SYF RESOURCES BHD, Transformation from Furniture to Property Development

Citta

Publish date: Fri, 01 Jan 2016, 12:08 AM

| SYF RESOURCES BHD Right management, Right direction and ALL Right! |

Introduction

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

Have you not heard the saying that when others are fearful we should be greedy. Property always pays better margin. Moreover people already fear for so long, isn't it there should be a turn of fend suitable. It is never feel enough to own only one house.

2016-01-01 13:04

Syf is a very small cap company and they just have 2 development projects currently, meanwhile locations are all very strategic, I believe Syf has no problem on this issue. Even few years back, Syf is managed to sold off all their new develop factory units in Sg.lalang semenyih, this is amazing. Btw, Syf has become smart, they pass all their property projects to sub-sales company (Gs Reality) and they have a lot of agents around selangor/klang valley. If you are still lack of confident, i suggest u should come to sg.long for a visit.

2016-01-02 11:49

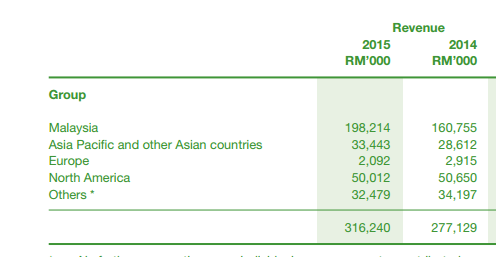

for furniture sales, they were doing good in US market where goods shipped from their Klang factory..95% products from tis factory shipped to US and recent 1 year each month capacities were fully occupied due to good recovery of US economies..

2016-01-04 11:32

Hopefully this could sustain in 2016, but logical thinking U.S interest rate hike, this could reduce their purchasing power and expenditure on goods. Btw, SYF's managements did mentioned that they will adjust the prices, so we could not expect much on this. But I got 100% faith on development segment.

2016-01-04 23:28

apini

Well done

Your patience had rewarded you 63% gain

Hope you will gain another 37 to make it 100%

Hahaha..

Happy new year

2016-01-01 12:53