Poh Kong Holdings - Ripe and Ready

sectoranalyst

Publish date: Wed, 21 Aug 2024, 12:42 PM

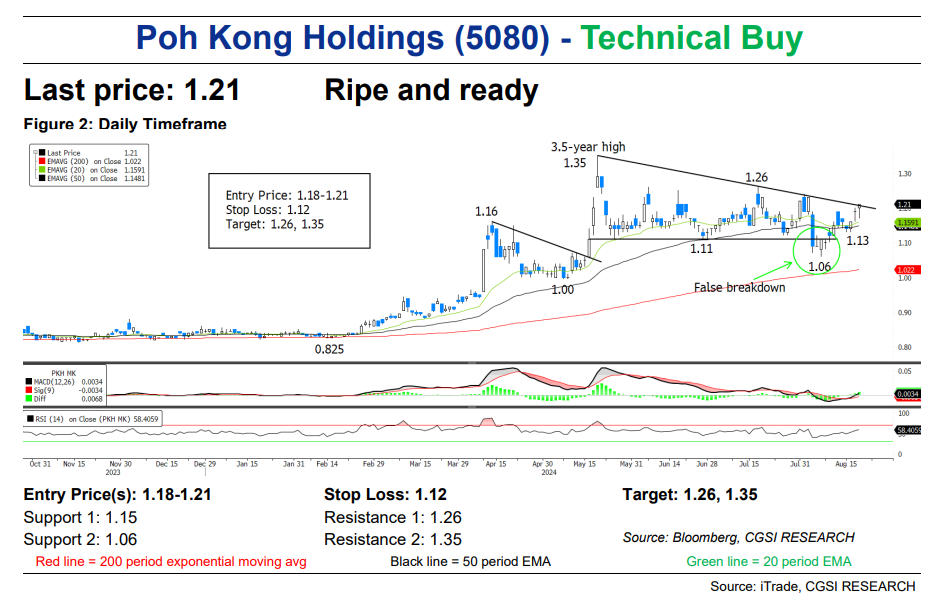

There was a false breakdown below its 2-month consolidation triangle in early August, but the bulls quickly fought back by climbing back above the 50-day EMA in the subsequent days. It has since formed a higher high and higher low structure from the RM1.06 low. With the stock closing marginally above the downtrend line from the 3.5-year high, the stock is ripe and ready to climb further next.

The Moving Average Convergence Divergence (MACD) has moved back into positive territory while the Relative Strength Index (RSI) has closed above the mid-point, indicating that the upward momentum is slowly picking up.

We think that aggressive traders may want to go long here or on weakness with a stop-loss set at RM1.12 (a tick below the last swing low). On the upside, prices may push on to test the RM1.26 resistance and possibly the 3.5year high at RM1.35 thereafter.

Source: CGS-CIMB Research - 21 Aug 2024

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on CGS-CIMB Research

Created by sectoranalyst | Jan 13, 2025

Created by sectoranalyst | Dec 11, 2024

Created by sectoranalyst | Sep 27, 2024