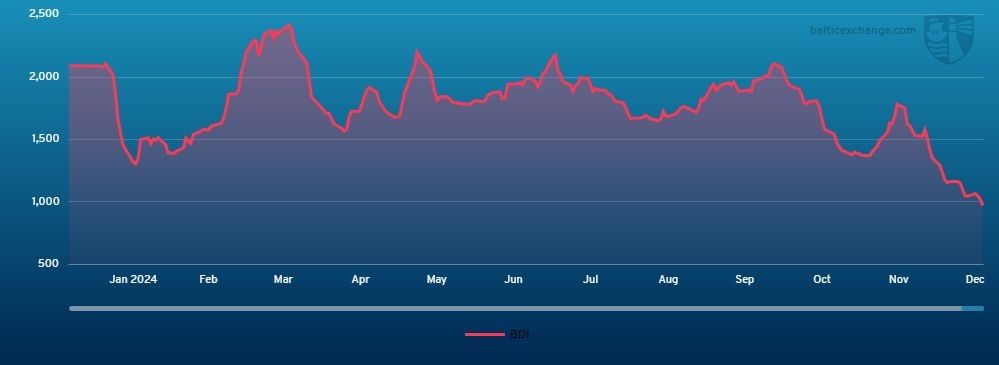

Baltic Exchange Shipping Updates: Dec 20, 2024

edgeinvest

Publish date: Fri, 20 Dec 2024, 09:59 AM

A weekly round-up of tanker and dry bulk market (Dec 20, 2024)

This report is produced by the Baltic Exchange.

The Baltic Exchange, a wholly-owned subsidiary of Singapore Exchange, is the world's only independent source of maritime market information for the trading and settlement of physical and derivative contracts.

Its international community of over 650 members encompasses the majority of world shipping interests and commits to a code of business conduct overseen by the Baltic.

For daily freight market reports and assessments, please visit www.balticexchange.com.

Capesize

The Capesize market began the week on a positive note but experienced a gradual weakening as the week progressed. Early in the week, signs of optimism were seen in the Pacific and Atlantic markets, supported by improved cargo flows and a shorter ballaster list. However, these gains were quickly reversed as the Pacific market faced a persistent oversupply of tonnage, with the C5 index dropping steadily from US$7.34 on Monday to end the week at US$6.385, as owners scrambled for fixtures ahead of the Christmas holidays. The South Brazil and West Africa to China routes showed some resilience, supported by an uptick in January cargoes and a reduction in ballasters, bringing a hint of optimism towards the week's end. This was reflected in the C3 index, which climbed to US$16.950. Despite a challenging week overall, the BCI 5TC managed to gain US$299, closing at US$9,244.

Panamax

A continuation of the previous week, with a steady rise in rates in the Atlantic. The North Atlantic again saw a tightening of tonnage supply, pitted against steady mineral demand throughout the week. Rates of US$10,500 were concluded several times on 82,000dwt tonnage for transatlantic grain trips, with firm sentiment taking hold on these routes. In contrast, fronthaul activity had a lacklustre week, with rates largely flat overall. Asia experienced a tough week, with pressure mounting from the start as the tonnage count grew and there was little fresh demand to counterbalance. US$5,500 was agreed on an 81,000dwt delivery from China for a NoPac round trip, while US$3,250 was rumoured for an Indonesia coal trip to China on an older 75,000dwt vessel delivering from South China. Unsurprisingly, given the low spot rates, period activity was limited, though reports emerged of an 82,000dwt vessel delivering from Japan at US$12,000 for a 14/15-month period.

Ultramax/Supramax

The last full week of the year for many did little to bring much Christmas cheer, with market fundamentals changing little throughout the week. The North Atlantic remained rather positional, with a 61,000dwt fixed basis delivery US Gulf for a trip to the Far East at US$18,750. Further south, from EC South America, brokers described a subdued mood, with a 63,000dwt fixing a trip from there to the Arabian Gulf at US$14,500 plus a US$450,000 ballast bonus. The Continent-Mediterranean market lacked fresh impetus, with a 63,000dwt fixing from the North Continent to the East Mediterranean at US$14,750. The Asian market continued its gentle downward trend as an abundance of vessels prevailed, with a 61,000dwt open in Gresik fixing a trip via West Australia with redelivery in the Philippines at US$13,000. Limited activity from Indonesia saw a 63,000dwt fixed from Dumai, trip via Indonesia with redelivery in China at US$10,750. The Indian Ocean also struggled, with a 61,000dwt fixing a trip from South Africa to Pakistan at US$16,000.

