A sweet deal for Scoop Capital in the Apollo Food buy

zaclim

Publish date: Thu, 21 Dec 2023, 09:45 AM

Shares in Apollo Food Holdings Bhd skyrocketed to a seven-year high of RM5.78 on Dec 19 following news that Scoop Capital Sdn Bhd, is acquiring a controlling stake in the company. It was indeed a sweet treat to investors who bought shares in Apollo Food when it was trading at a 52-week low of RM3.61.

The counter has surged 59.1% in the past year. At RM5.76, its market capitalisation stood at RM460.8 million.

On Dec 18, Scoop Capital, which is the franchisee of Baskin-Robbins, said it is buying a controlling 51.31% stake in Apollo for RM238.1 million cash. Scoop Capital is purchasing the 41.05 million Apollo shares from Keynote Capital Sdn Bhd at RM5.80 each, translating to a 7.4% premium to the last closing price of RM5.40.

Keynote Capital is the investment vehicle of Singaporeans Liang Chiang Heng and his younger brother Liang Kim Poh. Chiang Heng, 73, is currently Apollo’s executive chairman, while Kim Poh, 62, is the group's managing director.

Scoop Capital is obliged to extend an unconditional mandatory takeover offer to acquire all the remaining 48.49% stake in the group, but it intends to maintain the listing status of Apollo on the Main Market of Bursa Malaysia. Scoop Capital is 90%-owned by Datuk Cheah See Yeong, with the remaining 10% owned by his wife Datin Soon Gock Lan.

This is a nice ‘scoop’ for Cheah as Apollo is viewed as undervalued given that it has no borrowing and sits on more than RM130 million cash and deposits while paying decent dividends annually. Apollo makes compound chocolates, chocolate confectionery products and layer cakes under its own “Apollo” brand for both the local and overseas markets.

This deal is indeed a sweet one for Scoop Capital which will be able to boost Apollo’s revenue and net profit. As it is, Apollo has fared pretty well in terms of financial results.

Its net profit rose 5.15% to RM10 million for the 2Q ended Oct 31, 2023 from RM9.5 million a year earlier despite registering a 6.13% drop in revenue to RM66 million from RM70 million. The company saw lower export sales but investors should be relieved that it managed to record higher gross profit margin.

For the six months just ended, its net profit rose 25.4% to RM17.6 million from RM14 million a year ago while revenue fell marginally to RM124.3 million from RM125.8 million.

A change in ownership may be just what Apollo needs given that Chiang Heng and his brother might want to ‘retire’ comfortably after being with Apollo since 1979. Certainly, it is too early to tell if Cheah can do a better job in taking Apollo to the next level but investors are hopeful he can inject something exciting into the company.

