A Different Game of Fund Raising? Ft. PLS PLANTAITON BERHAD

Darren Woo

Publish date: Thu, 26 Jan 2023, 03:51 PM

A Different Game of Fund Raising? Ft. PLS PLANTAITON BERHAD

Dated 25th January, 2023, PLS Plantation had an announcement for a proposed placement of up to 56.23 million new ordinary shares to be issued at the price of RM0.950, representing a small discount of 9.52% based on the current price of RM1.050.

Understandably, investors are generally in detest of new placement as dilution may occur to their respective shareholdings, despite cash are being generated throughout the process.

But for PLS Plantation, things seems to be a little bit different.

Under the announcement made by the company, the company will issue a minimum of 39.96 million new shares (assuming no conversion of warrants) and a maximum of 56.23 million new shares (assuming full conversion of warrants).

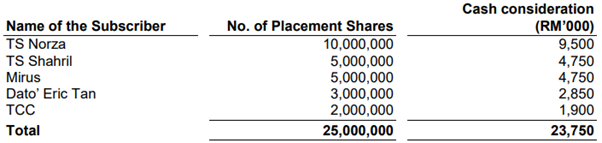

This is where the fun comes in, things get more spicy on the off-taker of 25.0 million new shares.

PS: The TS here stands for Tan Sri.

For some of you active traders in the market, TS Norza had indeed made a name in chairing the substantial increase in market capitalization for Citaglobal Berhad (formally known as WZ Satu Berhad), which he is also the indirect major shareholder for Citaglobal, which was backed by Tiza Global Sdn Bhd, with none other than himself Yang di-Pertuan Agong as the substantial shareholder of Tiza Global.

On a side note, he is also sitting on the board of AirAsia Aviation Group Limited.

Next, we have TS Shahril here to sits on the board for both Malaysia Airlines Berhad and Malaysia Aviation Group Berhad, which incidentally is also in the aviation industry – perhaps, this has something to do with the logistic arrangements for PLS Plantation durian’s grand scheme?

But let’s not get distracted, TS Shahril is also on the board of Ekuiti Nasional Berhad, Iskandar Waterfront Holdings Sdn Bhd, Right Sentiments Sdn Bhd, as well as Kuantan Agrofood Park Sdn Bhd.

We also have Mirus, a holding company of Mirus Aircraft Seating Limited (Mirus UK), which is involved in bringing innovative, high-performance products and redefining value in aircraft seats. Once again, we see another aviation related shareholder joins the rank of PLS Plantation.

Following Mirus, we have Dato’ Eric Tan who is the co-founder of Michong Metaverse (more will be familiar with the name Nomad Technologies Holdings Limited), and we have all heard the use of MetaFi in combining plantation and blockchain technology together.

Could we see the same for PLS Plantation?

Last but not least, TCC, one of the founding members of Reservoir Link Energy Berhad had also decided to invest in PLS Plantation Berhad, this leaves us to wonder, what exactly is brewing in PLS Plantation that have attracted the big names?

For some, they might argue that this is an exercise to increase the public spread from 12.26% to 20.24% to comply with the Listing Requirements. However, why would the Tan Sri and Dato join the company, if there was nothing going on behind the company?

Back in 16th August, 2022, PLS Plantation had entered into a binding term sheet with Landasan Erajaya Sdn Bhd in relation for a proposed collaboration between PLS Plantation and Landasan Erajaya for the development of cash crops and other plantation activities, which there will be a split of 51:49 in economic interests between the 2 parties.

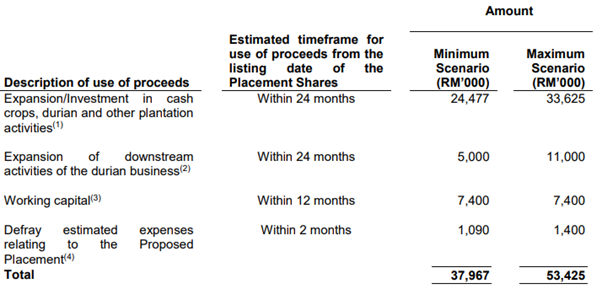

The company had earmarked a sum of RM50.0 million for the investment in construction works, contract farming works, marketing costs as well as other costs incurred in the cultivation of cash crops, durian and other plantation activities.

But back in 4Q2022, PLS Plantation had also signed an exclusive deal with the largest food processor, manufacturer and trader in China – China Oil and Foodstuffs Corporation (COFCO) for the export of durians to China.

And in last week, PLS Plantation had made an announcement where the company had strike another deal with notable Japanese firm MYFARMS, Inc to invest RM181.8 million in exchange for 49% stake in PLS LESB Sdn Bhd.

*MYFARM is a Kyoto-based Japanese integrated agriculture consultancy firm, with big time shareholders such as Japan’s National Federation of Agricultural Cooperative Associations, Tsumura & Co (market Capitalization of JPY211.55 billion), leading Japanese distributor of agricultural machinery and farm products Nichiryu Nagase Co Ltd, one of the largest home improvement business in Japan – DCM Holding Co Ltd, and last but not least SB Technology Co Ltd, previously known as Softbank Technology Corp.

With all these clear signals on the table, one can confirm that PLS Plantation had something in place as a strong plantation house, with sustainability earnings going forward, as durian trees can last 80 ~ 150 years (studies had shown they are capable of living indefinitely until the living conditions changes).

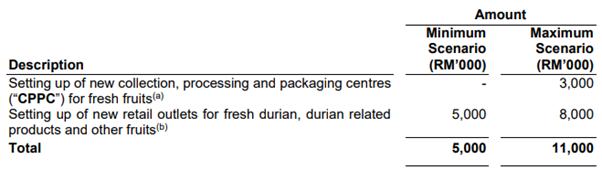

In terms of the balance of utilization of proceeds, PLS Plantation had set its eyes on setting up new collection, processing and packaging centres (CPPC) for fresh fruits as well as new retail outlets for fresh durian, durian related products and other fruits.

As for the balance of the fund raised, PLS Plantation plans to utilize them on working capital as well as defrayed expenses on the proposed placement.

With China reopening with the pent up demand for durian, things are seemingly great for PLS Plantation at the moment. This is what we would call the stars are aligned.

And most importantly, there are only 12.26% outstanding shares floating in the market, and we are seeing close to 2 million shares changed hand today – would we see more demand for PLS Plantation shares after the market realizes its potential?

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on DW Eagle Eye

Created by Darren Woo | Jan 27, 2023

Discussions

speakup

one nice article enuf to up 6%

-------------------------------------

I wish so, probably some funds had noticed the announcement too

2023-01-27 15:29

.png)

speakup

one nice article enuf to up 6%

2023-01-27 14:58