Another depeg in the crypto industry

DonkeyStock

Publish date: Mon, 13 Jun 2022, 03:39 PM

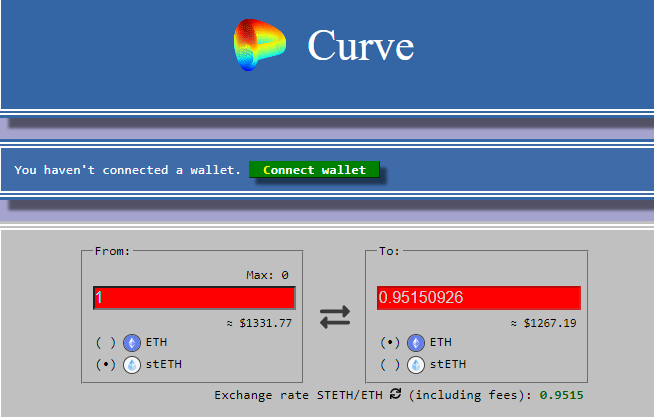

The crypto market has been shocked by another depeg. Staked Ethereum (stETH), a staked, DeFi variant of Ethereum, has diverged sharply from the latter in the past 48 hours.

The token, which is supposed to trade at a 1:1 peg to ETH, is currently trading at discount to ETH. stETH has been depegging since late Thursday, with the first wave of losses stemming from a massive $1.5 billion dump by Alameda Capital– one of the largest holders of stETH. Alameda sold all of its holdings of the token.

stETH does not have a direct link to ETH prices. It can be redeemed for ETH only after the merge becomes effective- the date of which is currently unknown. Although there is no direct link between these two tokens, stETH main role as collateral on DeFi platforms such as AAVE and Lido could have dire implications for DeFi. Sharp losses in stETH are also causing panic selling in Ethereum.

stETH, which represents ETH currently locked on the Ethereum 2.0 beacon chain. The token is usually used as collateral to borrow more ETH on DeFi platforms. if its price falls drastically, positions which have borrowed ETH using the token are susceptible to being liquidated. Holders will be forced to sell stETH on the open market, causing an even bigger price drop for the token. While this event has little direct impact on ETH prices, it appears to be causing panic selling of the second-largest cryptocurrency.

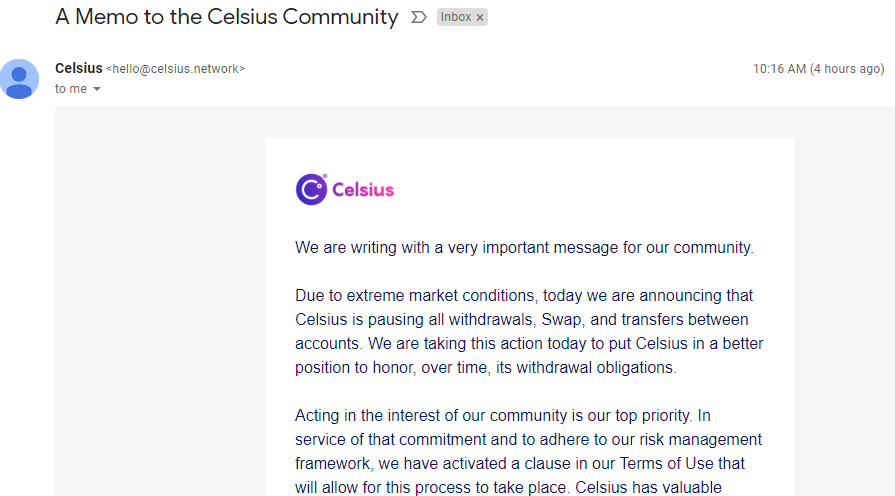

Currently, Ce

Fi platform Celsius has locked a lot of customer funds into stETH, which are liable to redemptions. If customers were to be spooked by the current stETH downturn, it could cause a bank run that would overload Celsius with redemptions, potentially causing a liquidity crisis.

As of the latest available data, Celcius's Asset Under Management (AUM) is USD 28.6 billion, 300,000 active wallet users and over 840,000 members.

This is something way larger than Luna incident and its implications are wide. Don't catch any falling knives.

Source: iSquare

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.