Dutch Lady Milk Industries - Holland's milk story in Malaysia I

ChongHH

Publish date: Sun, 31 Jan 2021, 12:01 AM

Company overview

Dutch Lady Milk Industries Berhad ("DLMI") is a Malaysia-based subsidiary of FrieslandCampina N.V. that produces and distributes ultra-high temperature treated milk ("UHT"), pasteurised milk, condensed milk, yoghurt and formula milk powder to cater to all age segment under two key brands namely Dutch Lady PureFarm and Friso. With more than half a century of operational excellence in Malaysia, the business grew to become the market share leader with more than 40% market share in liquid milk category and close to 20% market share in milk powder category. Despite long operational history together with other competitors, the Malaysian dairy industry provides compelling opportunities in respective niches.

Industry overview

1) Malaysia has very low self-sufficiency rate for dairy

Albeit difficult to believe, Malaysian demand for dairy and dairy equivalent products far exceed the supply. Although one may argue there are numerous cattles in the villages, only ~6% of cattles in Malaysia are dairy cattles. With 64 mln litres per annum of fresh milk consumption against 41 mln litres per annum of fresh milk production in 2019, the self-sufficiency rate for fresh milk in Malaysia is only at 63.0%. More worryingly, the self-sufficiency rate would be ~4% when benchmarked against total dairy consumption, which includes fresh milk and all imported dairy contents such as cheese, whey and processed milk powder.

The implication is important. In 2019, Malaysia imported 1.7 bln litres of total dairy products worth RM4.1 bln. Given that Malaysia is also an important re-exporter of dairy products, 570 mln litres of total dairy products worth RM1.3 bln were exported in the same year. With an ex-farm value of fresh milk quoted at ~RM100 mln, there is >RM2 bln market opened for import substitution especially to dairy companies that can successfully integrate upstream into fresh milk production.

2) Malaysia has low per capita consumption of fresh dairy products relative to income level

Despite the low self-sufficiency rate for fresh dairy, Malaysia is far from being a mature dairy market. Although Malaysia's GDP per capita is 2.6 times, 4.2 times and 1.5 times Indonesia, Vietnam and Thailand, its fresh dairy product consumption per capita is among the lowest at slightly below 2 kg per capita / annum. For context, Indonesia, Vietnam and Thailand consume ~3, ~7 and ~16 litres per capita / annum. As a result, fresh dairy product category has growth potential from both organic segment growth as well as market share consolidation from processed dairy product.

Key highlights

1) Industry players are increasingly integrating into upstream fresh milk production if and when possible

The advantages of possessing in-house supply of fresh milk is clear: the milk processor is able to utilize more advanced processing technology to produce better taste, aroma and nutrients. In addition, the vertically integrated dairy producer will also be able to avoid fresh milk supply bottleneck while supplying the market exactly what is needed at the most competitive price. As a result, players like Farm Fresh gained astounding success despite a short history of a little more than a decade. Based on latest public information available, Farm Fresh produces more than 40% of Malaysia's domestic fresh milk production. At downstream, Farm Fresh is already generating more than RM400 mln and intend to grow its clout further via an IPO. Likewise, F&N was also attempting to integrate upstream via Ladang Chuping project albeit cancelled. This would provide a respite to Ms Holland since integrating upstream would be more challenging given its cooperative mandate structure.

2) Intensifying competition, escalating cost and demographic headwind are present in the milk powder industry

A substantial share of Ms Holland's revenue is actually from milk powder be it Dutch Lady milk powder or Friso formula. The former are packed in Malaysia while the latter is imported in completed form. Hence, the former generates manufacturing profit while the latter generates only trading profit. However, babies per woman in Malaysia continued falling from 2.78 in 2000 to 1.80 in 2018. Although Ms Holland produces milk powder for all ages, its infant and adoslescent range comprised the largest share of milk powder revenue. As lower birth rate translates to lesser potential customers, it is fighting an uphill battle to generate growth for its milk powder business. As for adults and senior citizen product range, there are multitudes of competitors in the functional milk powder business i.e. Abbott, Nestle, etc. A second challenge would be escalating cost as market share leader Danone Dumex had already closed down its plant in Malaysia and relocated to Thailand due to escalation of wage cost. Since infant formula is already highly priced (due to importation of raw material or finished product) relative to average income level in Malaysia, cost pass-through is more difficult. Third: although the total market value for milk powder in Malaysia is ~RM2.6 bln, there are seven major players together with other smaller players and upcoming new entrants. Hence, it remains as a challenging segment in the market.

