Investors, had you noticed these undiscovered gems in the market?

prunman

Publish date: Tue, 19 Apr 2022, 05:57 PM

Investors, had you noticed these undiscovered gems in the market?

While the market is head over heels on technology stocks, especially ev related ones such as D & O and Genetec, honestly a huge portion of the growth had already been factored into the share price.

Thus, I would like to introduce a dual themed – high processed wood prices and high USD to RM stocks for your reference.

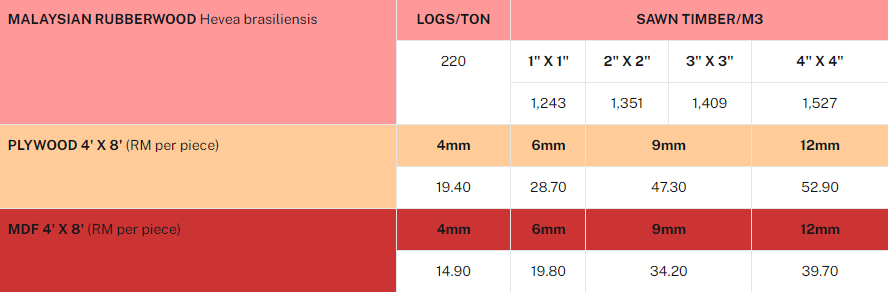

According to Malaysian Timber Industry Board (MITB), the logs, sawn timber, plywood and MDF had all gone up in prices. Here’s a snapshot of how the prices look like.

A quick channel check with industry players, the current price is at least 30% to 60% compared to 2021, which represents a significant increase in ASP for the players who involved in the processed wood industry.

By the way, as at the date where I’m writing this piece, the price of USD to RM had already gone up significantly, up to 4.2545. Though I’m not sure how many investors remembers or experienced it, but wood export related stocks had skyrocketed in share price once when USD to RM increase.

From 2014 to 2018, the share price of Lii Hen Industries actually went up by 846% in a short time frame of 51-month bars.

Poh Huat Resources, another miracle in making – achieved 1134% growth in a short period of 50-month period.

Latitude Tree Holdings – 1445%, amazing! Again, the time frame is very close to the first two companies we mentioned.

Based on what we see now, there are 3 other companies that may rally in the same manner as the stocks we tested above. These stocks include Sern Kou Resources, who is involved in the manufacturing and processing of all kinds of timber, wood, and related products, Jaycorp, who is specialized in pressure treatment and kiln drying of wood. Last but not least, Evergreen Fibreboard who is involved in MDF and particle board manufacturing.

Of the 3 companies, unfortunately Jaycorp had been in the red for longest time. I would not bet on this company as there are other proxies available in the market. If you look at the earnings, market capitalization and other indicators, it seems like Sern Kou have a very good chance to hit another 30% upside.

Also, I noticed an unusual amount of support in share price for Sern Kou, its like someone is quietly collecting its share. Perhaps we can see some price action from Sern Kou soon?

More articles on Furniture Watchdog

Created by prunman | Mar 30, 2022

Created by prunman | Jan 16, 2022