Kobay saw poorer 3QFY24 results but saw positive share price momentum

zaclim

Publish date: Thu, 11 Jul 2024, 08:50 AM

Kobay Technology Bhd has started to go on the uptrend again. The counter recently gained 17 sen to close at RM2.35 on July 5. It broke above its key level at RM2.34 and the stock is expected to challenge its resistance at RM2.58.

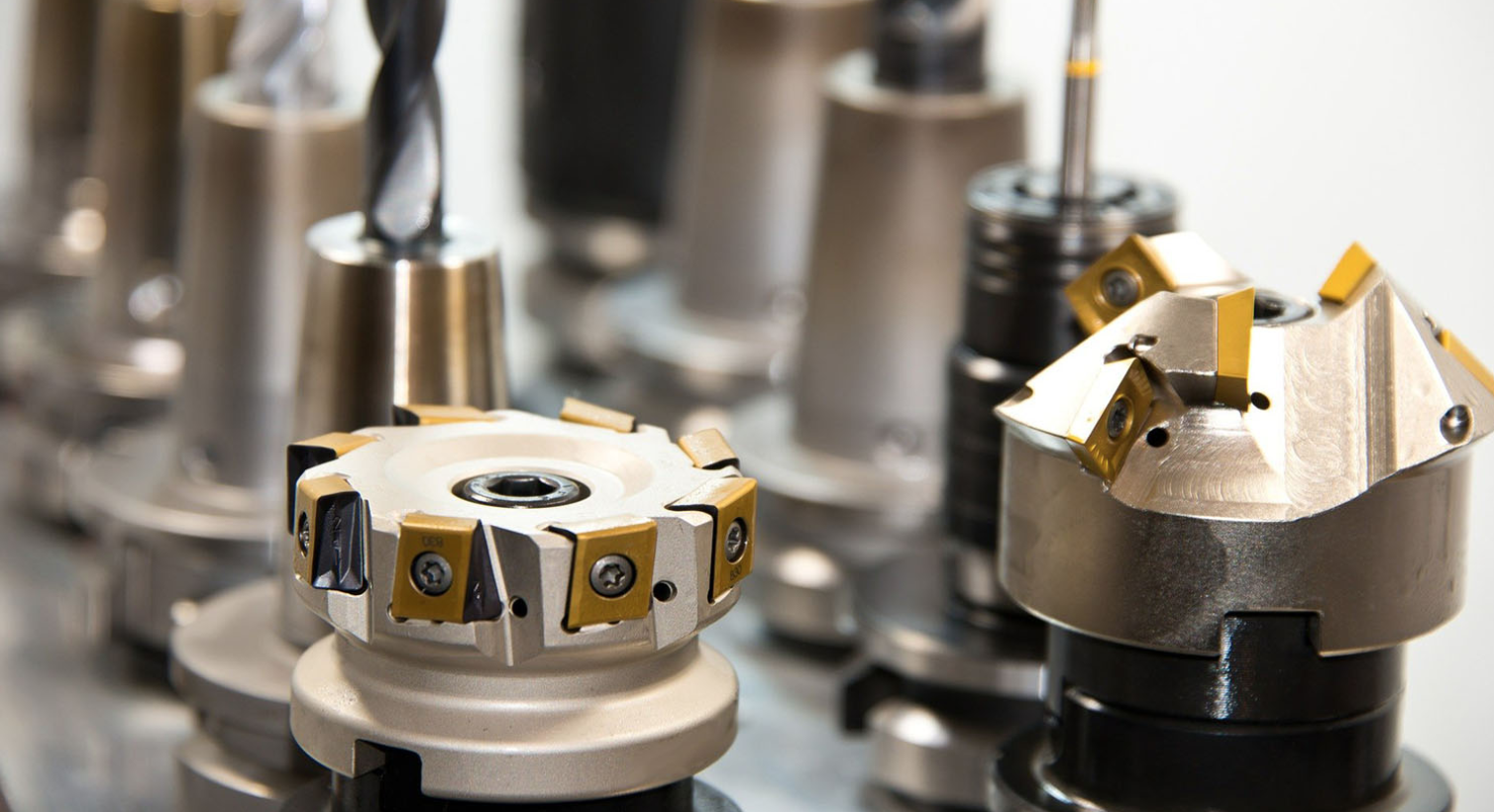

Kobay plunged to a year low of RM1.01 in February after announcing disappointing 2Q results. The manufacturer of precision parts saw its net profit plunged 66% in the second quarter from a year earlier due to a shift towards lower margin sales, subdued demand, and elevated setup costs.

