember Ben Graham Mr Market....Buy when Mr Market sell cheap cheap...when pessimistic......and undervalue ....with great margin of safety loh....!!

Sell when Mr Market is very optimistic....and chase the stock high high to overvaluation mah....!!

The key for determination of buying is valuation and margin of safety loh......!!

2016-12-02 00:00

I give this adv a BIG LIKE stockraider :

The key for determination of buying is valuation and margin of safety loh......!!

2016-12-21 13:27

cheoky

good analogy. But the decision to categorise a stock either a coconut or rain coat is not so clear cut in my opinion. Thus, how do you conclude the stock is costing the opportunity cost? It is only on hindsight can you conclude so right? MHK might become a coconut this month with rising CPO and good location landbank. CSC might become a raincoat with world steel price u turning... All this hindsight can we confidently said so. So how?

2016-12-01 14:14