Property Sector Still Underowned, Says RHB IB

edgeinvest

Publish date: Tue, 09 Jan 2024, 09:35 AM

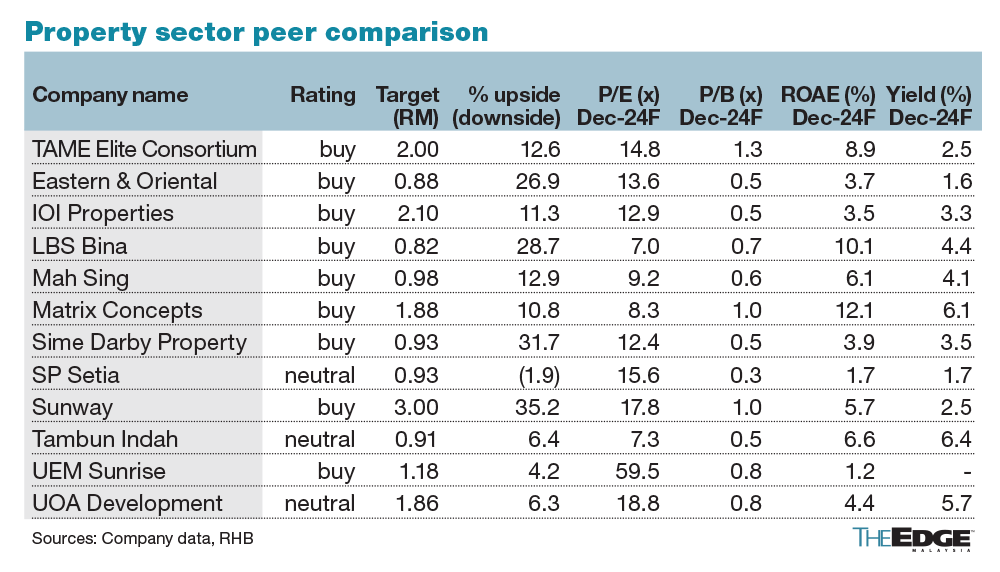

KUALA LUMPUR (Jan 8): RHB Investment Bank (RHB IB) Research has maintained its “overweight” rating on the property sector and said the re-rating in property sector still has legs.

In a sector update on Monday, the research house said that the overall macroeconomic environment, government policies and investment flows are encouraging, supporting the growth in property sales in 2024-2025.

Sector is still underowned

RHB IB said many local institutional funds have yet to take a meaningful position in the property sector.

It said foreign shareholding, for example, has yet to increase substantially.

It said both UEM Sunrise Bhd and Sunway Bhd have foreign shareholding of less than 6%, as compared to about 22% during the peak a decade ago (GIC’s shareholding made up 12% for Sunway then).

Iskandar Malaysia

“We remain confident with our positive view on the Iskandar Malaysia property market given the concentration of high profile investments and infrastructure developments that are taking place in the southern region.

RHB IB said that in the short term, both the Malaysian and Singaporean governments are expected to sign the memorandum of understanding for the highly anticipated Johor-Singapore special economic zone on Jan 11, 2024.

It said the recent entry of Nvidia and Microsoft points to a boost in confidence among foreign investors, especially in the data centre space.

“The influx of investments and rising demand for industrial lands are already driving the land prices in Johor, and major landowners such as UEM Sunrise Bhd and Sunway Bhd will likely enjoy further RNAV (revised net asset valuation) re-rating going forward,” it said.

10%-15% growth in property sales

RHB IB expects most developers to guide 2024 sales targets that are 10%-15% higher than the 2023 target.

“A number of developers indicated that they plan to roll out more projects in Iskandar Malaysia this year,” it said.

Source: TheEdge - 9 Jan 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

SUNWAY2024-12-31

UEMS2024-12-31

UEMS2024-12-31

UEMS2024-12-31

UEMS2024-12-30

SUNWAY2024-12-30

SUNWAY2024-12-30

SUNWAY2024-12-30

SUNWAY2024-12-30

SUNWAY2024-12-30

SUNWAY2024-12-30

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-27

SUNWAY2024-12-26

SUNWAY2024-12-26

SUNWAY2024-12-26

SUNWAY2024-12-26

SUNWAY2024-12-25

SUNWAY2024-12-25

UEMS2024-12-24

SUNWAY2024-12-24

SUNWAY2024-12-24

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-23

SUNWAY2024-12-21

SUNWAYMore articles on CEO Morning Brief

Created by edgeinvest | Dec 31, 2024

Created by edgeinvest | Dec 31, 2024

Created by edgeinvest | Dec 31, 2024

Created by edgeinvest | Dec 31, 2024

Created by edgeinvest | Dec 31, 2024