H.4.1 Central Bank Liquidity Swap

DonkeyStock

Publish date: Tue, 13 Sep 2022, 11:31 AM

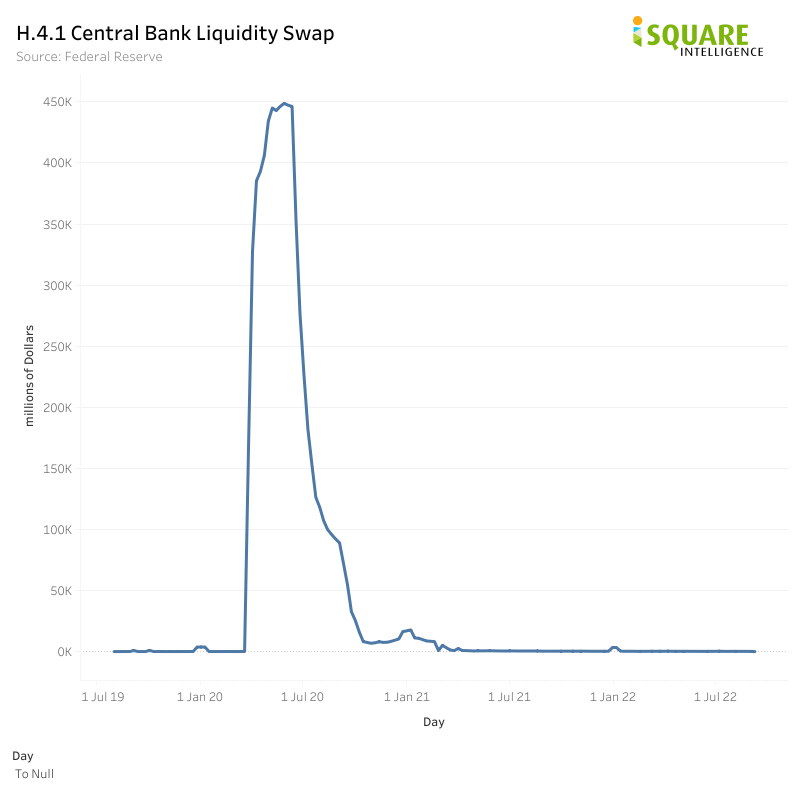

A central bank liquidity swap is a type of currency swap used by a country's central bank to provide liquidity of its currency to another country's central bank.

In a liquidity swap, the lending central bank uses its currency to buy the currency of another borrowing central bank at the market exchange rate and agrees to sell the borrower's currency back at a rate that reflects the interest accrued on the loan.

Central Bank Liquidity Swap is often known as a "bailout" of foreign banks. A sharp surge in these figures usually means the market is broken

Source:iSquare

More articles on Stock Infographics

Created by DonkeyStock | Jun 05, 2024

Created by DonkeyStock | May 28, 2024

Higher offer price for MPHB Capital Bhd ?

Created by DonkeyStock | May 27, 2024

DC Healthcare Bhd has delivered a worsening financial result

Created by DonkeyStock | Jan 04, 2024

Property investing by these visionary Singapore-based companies

Created by DonkeyStock | Jan 03, 2024

Discover the factors behind this surge, the challenges faced by top cocoa producers, and the ripple effect on chocolate manufacturers

Created by DonkeyStock | Aug 15, 2023

Created by DonkeyStock | May 03, 2023

Companies listed on Bursa Malaysia with an outstanding quarter results for the month of Apr 2023.