What's next for Stablecoin

DonkeyStock

Publish date: Fri, 13 May 2022, 05:38 PM

Is Tether next?

I don’t think so. My friends who are involved in providing fiat to USDT service or vice versa still accept USDT at no discount. Even when USDT started to unpeg yesterday, they still honor the 1:1 ratio.

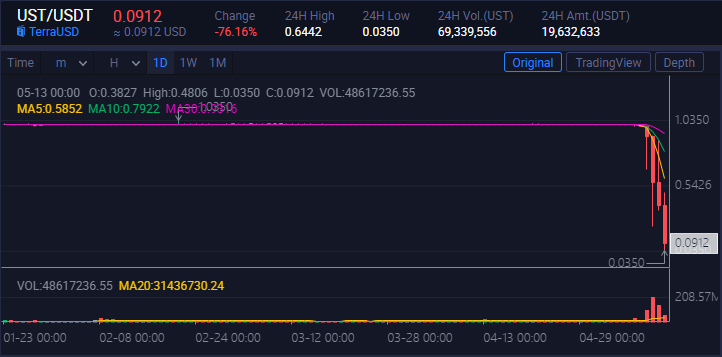

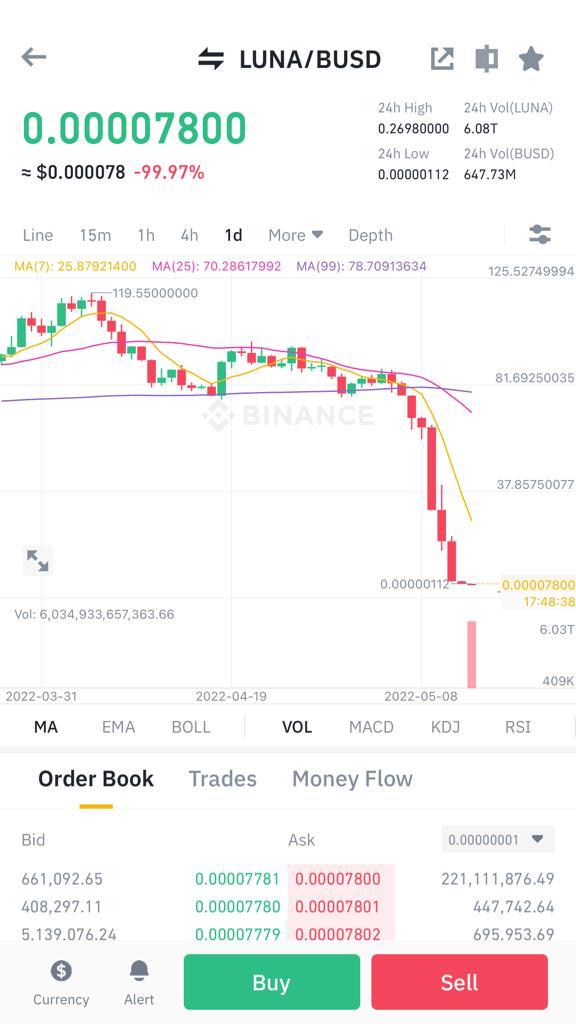

The good thing is that, unlike Luna/UST, the outcome is not binary. Tether is a money market fund that holds real assets — we just don’t know how much. USDT is backed by cash and cash equivalents and digital tokens. However, the price of digital tokens and bonds has plunged so much. This is certainly a concern.

But if USDT were to break peg, there’s a good chance someone with more detailed information on Tether’s accounts would be willing to pay. For example, if USDT falls to 90 cents for 1 USDT, knowing they’d get back 95 cents or thereabouts in a few weeks, the buying support will be extremely strong.

Disclaimer: I do not hold any USDT anymore when I am writing this article.

On the other hand, the risk/reward of holding Tether at the last price of $0.993 — 0.7% upside vs. unknown downside is bad.

Other Risks I am seeing:

1) Speculation has been swirling around what level of bitcoin would trigger margin calls at MicroStrategy. When that happens, Bitcoin will plunge and it would trigger the reserve of USDT.

2) More lasting risk is that bitcoin is rapidly losing any claim of being a hedge against inflation.

Blockchain is here to stay, but many coins with artificially inflated price are going to fall to their true value.

Source: iSquare

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.