Some thoughts on Focus Lumber’s soon-to-be released Q2 results

charlie kun

Publish date: Wed, 17 Aug 2016, 10:48 PM

The following post by Shaun Loong on Focus Lumber (FLBHD) caught my attention.

http://klse.i3investor.com/blogs/shaunloong_blog/101529.jsp

Three key points from Shaun:

1. Stock is oversold and at 10-month low

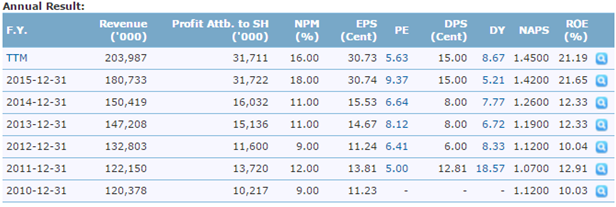

2. FLBHD is significantly undervalued at 5.5x trailing P/E and 2.7x EV/EBIT

3. Fair value RM2.11 – RM2.24

The stock price sank by RM1.37, or 45% from an all-time high of RM3.09 on 11th Jan 2016 to RM1.71 today. The price had discounted a big drop (40%-50%) in earnings for FLBHD this year. Is market overreacting? To answer this question, let’s do a check on the numbers in FY2015 Q2 results for a gauge of FY2016 Q2 results.

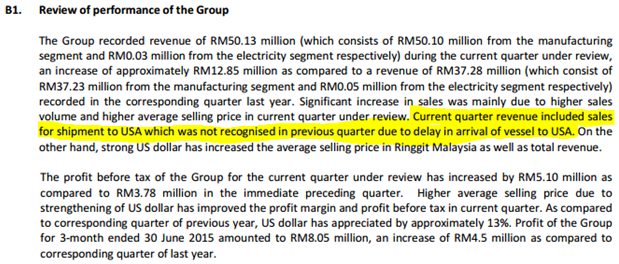

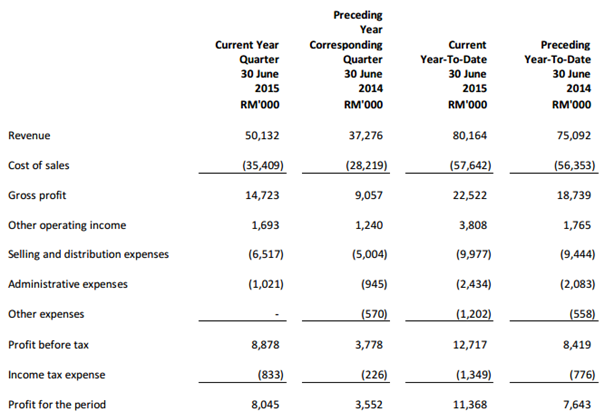

1. Revenue of RM 50.13 million for FY2015 Q2 included sales NOT recognized in FY2015 Q1 due to delay of arrival of vessel to USA (as highlighted above). The sales brought forward to FY2015 Q2 is projected at RM 8 million. Without that one-off sales, the revenue for Q2 is only RM 42 million.

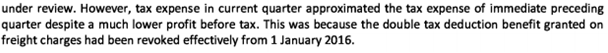

2. Tax rate was 9.38% in FY2015 Q2. Effective 1st January 2016, tax rate of 24% will be applied because the double tax deduction on freight charges had been revoked by the government.

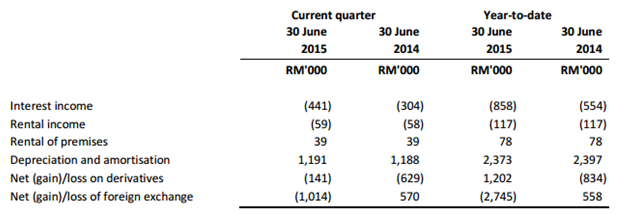

3. Net gain on foreign exchange/derivatives was RM 1.15 million in FY2015 Q2. Any one-off gain should be excluded from the calculation of core profit.

In summary

- Without the one-off sales, the revenue for FY2015 Q2 is only RM 42 million (16% lower than RM 50.13 million).

- Tax rate will increase from 9.38% in FY2015 Q2 to 24% in FY2016.

- Net gain on foreign exchange was RM 1.15 million.

Using the figures above, we can calculate FLBHD’s normalized earnings for FY2015 Q2 for a gauge of FY2016 Q2 results.

- All else being equal, normalized profit before tax was RM 7.46 million or 16% lower than the RM 8.88 million enhanced by one-off sales

- Applying tax rate of 24%, normalized profit after tax was RM 5.67 million or 29% lower than RM 8.05 million

Conclusion

The stock price of FLBHD sank by RM1.36, or 45% from an all-time high of RM3.09 on 11th Jan 2016 to RM1.71 today. Back to my question. Is the market overreacting?

All else being equal, normalized profit after tax for 2016 Q2 is projected at RM 5.67 million or 29% lower. Comparing this to the steep 45% correction of its stock price, it shows the market had over-discounted the stock price of FLBHD by a big margin. What if the actual 2Q results are better than expected? Will the stock price climb above RM3 again?

Investors who trade purely base on the reported figures, without considering one-off sales/gain/loss, will be penalized when they sell in panic. Conversely, smart investors will accumulate more when they are offered great bargains.

Is FLBHD worth investing now that it is oversold? How is its track record of earnings, dividends, ROIC etc? What is the fair value for FLBHD?

“Price is what you pay, value is what you get.”

Update: Focus Lumber's major shareholder Lin Hao Yu started buying more shares this week. Lin was appointed as Executive Director recently. Results announcement is due next week. Good results coming?

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5181405

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

Discussions

if not because of Mr Koon is a big shareholder of FLB, i would've bought.

I dont trust Koon, so I avoid all counters which Koon holds.

2016-08-18 10:31

when Koon tells u to buy means:

1) he has collected a lot already

2) he is ready to sell already

2016-08-18 10:33

dont get me wrong. Koon is a nice guy in person (i have met him and spoken to him once in his talk), but when it comes to stocks, he's not a nice guy.

2016-08-18 10:34

buy now and wait for KYY blog on FLBHD. so far he had left this counter untouch

2016-08-18 15:29

speakup dont get me wrong. Koon is a nice guy in person (i have met him and spoken to him once in his talk), but when it comes to stocks, he's not a nice guy.

18/08/2016 10:34

Couldn't agree MORE about the old con! kekeke

2016-08-19 07:55

Investors certainly overreacted. 2016Q1 profit before tax excluding forex gain/loss increase 84.34%!!

http://klse.i3investor.com/blogs/Goodstocks/101023.jsp

2016-08-19 23:24

PlsGiveBonus

Wait the director finish his stake first.

He is like a machine gun with endless ammo

2016-08-18 00:39