When will crypto go mainstream ?

DonkeyStock

Publish date: Tue, 05 Jul 2022, 10:09 AM

CeFi lenders such as Celcius or Blockfi explain away their troubles by pointing out that traditional banks would be similarly unable to meet withdrawals if more than 10% of their depositors made for the exits all at once.

But that doesn’t happen very often in the banking system. Partly because deposits are now federally insured, but also because banks provide a valuable service: You don’t keep your money in a checking account because of the interest it pays you — you keep it there because it’s the easiest way to pay your bills and make daily transactions.

That makes bank deposits sticky (How often do you change your bank?) — and sticky deposits allow banks to take mismatched duration risks: Banks can borrow short and lend long knowing their deposits aren’t going anywhere anytime soon.

What we’ve learned over the last few weeks is that CeFi lenders cannot take that same duration mismatch because their depositors are much more likely to make for the exits all at the same time.

When traditional banks learned about duration mismatch in 1907, the result was a lot of failed banks, government regulation, the Federal Reserve (1914), and FDIC insurance (1933).

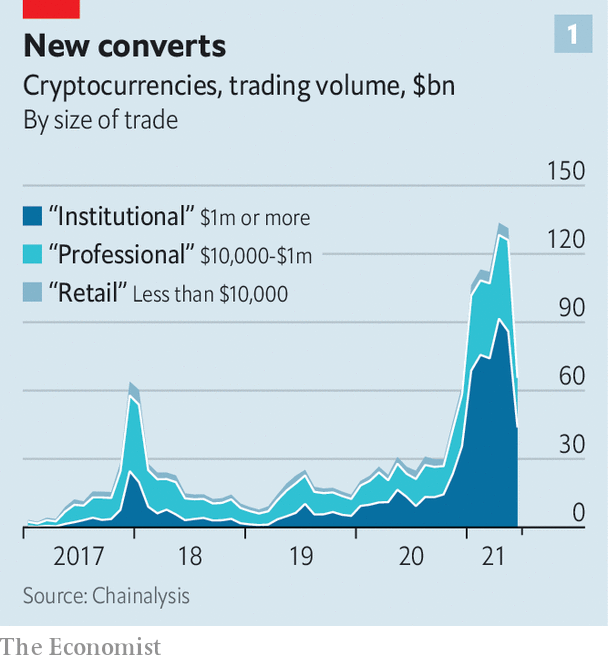

Crypto will only go mainstream and be widely accepted by the public once they undergo a similar process.

Source: iSquare

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.