IPO Binasat Communications Berhad (BINACOM): Attractive price and high growth potential

Erentitan

Publish date: Tue, 26 Dec 2017, 05:52 PM

Binasat Communications Berhad (BINACOM):

BINACOM provides telecommunication network support services in satellite, mobile and fibre optic categories. Supporting services offered are installation and commisioning works and operation and maintenance of telecommunication equipments:-

|

1. Satellite segment cover network services for petrol stations, self serving banking machine, oil palm plant, offshore oil and gas platform. |

|

2. While for mobile segment, main projects would involve in setup of BTS for telecommunication companies. |

|

3. The fibre optic would involve in laying fibre optic cable outside and inside of building including the related network equipments. |

Timetable for the IPO is as follows:-

|

Timetable |

Date |

|

Open |

13-Dec-17 |

|

Close |

26-Dec-17 |

|

Ballot |

28-Dec-17 |

|

Listing |

08-Jan-18 |

The indicative price of the IPO is RM0.46 which is at 11.92 times the last year EPS post enlarged share capital. There are a total of 125.979 million shares are made available in this IPO comprising 85.979 million new shares and 40 million offer for sale shares.

The shares allocated for retail investors offering is 13 million units, another 13 million units are for internal stakeholders, and large proportion is allocated for private placement which is amounting to 99.979 million units.The money will be raised from the share allocation is RM5.98 milion, RM5.98 million and RM45.99 million respectively.

Again I am a bit disappointed with this year's IPO offering where only small proportion of shares is allocated for retail investors. However, not commenting much I think maybe it is caused by moderate retail trading activities currently.

If you apply for this IPO, chances are you will be disappointed. Even if you are successful in getting the IPO, but your joy will be short lived as the number of share you will get is much way lower than what you apply for. Not only that, in IPO you have to pay upfront and will be refund later, which will burn you with opportunity cost.

BINACOM will raise about RM39.55 million through this IPO and mostly the fund will be used for buying machineries, equipments and facilities to help strenghthening the company foothold in the industry and also provide additional income stream.

The details of the funding usage is as below:-

|

Use of Proceeds |

Amount RM'000 |

% |

Estimate timeframe |

|

Setting up teleport |

14,360 |

36.3% |

within 24 months |

|

Operation and Maintenance Capability |

4,900 |

12.4% |

Within 12 months |

|

Fibre optic network capability |

4,800 |

12.1% |

Within 12 months |

|

Business Expansion: Vietnam, Myanmar, Laos |

1,500 |

3.8% |

within 18 months |

|

Working Capital |

10,790 |

27.3% |

within 24 months |

|

Listing Expense |

3,200 |

8.1% |

within 3 months |

|

Total |

39,550 |

100.0% |

One thing I like about this IPO is that large proportion of the money raised is allocated for either expansion or strengthening the company capability which in turn will fuel future growth prospect.

As an investor, I prefer this kind money allocation, where I know large proportion new money will be used for productivity purposes as opposed to pare down debt and cover listing expenses.

For example money used to pare down the existing debt might not be in the best interest of the company when there is availability of new investments that will bring in additional value to the company and sustain future earnings. Plus, there is a limit to how much money you can save from paring down the debt, its interest expense.

Notice that how low the proportion of money raised is allocated to cover the listing expenses? for me this is a fantastic work from the management, it is good for me to know that most of funding raised will used for much more productive usage and not thrown down the drain.

Post IPO, Major shareholders would maintain control on the company with only slight majority.

|

Major shareholding |

# shares'000 |

% |

|

Na Boon Aik |

67,010 |

25.8% |

|

Na Boon Tiam |

67,010 |

25.8% |

|

|

|

51.6% |

|

IPO for public, private placements and internal |

125,979 |

48.5% |

|

Total |

|

100.00 |

Industry Outlook

The future for this industry is bright because continuous technological advancement, demand for faster and much more efficient telecommunication services will require industry players to spend more in capital expenditure. Telecommunication companies will also continue to upgrade their facilities as government auction spectrum allocation from time to time.

