Choo Bee’s FA, TA & Its business - Buddyinvest

buddyinvest

Publish date: Wed, 30 Nov 2016, 04:07 PM

Disclaimer: This blog is to share the interesting observations I made in i3investor. Nothing in this article should be considered as investment advice nor is intended to be investment advice.

KYY has on 21st September, 2016 warned the investing community in the i3investor on the earning quality of Choo Bee. Because the market is so vibrant, different group of investors reacted to his posting quite differently. Many appreciated his views and acted swiftly to sell. A few doubted his intention and accused him of having a hidden agenda. Some took months to digest the reasonings. The stubborn chose to wait for results for confirmation.

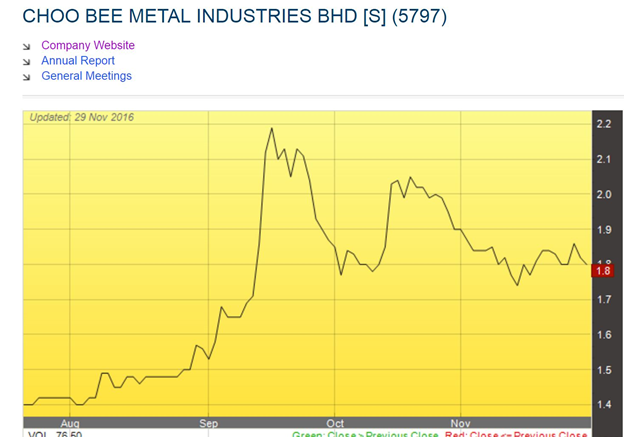

If you look at Choo Bee’s FA, TA & products as shown below, you will understand why its share price is still falling. These pictures will help you decide to buy or sell. A picture is worth a thousand words.

Ones who have a business sense will stay away from Choo Bee because of the poor industry outlook. To recap, Choo Bee buys thin steel plates from CSC Steel to manufacture small diameter household water pipes and hollow box section and C purlin for building construction.

There is currently an oversupply of properties in every town and city in Malaysia which is affecting Choo Bee’s sale and profit. Buying Choo Bee is the same as buying property stocks.

Many investors including financial experts are recommending you to buy because it is cash rich and the share is selling below its NTA. Remember the company is not going to give you all the cash.

To be really successful, investors must understand the company’s business, what it is making and who will buy its products.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Share Investment

Discussions

If Choo Bee's prospects are dim in current business environment, why is it rosy for CSC Steel, which KYY said is great? If one is downstream, and the other is upstream, for the same final customer?

2016-11-30 16:18

..2 reasons

- Megasteel also produces CRC ( and HRC), now dead

- crc products are used in a very wide base.....from electrical, electronic, mechanical, civil, you name it, they use it.....to support all the export assemblies in Malaysia too.

2016-11-30 16:24

I'm not a runner for you, you and you. I have high regards for anyone are able to talk sense. My purpose of posting the above is to share with you the interesting observations I have made. Observations expedite learning process and that is the message I'm trying to convey.

2016-11-30 16:44

the above shows very little. most steel counters posted better yoy results but weaker qoq, so the snapshot above doesn't show much actually

2016-11-30 18:00

Stockmammy analysis is wrong loh....when choobee do badly csc will also do badly too loh...!!

Just look at today choobee share price gap down, csc share price also gap down loh....!!

The arguement on mega steel as a block buster for csc do not hold water loh..!1

Yes u r now...not force to buy from mega steel on raw material....but u r still subject to imports of steel products, that will still compete with csc and mycron mah....!!

So the condition of other steel industry players is the same as csc loh...!!

Nothing special loh....!!

Still need to compete with cheap china import loh....!!

2016-11-30 18:09

Raider

Share price is today....tomorrow is another day

But business is for ever.

And yes, when a competitor is removed, it is a game changers for CSC .

For CB....it is only waiting to die

For CSC, ...it's a bright new day ....and anyway, eve very industry uses their product

2016-11-30 18:43

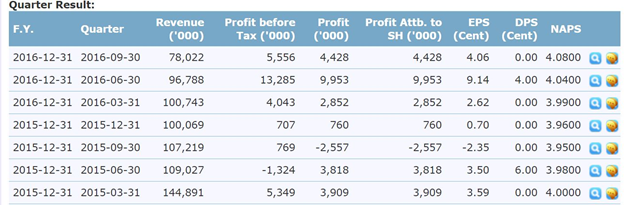

Based on the above data, revenue has dropped 46% over 7 quarters almost quarter by quarter. This indicates falling business volume despite increasing international steel prices or product selling price.

There is this phenomenon that upstream raw material prices is increasing but lack of demand at downstream. This cost push inflation is always a bad sign for the economy, especially for downstream player like Choo Bee. This is because their raw material cost is going up but they cannot past down to customers as a result of lack of demand (slow down in property market), hence their margin will be squeezed. Also, their market share is very small and they are in very competitive industry hence it is even harder for them to pass on the cost.

If they r importing raw material from oversea after the closure of Megasteel, they are also in disadvantage due to weak ringgit.

2016-11-30 18:44

Raider says MEGA...is not really a competitor...it is not an inefficient supplier of raw material force on to CSC mah...!!

The main competitor of CSC are mycron and cheap china imports loh...!!

Thats why raider says...choobee and csc are the same...they are in the steel industry...they face the same cheap china steel imports mah...!!

Mega steel is nothing special loh....furthermore csc share price already move to reflect good news, that the inefficient mega steel no longer force on its products to CSC loh...!!

2016-11-30 18:51

all this could have been easily avoided if stockman learnt how to do stock evaluation :(...

but he relied on his gut bacteria

2017-04-25 20:13

since he has no sense of maths, unfortunately he relies on this kinda pictures...which farts as strong as E=mc2!

2017-04-25 20:23

Correctloh....it is all documenred here...mammy pls be a gentleman just admit ur dead wrong on choobee....and apologise to those u have harmed bcos of ur useless analysis loh...!!

2017-04-25 20:32

Correctloh....it is all documenred here...mammy pls be a gentleman just admit ur dead wrong on choobee....and apologise to those u have harmed bcos of ur useless analysis loh...!!

2017-04-25 20:33

Correctloh....it is all documenred here...mammy pls be a gentleman just admit ur dead wrong on choobee....and apologise to those u have harmed bcos of ur useless analysis loh...!!

2017-04-25 20:33

otb....

please la....throw a dart can get a better stock in the KLSE the last few months.......

In any case, Choo Bee is facing tough times , why would anyone want to invest in a company facing tough times?

2017-04-25 20:34

OTB

if the best you can do with investment money is to buy a steel trader, I think you very low standard......

A steel trader is never a stock that excites any body.

2017-04-25 20:42

otb

a rising tide lifts all boats.

one can wait to be lifted, as is the case like Choo Bee....or choose to look for a leader....I prefer the latter.

2017-04-25 20:47

otb

what is so great about a stock dead for months?

announcing record profits soon? lol

2017-04-25 20:56

our fellow blogger leoting's analysis is more correct. He said that it is true that property projects had slowed down, reducing demand for steel. But on the other hand, with imported steel now no more in the market, domestic producers suddenly end up with the other half of the market to enjoy. That alone is sufficient to keep them very busy.

I always said KYY's analysis is too crude and he always got it wrong when come to earning forecast.

2017-05-19 20:01

probability

sometime i wonder what KYY did to this buddyinvest & stockmanmy....

2016-11-30 16:12