Sunway Bhd (5211) – Healthcare re-rating [$$bill]

dollardollarbill

Publish date: Thu, 03 Sep 2020, 09:37 PM

Sunway Bhd (5211) – Healthcare re-rating

Sunway could see some upside if research houses start raising the valuation of its healthcare business.

Bloomberg reported today that Sunway is looking to sell a 20-25% stake in its healthcare unit that could fetch at least USD250 mil.

That means:

If a 20% stake is worth USD250 mil, 100% stake is worth USD1.25 bil.

If a 25% stake is worth USD250 mil, 100% stake is worth USD1 bil.

USD1 bil is about RM4.15 bil.

That is much higher than the valuations given by some research houses, such as:

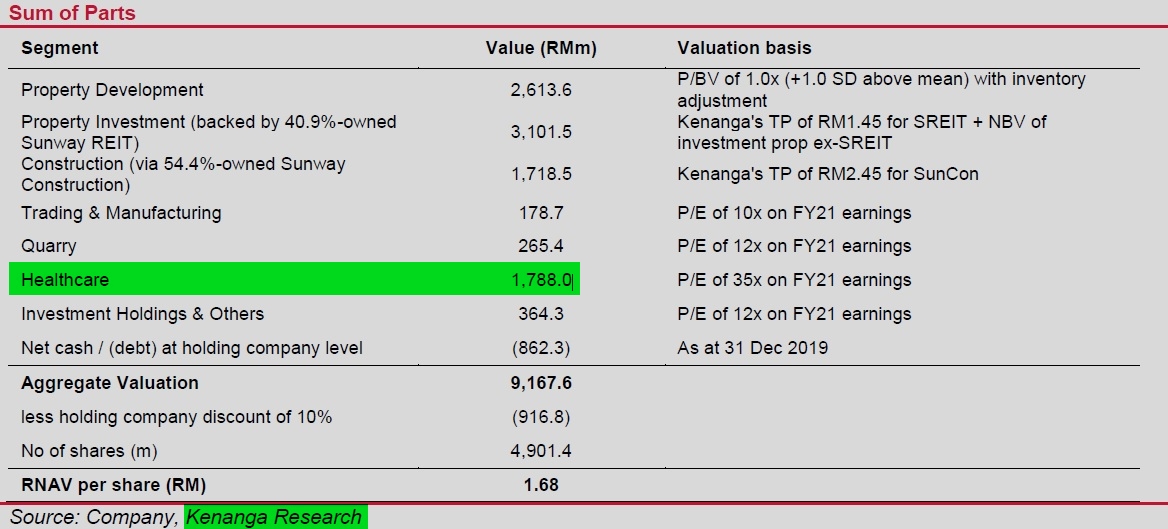

Kenanga IB: RM1,788 mil

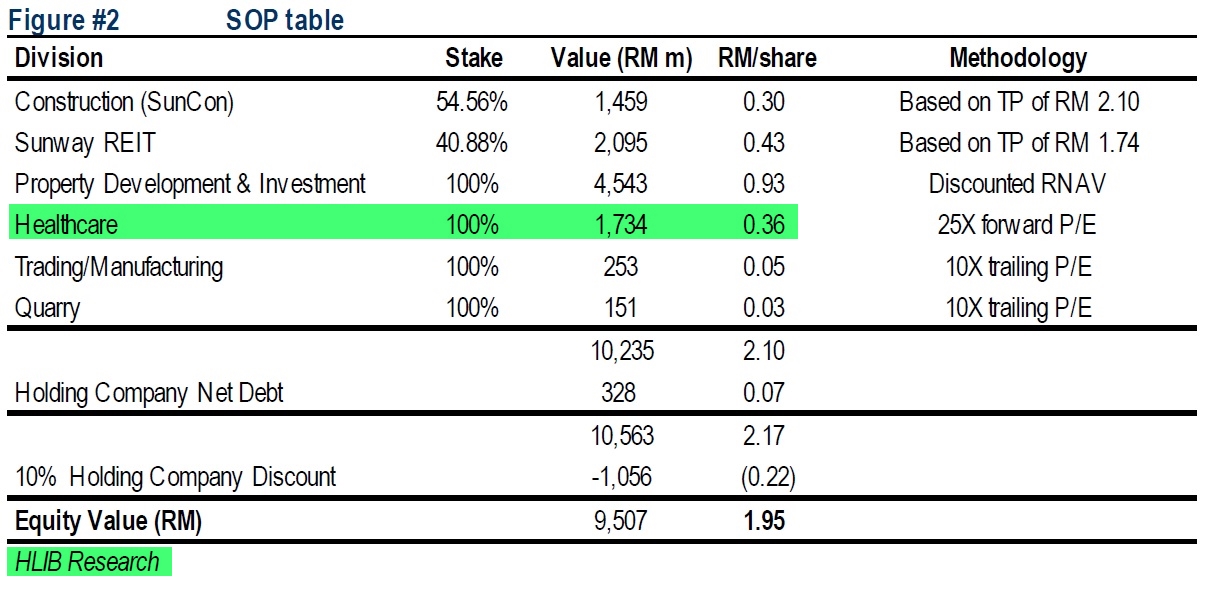

Hong Leong IB: RM1,734 mil

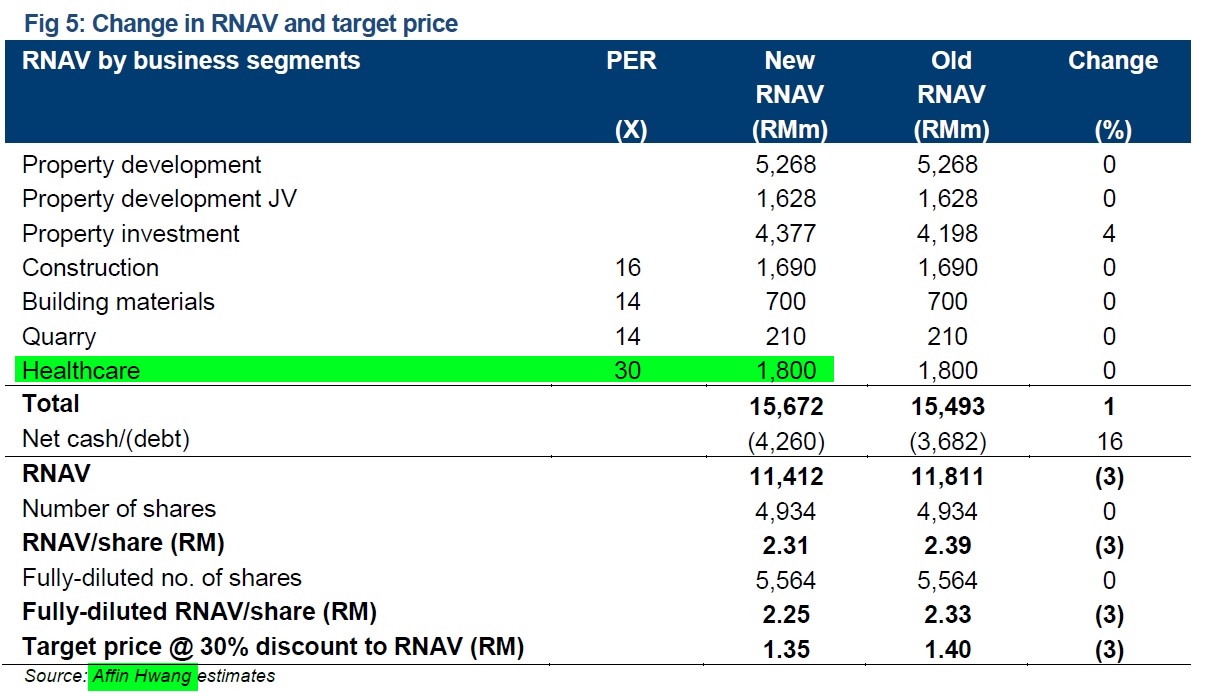

Affin Hwang IB: RM1,800 mil

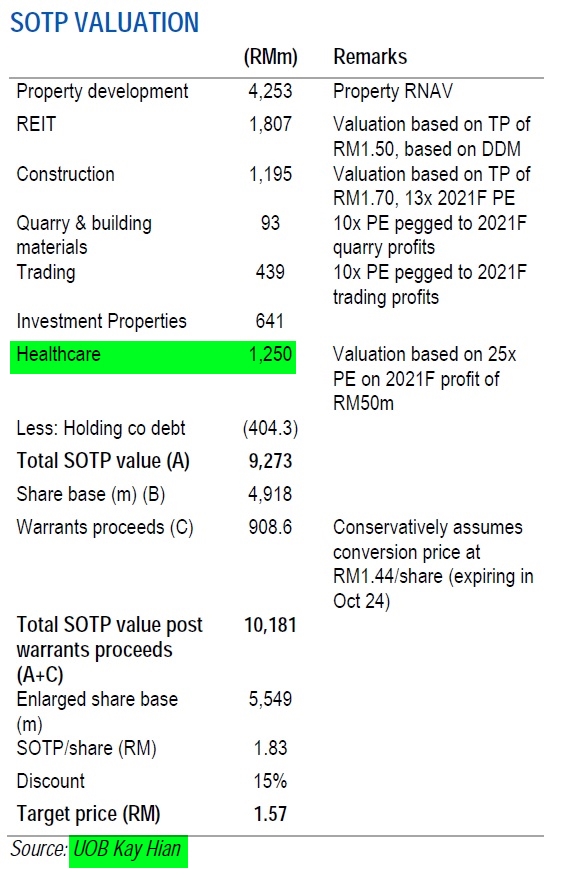

UOB Kay Hian: RM1,250 mil

(See pics at bottom)

Among the four above, Affin Hwang gave the highest valuation of RM1.8 bil.

However, using that USD1 bil (RM4.15 bil) valuation, that’s still a surplus of RM2.35 bil or 42 sen per share (based on fully diluted no. of shares).

42 sen is equivalent to 30% of Sunway’s share price of RM1.40.

The research houses are valuing using the price-to-earnings method. If valued based on the number of hospital beds, Sunway’s heathcare business should fetch a higher valuation (read: https://www.theedgemarkets.com/article/unlocking-value-healthcare-business)

From research reports dated 26 Aug 2020:

Join my Telegram channel for random updates @worthystocks

Disclaimer: All information here reflects the author’s personal views/thoughts and should not be considered as investment advice. It is very important to do your own analysis before making any investment based on your own personal circumstances. No content here constitutes - or should be understood as constituting - a recommendation to enter in any securities transactions.

#SUNWAY

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-08

SUNWAY2024-11-08

SUNWAY2024-11-08

SUNWAY2024-11-07

SUNWAY2024-11-07

SUNWAY2024-11-07

SUNWAY2024-11-06

SUNWAY2024-11-06

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-05

SUNWAY2024-11-04

SUNWAY2024-11-04

SUNWAY2024-11-04

SUNWAY2024-11-01

SUNWAY2024-10-30

SUNWAY2024-10-30

SUNWAY2024-10-29

SUNWAYMore articles on Worthy Stocks

Created by dollardollarbill | Oct 16, 2024

Created by dollardollarbill | Nov 30, 2023

Created by dollardollarbill | Apr 11, 2023