EPF Crisis

DonkeyStock

Publish date: Mon, 09 May 2022, 03:32 PM

\

\

The RM 10k withdrawal from our EPF accounts has boosted the economy. My friends who are in the retail industry, both online and offline channels, experienced a surge in sales. I believe a lot of the withdrawal is spent on shopping instead of spending it on daily necessities.

Over the decades, there are always rumors about EPF bankruptcy. When the 1MDB issue is in the limelight, the members are worried about their money being used to save the company and lead to EPF's bankruptcy. When the EPF office in Petaling Jaya caught fire, the members are worried about their EPF savings being burnt to ashes. Whenever I received questions from my friends and family regarding the financial status of EPF, I will always give them this answer: EPF is safe, our population is still growing and more and more people will be entering the workforce.

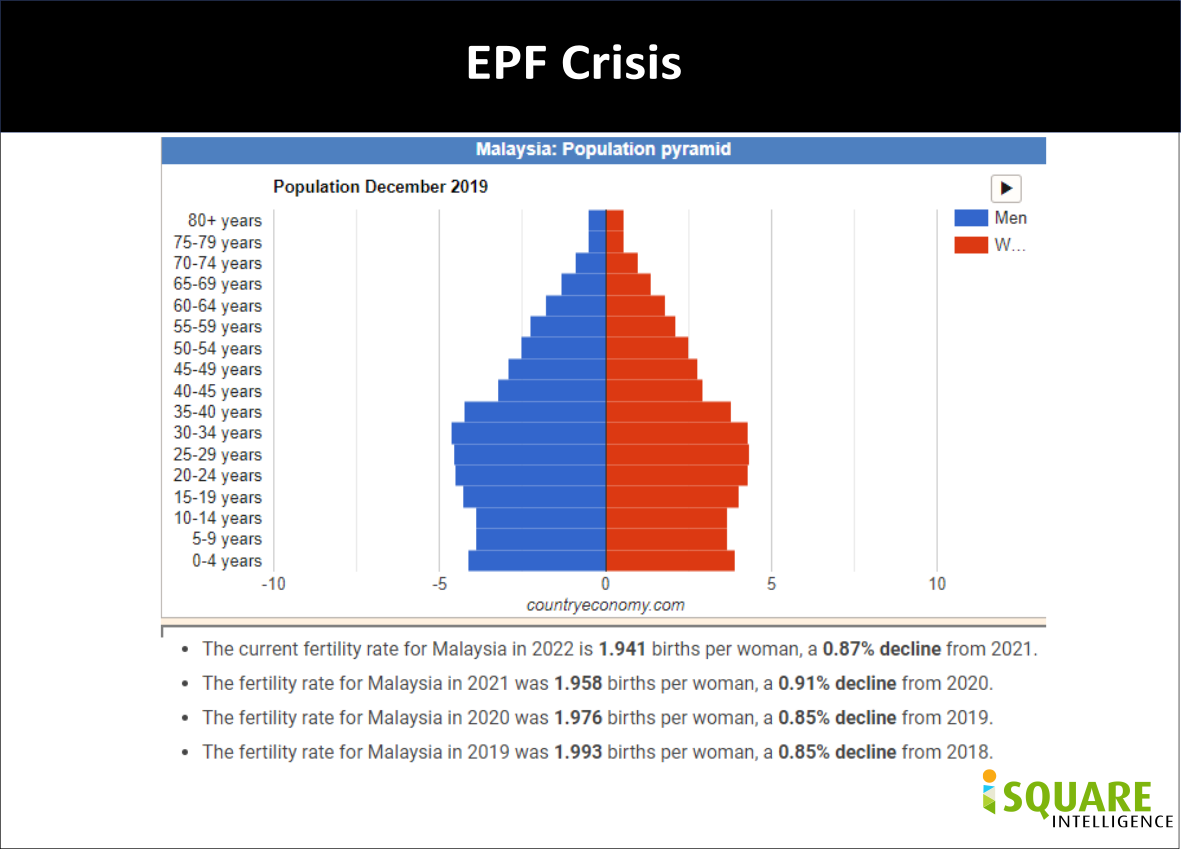

However, things had changed. Our Total Fertility Rate (the total number of children that would be born to each woman) has fallen to 1.94, which is lower than the replacement rate of 2.1. (On average, women give birth to 2.1 children and these children survive to the age of 15, any given woman will have replaced herself and her partner upon death. A TFR of 2.1 is known as the replacement rate.)

In fact, the statement of a growing workforce is going to change as well. Here's the population pyramid of Malaysia. The population of kids is now lesser than the number of working adults.

