A 2022 “Must Know” Investment Theme

prunman

Publish date: Mon, 13 Dec 2021, 12:32 AM

A 2022 “Must Know” Investment Theme

I think, we could all agree that 2021 was an extremely challenging year for investors to profit in the market apart from technology stocks investors. And as we are in the last month of 2021, we must now focus in thriving towards 2022, and not grieving after 2021.

So, I had identified a hidden trend that investors must know for 2022.

Quick question – do you think the construction industry will perform well in 2022? And what if we see an election coming, what is the quickest way that could boost the economy and GDP figure?

Infrastructure works.

I fully agree with you that local construction companies, especially the big boys that had something to do with politics and that is how they secure projects. But as an interior designer myself, I noticed a bigger problem:

IT IS EXTREMELY HARD FOR ME TO SECURE PLYWOOD OR MDF BOARD FOR MY CLIENTS.

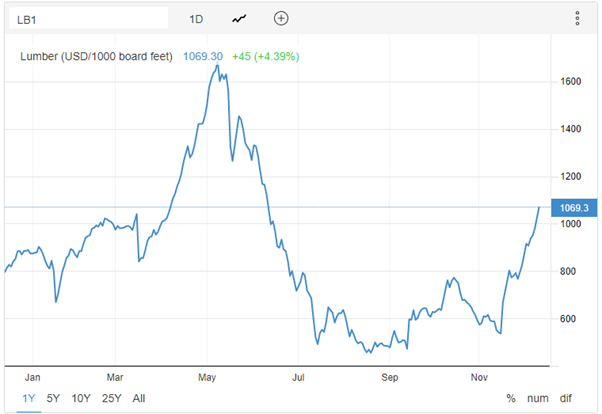

A glimpse on the Chicago lumber exchange price, most would notice that the price had retraced from its May 2021 high. And now, the price is trending up again.

What really scares me is the lack of supply is much worse in Malaysia that other countries. You can try to ask around in the construction market for raw logs or plywood and see if you have any luck with it. Chances are you might not even get any materials unless you are buying in bulk and in extremely high premium.

In fact, prices of these plywood or MDF board had risen more than 25% year-to-date, where the price of timber had increased by more than 50% in the same period.

For seasoned investors, you already know what I’m going to say – LOOK FOR SUPPLIER OR MANUFACTURERS OF PROCESSED / RAW WOOD.

One company I had identified and really interesting is Sern Kou Resources Berhad (KLSE: 7180).

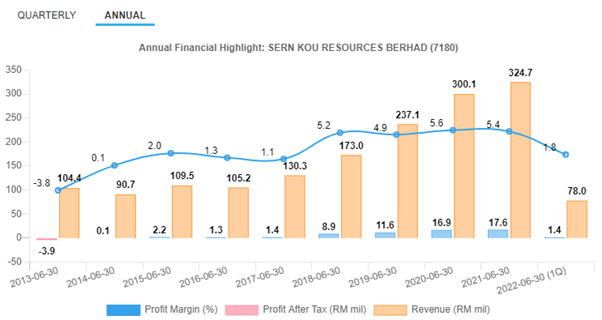

As you can see, the company is delivering consistent results for the past years even with the impact of covid-19. And while many thought that Sern Kou is a pure play furniture player – which is in fact, just one of their revenue contributors, but not the main one, Sern Kou profit generally comes from the processing and trading of wood.

To save you the time, I’ve looked deeper into their business, and the facilities for the company in terms of sawmilling and plywood manufacturing had a total production capacity of 3,000-ton per month with an additional 1,000-ton per month capacity installed in 2021 added to their group.

Most importantly, Sern Kou had geographical advantage as their facilities are located closely to the source of raw material. Some other sawmilling players located in Malaysia are too far away from the source of raw material and that would mean their operating costs are inflated.

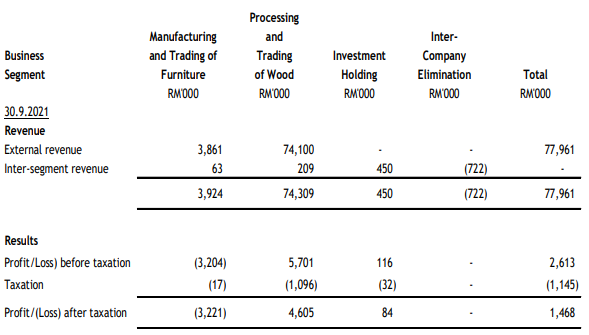

On the group level, you can see that they are still making handsome profit in terms of processing and trading of wood in the latest financial results.

Most importantly, the share price of Sern Kou is trending upwards while the market is DOWN. For seasoned investors, you already know that a counter-trend stock means heightened investors’ interest in the company. Given what is going on in the construction industry and I haven’t even mention about the pent-up demand from the furniture market, it is likely that fund managers are already buying the shares of Sern Kou.

So, this stock is definitely my top pick over the transition into 2022. And I sincerely hope that my industry knowledge could help you profit in your stock investments.

More articles on Furniture Watchdog

Created by prunman | Mar 30, 2022

Created by prunman | Jan 16, 2022