Brief Analysis: IPO Wegmans

Erentitan

Publish date: Thu, 22 Feb 2018, 01:29 PM

Background

Wegmans Holdings Berhad (WEGMANS) is a Muar based home furniture manufacturer. The company involves in design, manufacture, and sales of furniture. Majority of the end products are exported to overseas markets mostly in Asia (ex-Malaysia) (37%), Europe (21%) and North America (21%) regions. Wegmans is seeking ACE market listing and will raise RM29 million through the IPO. The IPO allocation for retail investors is only RM 7.25 million represents about 17% and the majority is allocated for private placement to institutional investors amounting to RM 31.9 million (73%). The breakdown of IPO proceeds utilisation will be as per below:-

| IPO Proceed Utlisation | RM'000 | % | Duration |

| CAPEX:- | |||

| 1. New Factories and integrated facilities | 11,000 | 2 years | |

| 2. Purchase of new machineries and equipments | 11,000 | 76 | 2.5 years |

| Working Capital | 3,500 | 12 | 2.5 years |

| Est Listing Expense | 3,500 | 12 | 3 months |

| 29,000 | 100 |

Majority of the proceeds will be utilised for capital expenditure, however, personally I think the allocation for listing expense is a bit too much. The reasonable amount should be around RM3 million which represent about 10% of total fundraised.

Based on market research by Smith Zander, the global demand for home furniture will grow at a compounded annual growth rate (CAGR) of 3.43%. Specific regions growth rate relevant for Wegmans are:-

Japan import CAGR -0.62%

USA import CAGR 7.16%

Australia import CAGR 1.46%

UK import CAGR 3.77%

Financial

Since most revenue is derived from exports, the exchange rate USD/MYR will play an important factor in Wegmans's profitability.

Here is the chart of MYR against 1 USD

Average MYR per USD for year:-

2014 : RM3.25

2015: RM4.03

2016: RM 4.15

2017: RM4.28

2018F: RM3.90

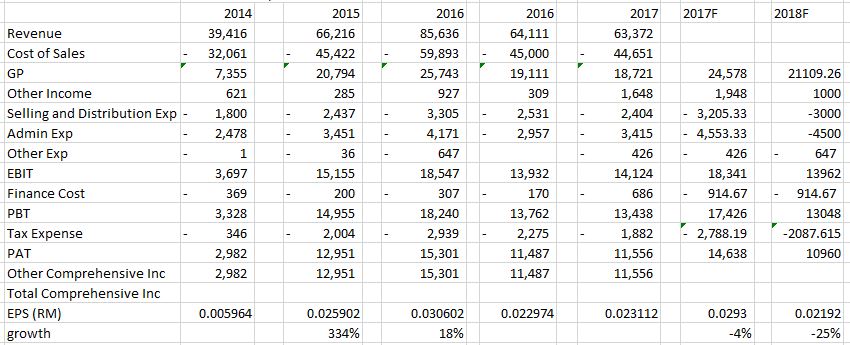

Hence based on sensitivity of profitability against USD/MYR fluctuation as per management guidance, below is the historical financial figures and also my own forecast figures.

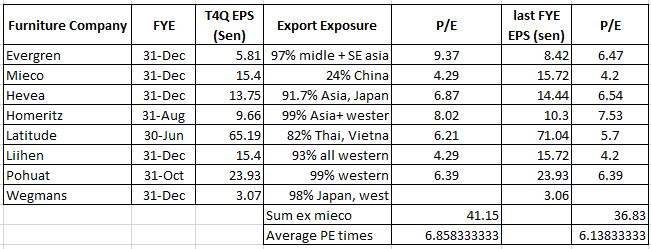

Peers comparison as at 22/2/2018

Valuation matrix for Wegmans based on PE multiples

based on FYE 2016, EPS 3.06 sen, V=RM0.19

based on T4Q EPS 3.07 sen, V=RM0.21

based on full 2017F, EPS 2.9 sen, PE.7 times, V=RM0.203

based on 2018F, EPS 2.2 sen, PE 10 times, V=RM0.22

It is interesting to see what the next quarterly financial statements will look like. It is expected the last quarter for 2017 FYE will be released by the end of this month, ie before the stock listing in Ace market, Bursa Malaysia. My expectation is the profit will drop quarter on quarter and year on year in tandem with the appreciation of MYR against USD. Hence, post listing stock price might be cheaper than the IPO price. However this is a penny stock, many things can happen and since it is a small market cap, the stock price may be influenced by manipulation on the listing day.

Thank you

This is my personal view only, please seek licensed professional advice before you made any investment decision.

More articles on Eren Thinks

Created by Erentitan | Dec 26, 2017

Created by Erentitan | Nov 14, 2017