In short, EPF is going to deal with its own “crisis” once the demographic dividend disappears after the middle of the next decade when the monthly withdrawals are going to be larger than the money going into the EPF due to our aging society. Once the outflow is larger than the inflow, EPF has to sell off its assets from the capital market and this could be huge selling pressure on all of Malaysia's financial assets.

We cannot avoid the day but we should not be accelerating that process.

Source: iSquare

More articles on Stock Infographics

Created by DonkeyStock | Dec 05, 2024

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.

Discussions

Capital market includes both equity and bond market, in case you dont know what it means

2022-05-09 18:32

regret i didn't draw my part.

next year's dividend sure low while i have to contribute the portion which i would be getting to those who draw theirs.

2022-05-10 10:13

Don't forget the huge foreign immigrant workers don't contribute to EPF. Big amount of money repatriate out of Malaysia every month by the foreign workers.

EPF experience CASH FLOW problem and could gets worse a few years down the road

:(

2022-05-10 15:27

Maybe forcing foreign immigrant worker to contribute to a savings fund could works, thats really a huge leaking hole for Ringgit

2022-05-10 16:15

I don't know why our government don't make it mandatory for foreign workers to contribute to EPF! It benefit us tremendously! This will stop outflow of foreign workers salary back to their countries! And EPF can invest further! And also stop foreign workers from constantly changing their identity! Yes, foreign workers can easily change their identity if you don't know about this!

2022-05-10 18:03

@Tobby

Foreign worker's EPF contribution is negligible amount. Foreign workers sending money back home is in billions of ringgit each month. I don't know how many of them are here but not less than three(3) million ( source various news reports).

If all of them send back assuming RM500, outflow is RM1.5 Billion (conservative amount) per month.

Foreign workers tracking is easy but enforcements are doing a intentional sloppy work for reasons whihc you can predict well.

2022-05-10 18:56

I say stop taking foreign workers and employ locals. Money stays and circulate within country.

2022-05-10 18:57

Government should stop all freebies and free money. Shutdown welfare ministry.

2022-05-10 18:58

" Posted by OnTime > 35 minutes ago | Report Abuse

locals demand rm3k minimum pay. Can afford?"

========================

If employers cannot afford, shutdown the business and put their money under the pillow.

2022-05-10 19:54

@OnTime, the demand of rm3k minimum pay by locals can only granted if local employees can double their productivity? Can local employees afford?????? Perhaps foreign workers can....because they dont have ibu sakit lah, anak sakit lah, bapa mati, uncle mati, isteri beranak, anak sekolah, etc etc, etc. Now you know why Employers prefer to hire foreign banglas, burmese, etc.

2022-05-11 08:16

Greedy pigs as employers, of course, will use age old excuses to support their need for slave foreign workers. Hope they get Topglove Bangla workers who exposes them until cannot get up. The only reason they like foreign workers is they can treat them like slaves for pittance.

Malay politicians are highly corrupted and sttuupid for they cannot realise how the employers are banging their rear end at the expense of own citizen and well being.

2022-05-11 10:04

public sectors also must be EPF deducted like migrants to be fair to all. not billions pension balloon waiting to explode one day

2022-05-11 10:13

As i say earlier....those low income holding small amount in EPF like say Rm 30k & below...it is better to allow them withdraw & try their luck in cash small business, grabs, panda, shopee, lazada, lalamoves etc.

They just have to invest in vehicles & handphones and they can earn more than Rm 4k a month mah!

2022-05-11 10:22

nothing to do with income level why many including Malay opt. to withdraw earlier... low confidence, low trust on taliban gomen ...many buy gold from myr10K... MYR BOR YOR KIU

2022-05-11 12:55

last few byelection won by DUMNO does not translate real support. its protest vote, Putus Harapan vote on Pakatun....

2022-05-11 13:07

MuttsInvestor

EFP ...Only Invest in Equities, Funds, etc ? ... ZERO holdings in Govn Bonds and Treasuries ??? Telling .. " Half Truths " ... Donkey Stock !!! Even with Declining Birth Rates ... NOW HAPPENING to ALL COUNTRIES in the WORLD ( Except POOR nations ) ..... So what is it an ISSUE to Malaysia ONLY ? Imagine Thailand HAS NO "EPF"... Neither has Indonesia . This 2 nations combined population is 360 + 80 = 440 Million. Compared to Malaysia of 35 million only. Which country will have serious Hardship if Recession Hit World economy ?

2022-05-09 16:42