Malaysia's real estate market is going to recover very soon, 6 months after the recovery of banking stock

The share price of Malaysian banks is charting a new high almost every month since Oct 2021.

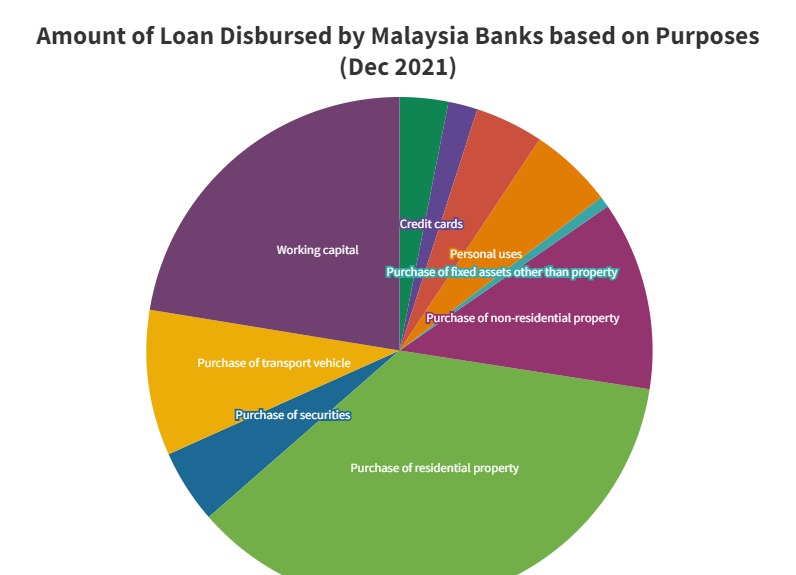

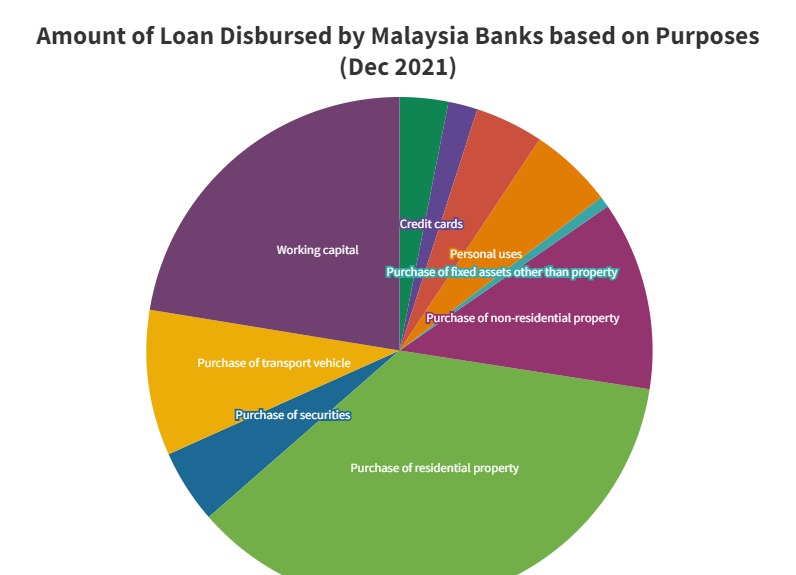

In Malaysia's banking system, more than half of the loan is disbursed for the purposes of purchasing a property. Here's a chart showing the total loan disbursed by Malaysian banks. Property loans made up of approx half of their loans disbursed, followed by working capital loans.

You can say Malaysian banks rely on property loans to earn their profit. If the market is expecting a better financial result delivered by banks, it also means the demand for property loans is expected to grow and the non-performing loan of arises from the property segment is going to decrease.

These can only lead to a conclusion, Malaysia's real estate market is going to recover very soon. Usually, there are 6 months lagging effect between the recovery of banking stock and the real estate market. Hence, we might see a property market rebound soonest by Mar 2022.

To check out the price index of Malaysia property, check out the tools here: Malaysia Property Price Index

To check out how the loan disbursed by the Malaysia banking system changed over the last 15 years, check out the tools here: Malaysia Loan Disbursed

Source: iSquare Intelligence