Handysize

The market this week saw minimal visible activity across both basins, with rates continuing to slide in the Continent and Mediterranean, and sentiment generally soft. A 33,000dwt open Newport UK around Dec 20 fixed delivery Newport via Baltic Russia to West Africa at US$9,000. In the South Atlantic and US Gulf, sentiment remained subdued, with tonnage availability putting additional pressure on rates. A 36,000dwt was placed on subjects for delivery Santos, trip to redelivery Nigeria at US$17,000, while a 39,000dwt open US East Coast fixed delivery Savannah to redelivery Continent at US$13,000. The Asian market also faced challenges, with rising tonnage and a lack of cargo, with a 39,000dwt fixing delivery Far East to redelivery SE Asia at US$8,750.

Clean

LR2

MEG LR2’s dipped a little this week, however there has been enough enquiry to prevent complete crumbling of the market. TC1 75kt MEG/Japan lost 3.06 points to WS106.94. A trip West on TC20 90kt MEG/UK-Continent shed US$212,500 to US$3.06 million.

West of Suez, Mediterranean/East LR2’s on TC15 remained at the US$3.1 million level for the third week on week.

LR1

The TC5 55kt MEG/Japan index held level at around WS110 all week. A run to the UK-Continent on TC8 65kt MEG/UK-Continent dropped another inc US$114,400 to US$2.36 million.

On the UK-Continent, the TC16 60kt ARA/West Africa index was resolute at WS129 all week.

MR

MR’s in the MEG remained positive this week. The TC17 35kt MEG/East Africa index, nudged up 9.64 points to WS210 where it looks to have plateaued for the moment.

UK-Continent MR’s stalled this week. The TC2 index 37kt ARA/US-Atlantic coast saw an incremental drop of 5.31 points to WS131.88 with the Baltic TCE showing US$11,571 / day round trip. TC19 37kt ARA/West Africa dropped off a little more than TC2 with the index dropping from WS186.25 to WS171.25.

MR’s in the USG continued their current firming sentiment this week reflected in the TC14 38kt US-Gulf/UK-Continent marked 22.86 points higher than last week at WS210. TC18 the 38kt US Gulf/Brazil index also hopped up from WS237.86 to WS171.25. A short trip on TC21 38kt US-Gulf/Caribbean also stepped up another 20% to US$1.13 million. This returns US$47,379 /day on Baltic description round trip.

The MR Atlantic Triangulation Basket TCE gained US$3,170 to US$36,605.

Handymax

In the Mediterranean, Handymax rates had a sharp knife taken too them and the TC6 index went from WS204.44 to WS1667.67.

Up on the UK-Continent, the TC23 30kt Cross UK-Continent held onto its mark of low/mid WS180’s all week.

VLCC

The market appears to have touched bottom, at least for now. The 270,000mt Middle East Gulf to China trip (TD3C) has been held at the WS39-40 mark giving a daily round-trip TCE of about US$18,700 basis the Baltic Exchange’s vessel description. In the Atlantic market, a similar story played out with the rate for 260,000mt West Africa/China (TD15) being maintained around the WS46.5/47 level (corresponding to a round voyage TCE of around US$26,600 per day), while the rate for 270,000mt US Gulf/China (TD22) ended the week US$359,667 less than last Friday at US$6,445,333 (which shows a daily round trip TCE of US$28,006).

Suezmax

Charterers continued to apply pressure on owners this week, especially in the Atlantic where the slowdown in US Gulf activity has impacted West Africa trade. The 130,000mt Nigeria/UK Continent voyage (TD20) fell by about six points to WS81.94, meaning a daily round-trip TCE of US$28,613, while the TD27 route (Guyana to UK Continent basis 130,000mt) lost about 3.5 points to WS81.94, which translates into a daily round trip TCE of US$28,311 basis discharge in Rotterdam. For the TD6 route of 135,000mt CPC/Med, the rate lost another nine points this week to WS88.30 (showing a daily TCE of US$25,681 round-trip). In the Middle East, the rate for the TD23 route of 140,000mt Middle East Gulf to the Mediterranean (via the Suez Canal) was a point weaker at WS90.83.

Aframax

In the North Sea, the rate for the 80,000mt Cross-UK Continent route (TD7) gained close to four points to WS131.67 (giving a daily round-trip TCE of US$35,817 basis Hound Point to Wilhelmshaven).