Net profit for the three months ended Dec 31 was RM3.07 million, compared with RM9.03 million a year ago. Revenue for the quarter slipped 6% year-on-year to RM77.25 million from RM82.15 million. But the company is not worried.

For its mainstay manufacturing segment, Kobay said the slowly rebounding momentum will lead to higher sales compared with the previous financial year. The division will strategically broaden its client portfolio by entering the renewable energy sector.

Kobay said it has a positive view of its property business amid rising tourist arrivals but flagged escalating expenses of building materials and the surge in borrowing costs. As such the company said it will judiciously time new product launches in accordance with prevailing market dynamics.

On its pharmaceutical business, the company said it is also concerned about rising raw material costs and a surge in borrowing expenses. However, the company still has a positive outlook on the business amid strong demand for healthcare and wellness products.

Probably its positive outlook was enough to push the counter to surged to its 52-week high in May to touch RM2.58. Since then, the counter succumbed to profit taking activities. Even then, it is holding up commendably, closing at RM2.33 on July 10.

Investors appear to still be positive on the company despite it posting a 30.77% decline in net profit for the third quarter ended March 31, 2024 to RM5.48 million, from RM7.92 million a year earlier. Its results were dragged by lower contributions from property development after completing a project in Langkawi.

It was also posted a 19.23% decline in revenue to RM87.79 million from RM73.63 million previously. For 9MFY2024, net profit more than halved to RM10.08 million from RM27.47 million a year earlier. Revenue for 9MFY2024 slipped by 3% to RM237.80 million, compared with RM245.22 million a year earlier.

Kobay said it is planning to expand its clients portfolio for its manufacturing business by entering into original equipment manufacturing (OEM) and high-level assembly services. It also expects a recovery in the manufacturing sector in the second half of this year.

Perhaps the counter will continue to trend higher not only due to encouraging technical indicators but also anticipation of better outlook for the company.

More articles on The Daily Pulse of Bursa Malaysia

Created by zaclim | Jul 16, 2024

Unisem (M) Bhd is slowly but surely regaining its lustre. All things are moving towards better days for the manufacturer of semiconductor devices.

Created by zaclim | Jul 15, 2024

Texcycle has been on the upcycle in terms of share price, touching a record high of RM1.49. It has lost some ground since its high but the counter is trending out recently.

Created by zaclim | Jul 15, 2024

Electronic manufacturing services provider ATA IMS Bhd has been trading higher in the last couple of weeks and looks to be able to sustain its upward momentum. Is it still time for investors to enter?

Created by zaclim | Jul 09, 2024

The company recently ventured into the manufacturing of power cables and wires following a takeover exercise of Central Cables Bhd.

Created by zaclim | Jul 09, 2024

OCK Group Bhd continued its upward momentum on anticipation of a record breaking year in terms of earnings. Can the good run be sustained?

Created by zaclim | Jul 09, 2024

Backed by promising growth in the air travel sector as demand for air travel continues to surge and airlines are expanding their routes and capacity.

Created by zaclim | Jul 04, 2024

Velesto Energy Bhd saw better results in FY23 but it has not budged that much. Is it time to let go?

Created by zaclim | Jul 01, 2024

Sunview Group Bhd has been moving uptrend in recent month, having surged about 15% to close at 74 sen on June 28. How much room can it manoeurve upwards?

Created by zaclim | Jun 28, 2024

Ancom Nylex Bhd is on the uptrend as it is expected to benefit from a slew of positive developments. This will probably help propel the counter to continued uptrend.