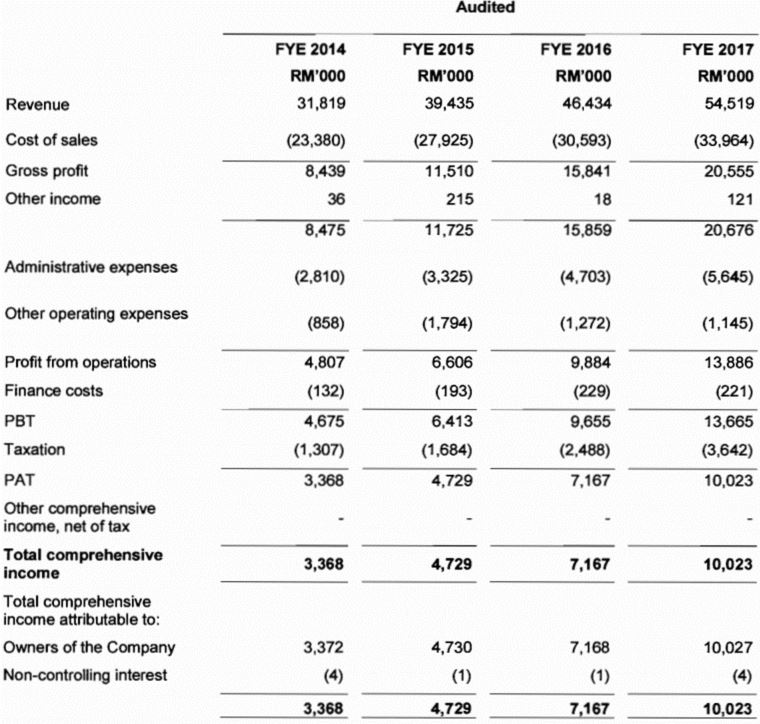

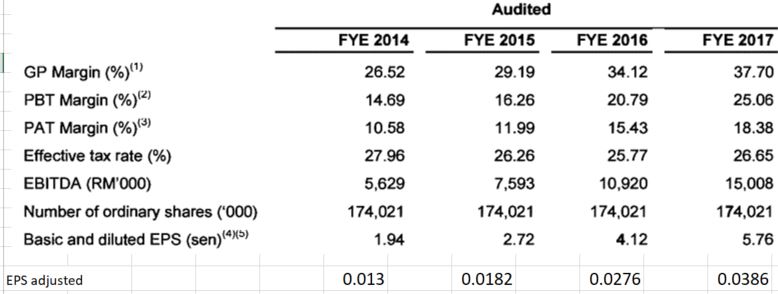

Past Performance

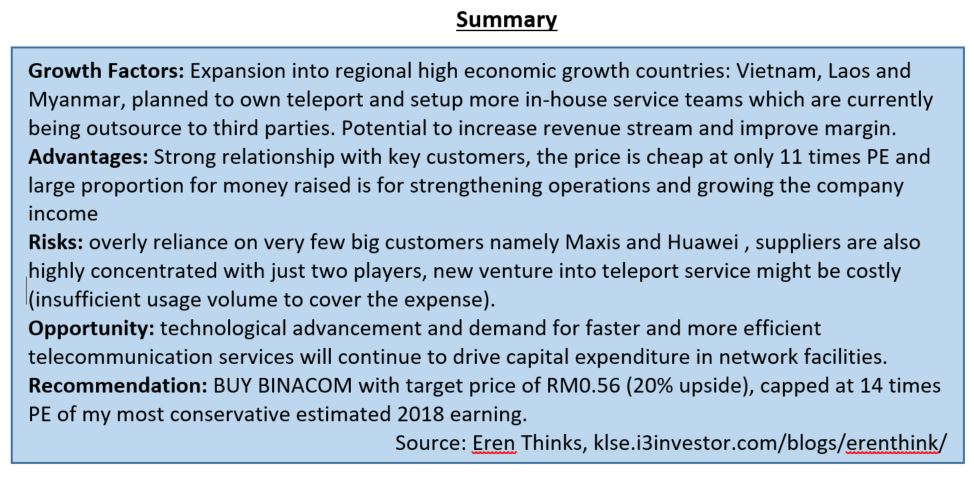

Over the last four financial years, BINACOM experiences rapid growth in both revenue and profit. The company margin improvement exhibit the benefit of economies of scales, the higher the revenue and bigger the company size is, the better company is able to save cost by improving efficiency.

Conclusion

The only sensible company that I think would be comparable to Binacom is OCK. However, even OCK business direction and segments has varied very differently since it was first listed in Bursa.

Nowadays, OCK has diversified into green energy business and much more focus on build and own telecommunication tower and lease it to telcos.

Nevertheless, both companies are in the same industry which is providing telecommunication support services. As a conclusion, I would recommend BUY BINACOM with target price of RM0.56 (20% upside), capped at 14 times PE of my most conservative estimated 2018 earning.

|

Mkt cap |

NAPS |

EPS |

PE |

price |

BV |

NP margin |

ROE |

P/S |

|

|

OCK* |

785m |

0.50 |

0.0330 |

27.27 |

0.90 |

1.8 |

7.45% |

6.60% |

1.7 |

|

BCB |

119.6m |

0.24 |

0.0386 |

11.92 |

0.46 |

1.9 |

18.38% |

16.2% |

2.2 |

* OCK financial is based on last 4quarters financial results

PS: by no means that my analysis above would provide comprehensive cover about this IPO. With limited resources, shallow experience and time constraint I would like to advise readers to make their own research and judgement to make better investment decision.

Disclaimer:

Readers should be fully aware that this report is for information purposes only. The opinions contained in this report are based on information obtained or derived from sources that we believe are reliable. This report is not, and should not be construed as, an offer to buy or sell any securities or other financial instruments. The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. All opinions and estimates are subject to change without notice. The writer does not own or have any intention to buy the abovesaid stock.

More articles on Eren Thinks

Created by Erentitan | Nov 14, 2017

Azman Hashim

The moment of truth is coming

2018-01-08 07:15