On the run Treasuries and off the run Treasuries

DonkeyStock

Publish date: Tue, 05 Jul 2022, 10:19 AM

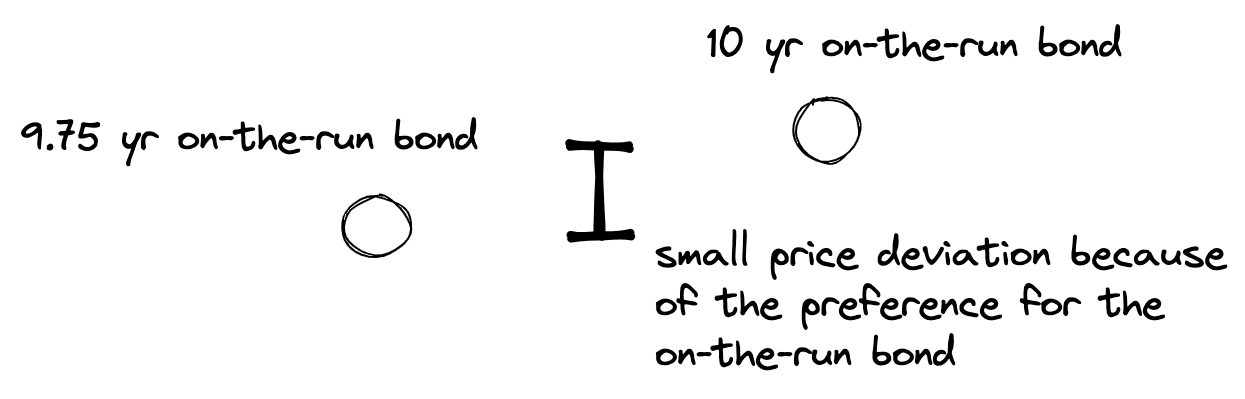

On-the-run Treasuries are the most currently issued Treasury bonds or notes.

It is the most commonly traded form of a Treasury note of a specific maturity. The on-the-run Treasury is significantly more liquid than other forms of securities. Therefore, they tend to trade at a premium.

Off-the-run Treasuries refer to debt instruments issued by the US Treasury that are not the latest offering.

Long Term Capital Management (LTCM), a hedge fund that was making its profit by trading this spread was incredibly successful before it imploded and almost took down the financial system along with it.

There are opportunities for arbitrage in the market, but don't average down when the market direction is against you. You may be right eventually but your position may go bust before the market reverts back to its normalcy.

Source:iSquare

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.