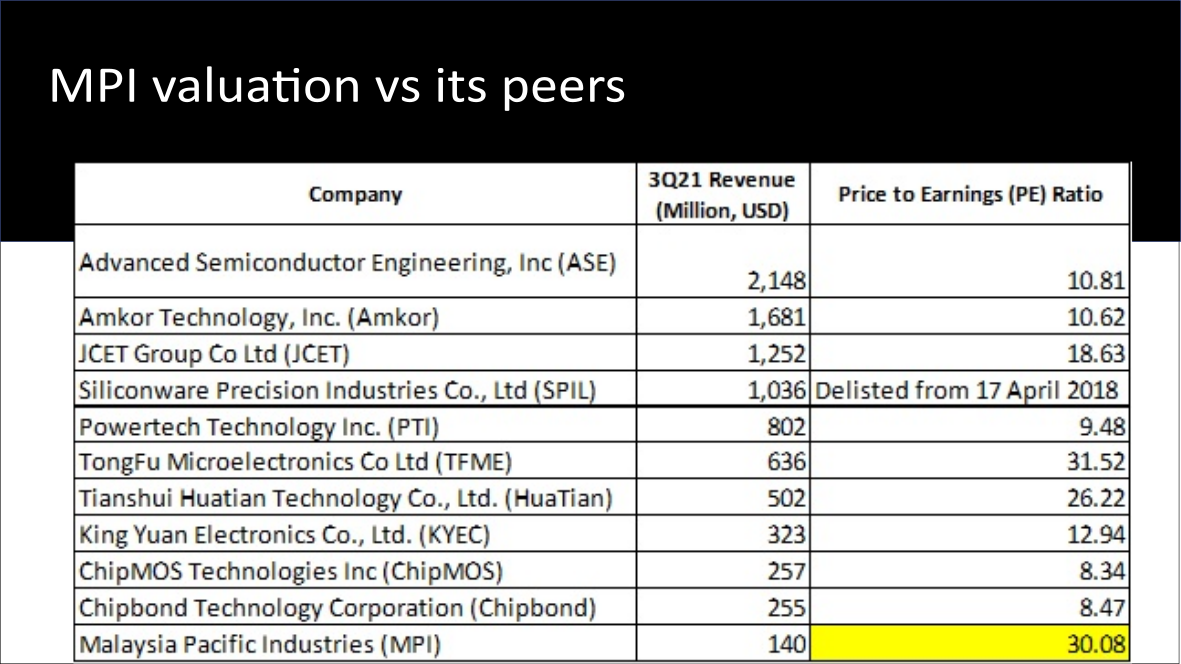

Malaysia Pacific Industries (MPI) valuation vs its peers

DonkeyStock

Publish date: Fri, 14 Jan 2022, 03:57 PM

Tech stocks are experiencing bloodshed this week. In the US market, loss-making growth stock and stock with negative operating cash flow are the top losers.

In Malaysia, players in the semiconductor supply chain are the top losers. Just a quick comparison between our 2021 top performer, Malaysia Pacific Industries (MPI), and its peers, you will know their current valuation is absurd.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.

Discussions

2000 y2k a lot of rich waterfish bought at RM80+

2021 a lot of rich waterfish bought at RM40+

2022-01-14 16:22

Buy glove at peak during 2020 may have to wait for 100 years to escape

Buy tech at peak during 2021 may have to wait for 10 years to escape

MPI was ard RM80 in 2000

Ops even after 20 years also cannot recover

2022-01-14 17:27

https://klse.i3investor.com/blogs/AmInvestResearch/2021-11-29-story-h1594704443-Malaysian_Pacific_Industries_Bright_prospects_ahead.jsp

After last few days drop of about 20%, PE becomes 27.

Are they doing the same even though they are OSAT. MPI focused more on automotive EV, and 5G. Now still facing shortages esp automotive parts.

I am looking to buy cheap MPI back this round of selling. I have some MPI but taken profit end of 2021.