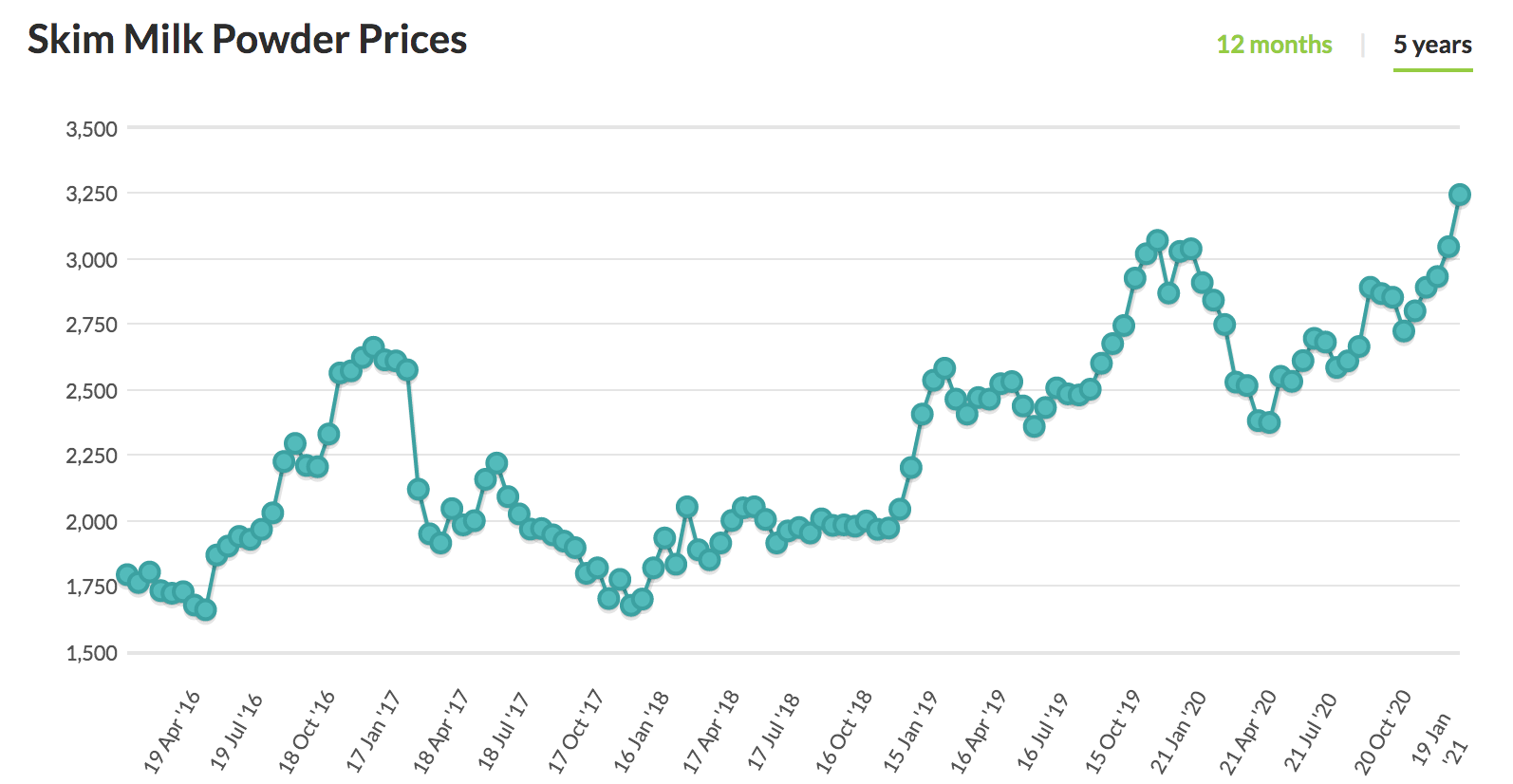

3) Increasing milk powder prices serve as a headwind for players without upstream capabilities

More than two-third of a typical dairy processing company's raw material cost comprises skim-milk powder. Although there are inventory lags in the case of Ms. Holland due to its global procurement structure, it is likely to feel the pinch from escalating skim-milk powder price as the uptrend has been quite violent.

4) Construction of new manufacturing facilities in Bandar Baru Enstek to fuel the next growth phase

On 17 Dec 2020, Ms. Holland completed the acquisition of three parcel of bare freehold land in Mukim of Bandar Baru Enstek measuring 131,900 sqm altogether, slightly larger than the size of Pavilion Bukit Bintang. Comparatively, this is ~3x the land space of its existing facility in Petaling Jaya ("PJ"). As expected, Ms. Holland will also monetize the PJ land after the relocation is completed. According to the board of directors, new production facilities will be constructed on the new lands between 2021 and 2025 at a total capital investment of RM340 mln. As at FY19, its total cost of property, plant and equipment were ~RM280 mln and these were highly depreciated assets that existed for decades given its operating history in Malaysia since 1960s. Upon completion of the relocation, the production capacity expansion and production efficiency improvement might very well be substantial.

Conclusion

At the very least, we would know by now that Malaysia faces low self-sufficiency of both fresh milk and total dairy product. However, the growth potential is immense given that Malaysia's fresh milk (or even total dairy product) consumption per capita is relatively low compared to other nations. The rewards are compelling and up for grabs by those that can vertically integrate upstream, produce higher quality products more cost-efficiently without being heavily reliant on imported raw materials, and market through strong branding and dense distribution network. While the milk powder segment is affected by intensifying competition and escalating operational cost, the vertically integrated dairy company will be able to consolidate market share simply by being the lowest cost producer. Having said that, this segment is not as attractive given the declining birth rate per woman in Malaysia. In the shorter term, escalating skim-milk powder price would not bode well particularly among players with minimal pricing power / cost pass-through capabilities. In fact, Ms. Holland indicated in its most recent 20Q3 financial result that increasing global dairy price has impacted its performance. Adopting a longer term orientation, however, the relocation to Bandar Baru Enstek may be a game-changer.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|