In the Mediterranean market, the rate for 80,000mt Cross-Mediterranean (TD19) regained eight points to WS152 (basis Ceyhan to Lavera, that shows a daily round trip TCE of US$42,246).

Across the Atlantic, the market for the shorter hauls improved early in the week but by Thursday had fallen back to levels seen last Friday with longer hauls attracting the most attention. Basis week-on-week values, the 70,000mt East Coast Mexico/US Gulf route (TD26) and the 70,000mt Covenas/US Gulf route (TD9) rates have remained at the 166 and 170 levels, showing a daily round-trip TCE of US$38,039 and US$42,732, respectively. The rate however for the trans-Atlantic route of 70,000mt US Gulf/UK Continent (TD25) has rebounded and is 10 points firmer than last Friday at WS172.22 (showing a round trip TCE basis Houston/Rotterdam of US$41,397 per day), which should discourage further ballasters from Europe, for the moment at least.

LNG

As the year-end festivities are in full swing, the LNG market has had a challenging year, with 2024 proving tougher than many anticipated. While macroeconomic events have influenced certain market dynamics, other factors contributing to the downturn have been less clear. This week has seen minimal movement across most routes.

The BLNG1 174k CBM 2-Stroke index rose modestly by US$1,100 to close at US$22,300. Meanwhile, the BLNG1 160k CBM TFDE index remained largely flat, with only a US$200 decrease, ending the week at US$14,000. In the Atlantic, the trend was similarly subdued. BLNG2 Houston-Continent for 174k CBM 2-Stroke ships saw a small rise of US$800, closing at US$23,200, while the 160k CBM TFDE equivalent dropped by US$600 to settle at US$14,000. BLNG3 Houston-Japan followed suit, with the 174k CBM 2-Stroke route up by US$1,000 to US$29,400, while the 160k CBM TFDE route fell by US$400, ending at US$17,000. Tonnage length and a lack of enquiry kept rates under bearish pressure, albeit with marginal declines for the TFDE.

The period market remained quiet as expected, with owners pausing to reassess strategies ahead of the new year. Rates for six-month charters dropped to US$25,600 per day, while one-year periods declined to US$33,067 per day. The steepest drop was observed in three-year terms, which fell by US$10,250 to US$43,600 per day. As brokers and owners close the books on 2024, many are eager for a fresh start in the new year, hoping for renewed opportunities and more favourable market conditions.

LPG

As Christmas draws near and Saudi acceptances were released this week, the market anticipated a strong upward movement despite the ongoing festive celebrations. Although rates increased, the rise fell short of expectations. A reported fixture at US$67 failed to significantly influence the broader market to push rates higher. The BLPG1 Ras Tanura-Chiba route recorded a gain of US$3.084, closing the week at US$62.667. This continued its recent upward trend, with TCE earnings rising to US$45,216 per day. In contrast, BLPG3 Houston-Chiba faced challenges despite ongoing cargo activity and a tight tonnage list for West cargoes. The route fell by US$3.5, publishing at US$110.167. This decline reflected spot deals concluded at lower-than-previous levels, which hindered recovery. As a result, daily TCE earnings for this route dropped by US$3,134 to end the week at US$44,936 per day. Meanwhile, BLPG2 Houston-Flushing saw limited activity, with one reported fixture including an option to discharge in the UK Continent. The index slipped by US$2.25, settling at US$0.75. TCE earnings for this route remained robust at US$61,274 per day, despite the lack of significant movements.

Disclaimer:

While reasonable care has been taken by the Baltic Exchange Information Services Limited (BEISL) and The Baltic Exchange (Asia) Pte Ltd. (BEA, and together with BEISL being Baltic) in providing this information, all such information is for general use, provided without warranty or representation, is not designed to be used for or relied upon for any specific purpose, and does not infringe upon the legitimate rights and interests of any third party including intellectual property. The Baltic will not accept any liability for any loss incurred in any way whatsoever by any person who seeks to rely on the information contained herein.

All intellectual property and related rights in this information are owned by the Baltic. Any form of copying, distribution, extraction or re-utilisation of this information by any means, whether electronic or otherwise, is expressly prohibited. Persons wishing to do so must first obtain a licence to do so from the Baltic.

Source: TheEdge - 24 Dec 2024

More articles on CEO Morning Brief

Created by edgeinvest | Dec 24, 2024

Created by edgeinvest | Dec 24, 2024

Created by edgeinvest | Dec 24, 2024

Created by edgeinvest | Dec 24, 2024

Created by edgeinvest | Dec 24, 2024