Extract from Ambank Report

We raise our FY22, FY23 and FY24 core profit forecasts by 20%, 34% and 32% to RM366.6mil, RM459.6mil and RM509.0mil respectively. This is to account for brighter automotive and industrial outlook, which is poised to benefit MPI due to its strategic position underpinned by its power products investments, such as silicon carbide (SiC) and gallium nitride (GaN).

End-user segment update: MPI’s revenue growth largely came from the automotive and industrial segments, which expanded 15% and 12% QoQ respectively, contributing 37% and 31% of its revenue. The consumer & communication segment’s growth remained flattish, while growth for the PC & notebook segment declined 5% QoQ.

Capital expansion progress: MPI continues to invest in identified technology drivers for growth such as 5G, SiC, GaN, electrification, sensors and safety for the automotive sector. In Sep 2021, the group completed its 2nd phase of level 2 expansion for Carsem Suzhou, adding 4,400 sq metres to the plant. The group is also scouting for new land in China, with aim of setting up another facility to cater for growth in SiC-related products.

2022-01-14 17:46

Comparing Intel's PE Of 10 with NVIDIA's PE 80+ of may not be appropriate....

Likewise, compare Alibaba and Amazon may not be apple to apple comparison as well even there are e-commerce giant...

Anyway i am not expert in tech and hope to find out more...

2022-01-14 17:55

Semicon parts for EV should have very long growth going forward, at least next 10 years while semicon for PC may flat or drop marginally...

MPI’s venture into silicon carbide (SiC) power modules in 2020 offers promising prospects given the increasing popularity among electric vehicle (EV) manufacturers.

Silicon Carbide (SiC) is an innovative technology that will replace silicon in many applications. The idea of using SiC for electric vehicles (EVs) was born when efforts were made to increase the efficiency and range of such vehicles, while reducing the weight and cost of the entire vehicle and thus increasing the power density of control electronics.

Power electronics for EVs can effectively be enhanced with Silicon carbide solutions that meet design parameters and make an essential contribution to system performance and long-term reliability.

2022-01-14 18:28

Goreng so-called high tech stocks which are very overvalued with PE over 50, better avoid at all costs

Greatec

UMC

Penta

Unisem

Vitrox

KESM

Kobay

Genetec

and many others

As for MPI... under my watch list, haha..

2022-01-14 18:46

Above is a not-so-good comparison.

Below is PE for Msia tech stocks as reference only but also not a good comparison as difference companies have difference product mix, expansion plans, clients etc.

Msia Osat players namely MPI, Inari and Unisem all have difference product mix, growth rate, mkt segment etc, eg Unisem net profit is not growing qoq and yoy whereas MPI and Inari has good growth qoq and yoy.

PE as of 14 Jan 2022 price

Inari : PE 34.07

MPI : PE 27.23

Unisem : PE 24.36

Vitrox : PE 51.65

Greatech : PE 44.54

D&O : PE 56.90

KESM : PE 36.27

UWC : PE 59.83

Which one cheaper, which one expensive?

2022-01-15 09:37

This is a major correction not game over for tech. Unlike glove which thrives during covid only

Technology affects almost every aspect of 21st century life, from transport efficiency and safety, to access to food and healthcare, socialization and productivity. Pick a good tech stock to buy during this correction.

https://www.youtube.com/watch?v=Iifz7upRoRQ

科技股为何大跌?是"调整"还是"完蛋"了?(Part.1/2)

2022-01-15 09:48

Donkeystock did a research in semiconductor industry. He has more information on his hands. Hope he would share more with us about benchmarking against global players within the industry.

2022-01-15 10:48

Investment Guru already mentioned major correction ahead for Bursa Tech Sector

2022-01-17 08:23

No worries, choose companies with strong fundamental and it will bounce back, the money is in the waiting..hahaha

2022-01-19 12:40

firehawk

too few semiconductor counters for investors .... push to too high valuation, buyers are exposed to high risk .....

2022-01-14 16:20