Commodity Boom is over?

DonkeyStock

Publish date: Thu, 19 May 2022, 04:02 PM

Inflation surged when the Ukraine-Russia conflict started in February this year. Commodities prices such as aluminum, wheat, and oil had increased by more than 50% since then.

The most recent surge in commodities prices is wheat, which has seen its price increase sharply in the wake of India’s decision to restrict exports

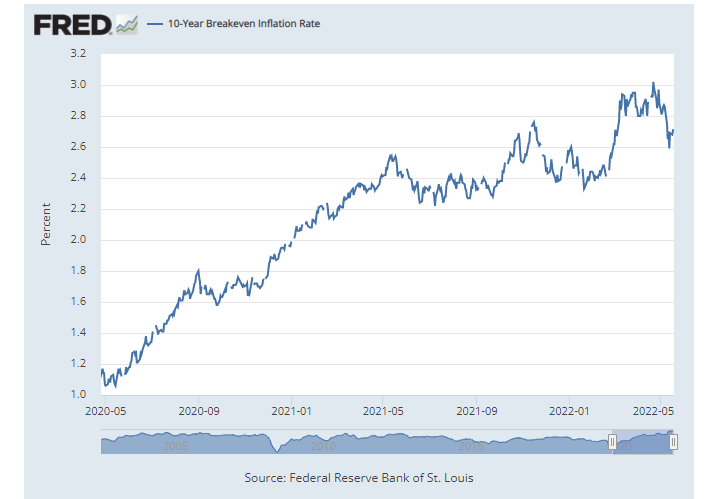

Strange as it may seem though, inflation expectations in the US bond market are subsiding despite the recent resurgence in wheat, crude oil, and the commodity complex in general.

Source: iSquare

The breakeven inflation rate represents a measure of expected inflation derived from 10-Year Treasury Constant Maturity Securities and 10-Year Treasury Inflation-Indexed Constant Maturity Securities. The value implies what market participants expect inflation to be in the next 10 years, on average.

That actually aligns pretty well with the perception that the risk of recession is increasing. At some point, supply-shock-driven inflation is likely to bring about its own demise via demand destruction, and bond investors look to be signaling we are getting close to a tipping point for broad price gains even if wheat and crude stay elevated.

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.