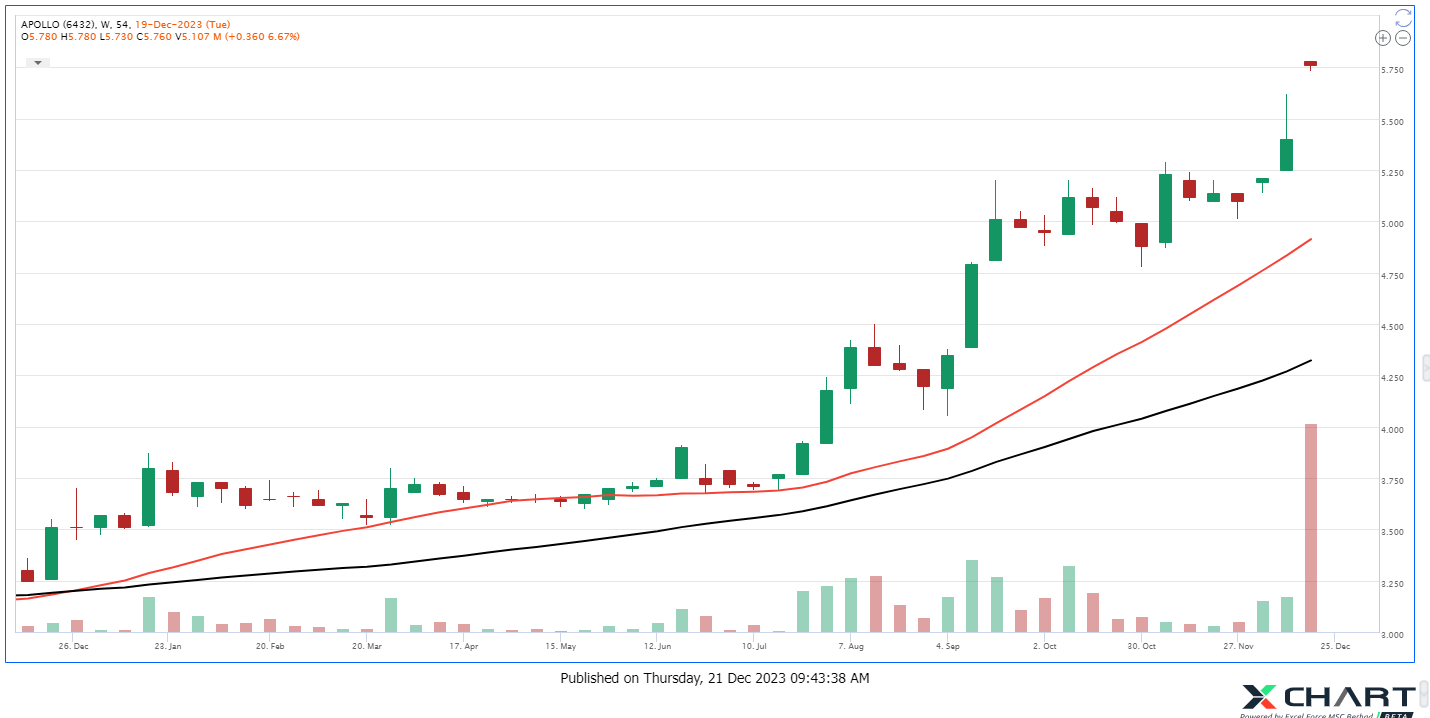

Based on Weekly Chart:

1. Apollo is riding in the strong uptrend with several pullback

2. However price currently is far from 20MA and climatic volume appeared at the top

3. This might indicates another round of pullback or sideway is likely to happen soon

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Aug 22, 2024

AEON Co. (M) Bhd is experiencing significant growth, with its stock hitting a 52-week high of RM1.54 on August 21, a 30% surge year-to-date. Can it continue to draw investors’ interest?

Created by zaclim | Aug 21, 2024

Capital A Bhd may be racing against time to get itself out of the PN17 status but its share price has been moving upwards. Can it maintain its positive run?

Created by zaclim | Aug 20, 2024

PBA has been making a big splash following the revisions on water tariff. This goes to enhance it bottomline and provide a catalyst for investors looking for exposure in this segment.

Created by zaclim | Aug 19, 2024

Vestland Bhd has been building a strong momentum after it dipped to its low of 30 sen in January. Can it continue to make a good run?

Created by zaclim | Aug 16, 2024

Investors should be happy that pole maker Mestron Holdings Bhds seeing a strong rise in its share price in the past 5 days, igniting hopes of sustained upward momentum

Created by zaclim | Aug 15, 2024

AMMB Holdings Bhd has seen its share price tumbled sharply to RM4.22 after hitting a high of RM4.58 in August 1. Signs indicate more upside ahead.

Created by zaclim | Aug 14, 2024

Mikro MSC is adding another company in its portfolio and this would provide a much needed boost to its financials. The counter is already on upward momentum and signals are clear for further upside

Created by zaclim | Aug 13, 2024

After some disappointing share price performance in the past year, Catcha Digital Bhd is playing catch up, crossing the 41 sen resistance mark. Signs are that there is more upside.

Created by zaclim | Aug 12, 2024

RCE Capital Bhd has been increasing to close at RM3.20 on Aug 9. It rose to a high of RM3.40 in January from a low of RM2.21. The counter could move upwards following a consolidation phase.

Created by zaclim | Aug 12, 2024

Shin Yang Group Bhd has been treading at its year high of 98 sen recently and signs indicate it could cross the RM1 hurdle. With business diversification, the upside looks good

.png)